Crypto market tests one-month high

Market Picture

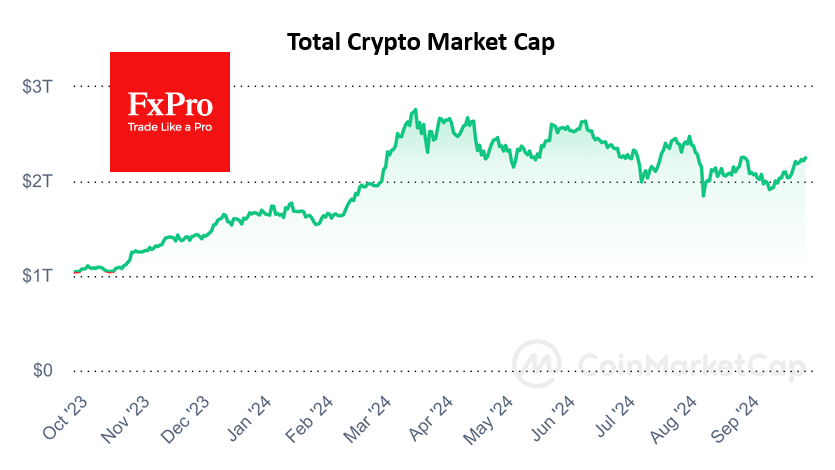

The crypto market rose 1.2% in 24 hours to $2.25 trillion, approaching the highs set exactly one month ago. New highs could attract more buyers and signal a break in the multi-month downtrend. The sentiment index rose to 59, the highest since late July, which looks like the optimal range for further gains. It is far from extreme greed, which signals overbought conditions, and fear-selling is behind us.

Bitcoin hit a new monthly high of $64.7K early on Wednesday but has since pulled back around $1000 - a common pattern of late. The first cryptocurrency has been struggling to find equilibrium near the highs of late last month and near the 200-day moving average. It will take new data and momentum to tip the price out of equilibrium. There is a risk that short-term gains in risk appetite on policy easing in the US and China will fade.

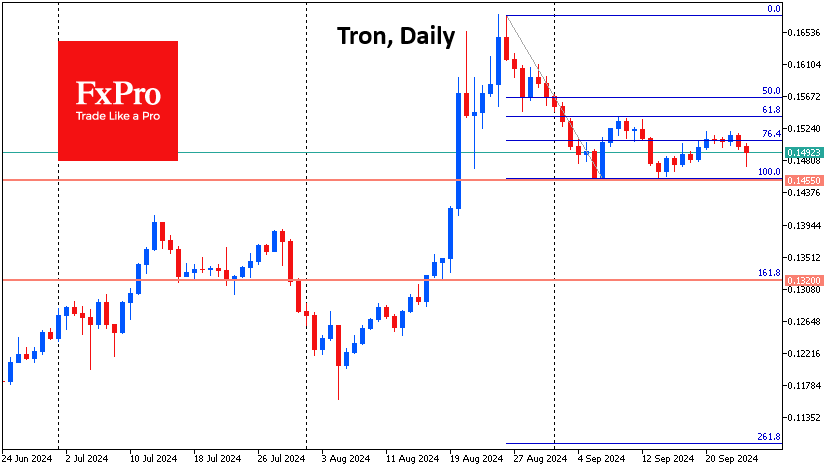

Tron is giving up positions for the second day in what so far looks like new bearish momentum after a corrective bounce. The focus will be on how the coin behaves on the decline from the current $0.15 to $0.1450. An update of the local lows will take the main scenario down to $0.132. The ability to stay above it will potentially open the way for an update of the highs at $0.168.

News Background

According to 10x Research, Bitcoin could hit new all-time highs in October thanks to Fed rate cuts and upcoming payments to creditors of bankrupt crypto exchange FTX.

Ethereum has grown almost twice as fast as Bitcoin since the Fed's rate cut on 18 September. Following the monetary easing in the US, funding rates for ETH-based perpetual futures turned positive, according to CoinGlass data, reflecting increased demand for leveraged long positions.

According to QCP Capital, interest in the Ethereum options market has shifted from puts to calls. The implied volatility of ETH contracts exceeds that of Bitcoin by 9%, suggesting improved sentiment and potentially greater price movement.

Play Solana has opened pre-orders for the PSG1 blockchain-enabled handheld gaming console. The PSG1 supports Solana blockchain-based games and has a built-in hardware wallet.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)