Dollar and equities in limbo after mixed US data

Dollar caught in the middle

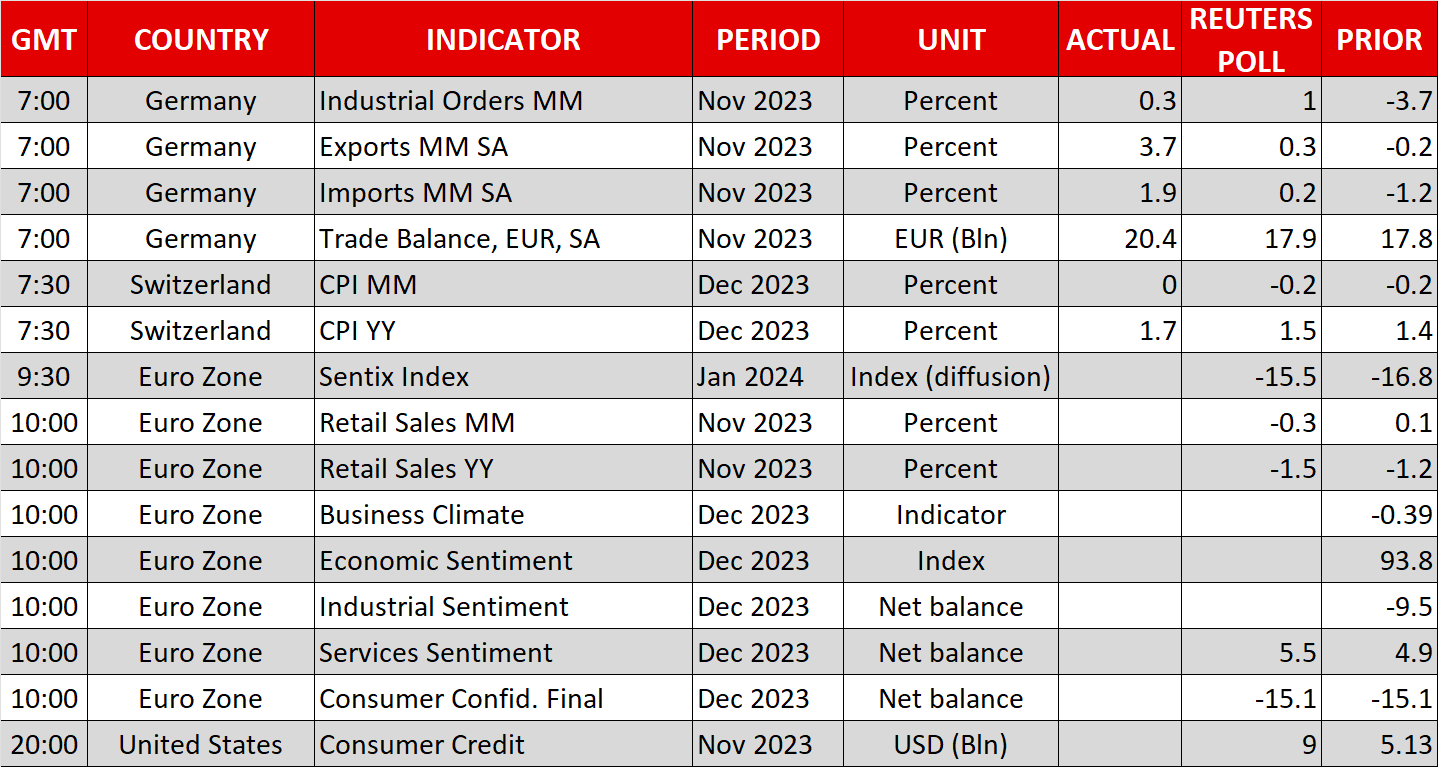

A mixed batch of economic data releases left the US dollar and equity markets without a clear direction on Friday. On the bright side, the US employment report for December exceeded expectations, with nonfarm payrolls beating forecasts and wage growth coming in hotter than anticipated.

