Cryptocurrencies dispel fears

Market picture

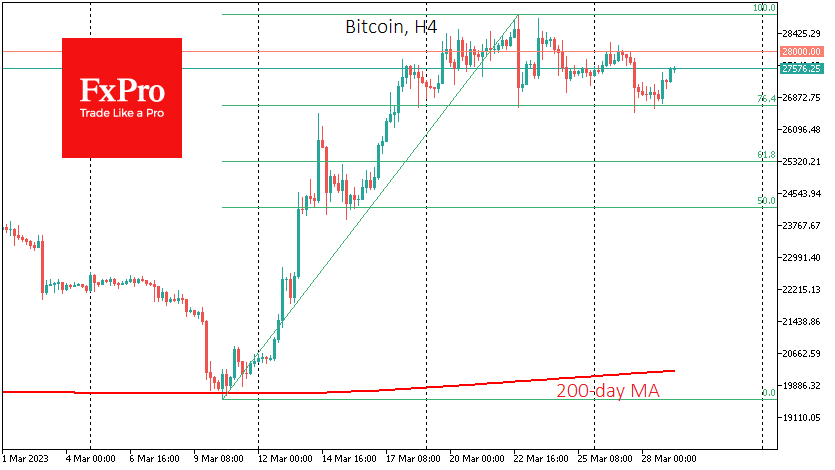

After spending most of Tuesday below $27.0K, bitcoin began to gain strength towards the end of the day, trading at $27.5K on Wednesday morning, up 2.3%. Total crypto market capitalisation rose 3% to $1.16 trillion, driven by general demands for risky assets following optimism around Alibaba and continued confidence in an imminent Federal Reserve rate cut.

Technically, BTCUSD found support from buyers after a correction to 76.4% of the rally since March 10th. Such shallow retreats (compared to a typical pullback to 61.8%) are characteristic of strong bull markets. More cautious investors may prefer to wait for confirmation of new bullish momentum with a takeover of $29.0K.

News background

Changpeng Zhao, head of major cryptocurrency exchange Binance, has denied allegations made by the Commodity Futures Trading Commission (CFTC). He said the CFTC's claim contained an "incomplete statement of facts" and was "unexpected and disappointing". Zhao pointed to the firm's mandatory KYC programme, blocking US users, interaction with authorities and commitment to transparency.

Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, described the CFTC's lawsuit as an attempt to deal a fatal blow to Binance and did not rule out that the authorities "have a good chance of success". The regulator classified BTC, Ethereum, Litecoin, USDT and BUSD as "commodities" in the lawsuit.

According to Thanefield Capital, exchange customers withdrew more than $1 billion from their accounts overnight following the CFTC's lawsuit. According to Coinglass, Binance users started 3,611 BTC overnight. Binance's spot market share shrank by nearly 10% in a week.

After a month of litigation, US authorities secured a $1 billion settlement between bankrupt crypto lender Voyager and Binance.US.

Speculators have stepped up transfers of BTC to exchanges, confirming profit-taking, Glassnode noted. However, most investors are willing to hold the coins for longer, hoping that the uptrend will continue.

Under pressure from critics, the UK government has abandoned the Royal Mint's plans to issue non-exchangeable Royal Mint NFT tokens.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)