Cryptocurrencies Look Stronger than Stocks

Market picture

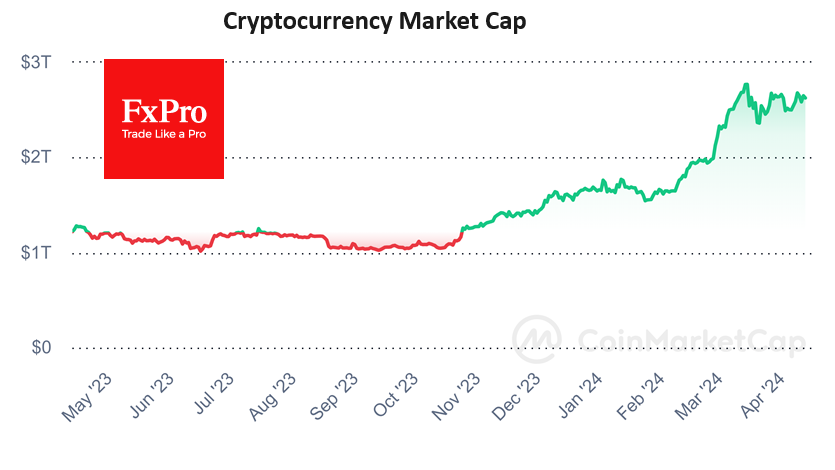

The crypto market continues to avoid gaining momentum on the upside but remains within an uptrend: the bulls fail to accelerate price gains, but the overall upward trend remains. ‘Extreme Greed’ persists in the markets, with the corresponding index at 79. In contrast, the sentiment in the stock markets is almost ‘Neutral’.

Bitcoin maintains its uptrend, leaving a gap between the price and the 50-day moving average of around 3.5%. From the current $71K, the first cryptocurrency has little trouble rising to $72K, but it could enter a turbulent zone further down when it starts to struggle against strong resistance. On the bearish side, a rising dollar and a breakdown of the upward trend in stock indices.

As a result of another recalculation, the difficulty of mining the first cryptocurrency increased by 3.92%. The index updated the maximum and reached 86.39 T. The average hashrate for the period since the previous change in the value was 705.39 EH/s.Toncoin (TON) hit an all-time high of $7.70 on Thursday, rising 40% over seven days on the back of multiple announcements from The Open Network and Telegram. The token surpassed Cardano by capitalisation and ranked 9th by CoinMarketCap.

News background

TON's positive momentum is attributed to recent initiatives by blockchain developers The Open Network, including several integrations with messenger Telegram. Meanwhile, there are some concerns in the community regarding the distribution of TON issuance. According to CoinCarp, more than 60% of the coins are held by the top 10 holders, while 93% are concentrated in the top 100 users.

Outflows from Grayscale's (GBTC) spot bitcoin-ETF have exhausted themselves, said Grayscale CEO Michael Sonnenschein. He attributed his expectations to the completion of a number of transactions for the realisation of GBTC units by bankrupt cryptocurrency companies. He cited the passing of the peak of a wave of clients switching to alternative Bitcoin ETFs with lower fees as another reason. Since the ETF was approved, outflows from GBTC have approached $16bn.

Uniswap, the largest decentralised exchange, has been warned by the SEC that securities law violations have been discovered and a civil lawsuit could be filed in the future. The exchange's team said it was ready to fight. It considered the regulator's arguments weak.

According to Policygenius research, cryptocurrencies are more popular than stocks among Zoomers in the US. About 18% of US Zoomers own stocks, while 20% own crypto.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)