However, a sharp drop in labor force participation served as a warning that employment conditions are not quite as strong as they seem at first glance. That was quickly followed by a disappointing ISM non-manufacturing survey, which signaled weaker hiring intentions among businesses and a slowdown in new orders.

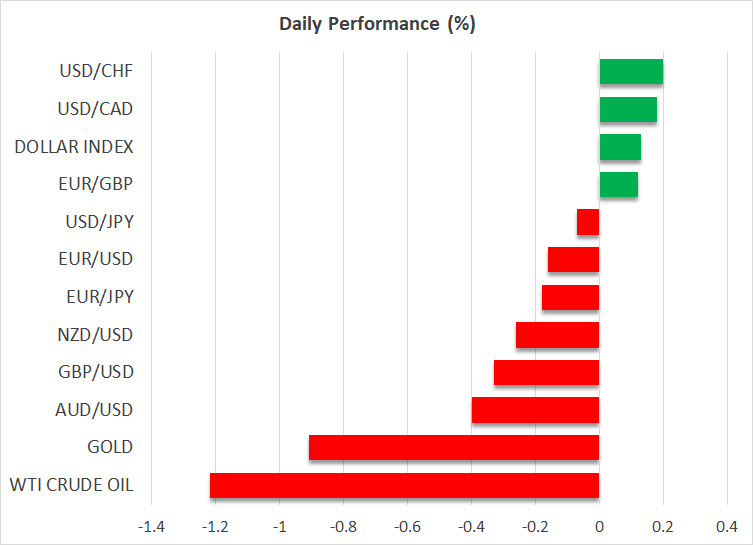

The dollar traded higher directly after the employment report but its gains soon started to evaporate and it ultimately closed the session unchanged. It was a similar story in the equity space, with shares on Wall Street closing a volatile session near their opening levels.

Overall, this dataset did not have much of an impact on the anticipated trajectory of Fed interest rates. Investors weighed a decent employment report against a gloomy ISM survey and decided that the two cancel each other out. This elevates the importance of the upcoming CPI data on Thursday, which could break the deadlock in the debate over how soon the Fed will slash rates.

Gold struggles for altitude, oil hits rough patch

In the commodity sphere, gold prices traded in similar fashion to the US dollar and equities on Friday, closing near their starting levels after whipsawing around. That said, bullion resumed its decline early on Monday, feeling the heat of a slightly stronger dollar and some adverse bond market moves.

Gold’s performance in the near term will depend on this week’s inflation stats, but in the bigger picture, the fundamental outlook appears favorable as it is simply a matter of time until interest rates come down. The trend of central banks purchasing gold directly is another bullish development that could persist for years if the geopolitical climate remains unstable.

Speaking of geopolitics, worries about a conflagration in the Middle East intensified last week after Israel struck the capital of Lebanon to kill a senior Hamas leader. These escalation fears translated into a boost for oil prices, but the move has already started to run out of juice, following news that Saudi Arabia will cut the price at which it sells crude.

When a major oil producer like Saudi Arabia offers price discounts, it’s either a sign of concern about weakening demand conditions or an attempt to stop foreign producers such as the USA from stealing market share away. Either way, it’s a bearish signal for energy prices.

Chinese stocks fall as shadow bank goes bankrupt

One of the biggest players at the heart of the Chinese shadow banking system filed for bankruptcy on Friday, providing the clearest indication so far that the property market crisis has started to infect the opaque lending industry. Even though investors were aware Zhongzhi Enterprise Group was facing severe liquidity issues, the news of its bankruptcy still dragged local equity markets down today.

Zhongzhi’s downfall underscores the difficulties Beijing faces in its attempt to stabilize the real estate market and rein in private debt levels, in a financial system that includes many dark corners and therefore hidden risks.

Finally in the US, Congressional leaders reached a spending deal that makes a partial government shutdown later this month less likely. That said, the deal still needs to pass both chambers of Congress and be signed by the President.