Dollar off highs ahead of NFP, equities buoyed by trade hopes

Hopes rise of US-China trade dialogue

Trade tensions have significantly de-escalated this week as the Trump administration has been focused on restoring some calm to the markets to mark the President’s 100 days in office. But whilst there have been a number of tariff exemptions and progress in trade negotiations with several countries, Washington and Beijing aren’t even talking.

That could be about to change as China has signalled it is “evaluating” whether to start discussions with the US on trade. The statement published today by the country’s commerce ministry is the first time the Chinese have reached out to their American counterparts, having until now been adamant that they will not give in to US demands.

According to Chinese officials, the US has been trying through multiple channels to engage in talks even though Treasury Secretary Scott Bessent has insisted that it is “up to China” to make the next move. However, this is only a first step and the two sides are far from joining the negotiating table as China appears to be seeking a goodwill gesture from Trump before talks can even begin.

The statement is suggesting that the White House undo some of its tariff measures to “show its sincerity”, something that Trump is unlikely to agree to, at least not before he’s extracted some concessions from Beijing.

Equities eye weekly gains; Apple and Amazon disappoint

Nevertheless, investors are interpreting this as progress and equities are extending their recovery from the early April lows to a third week. Chinese markets remain closed today but stocks elsewhere in Asia and in Europe look set to end the week on a high.

US futures are also up today, having finished higher on Thursday, with the Nasdaq leading the gains. Upbeat earnings results as well as solid guidance from Microsoft and Meta bolstered the tech-heavy Nasdaq, which has been underperforming against the S&P 500 and Dow Jones this year.

But a big rally today to wrap up the week seems unlikely as yesterday’s earnings by Apple and Amazon.com failed to match the prior day’s stellar results. Although both firms beat their earnings estimates, investors are worried about Apple’s falling iPhone sales in China and the hit to profits by Trump’s tariffs. The trade war is also weighing on Amazon’s profit outlook just as revenue growth in its cloud unit is slowing.

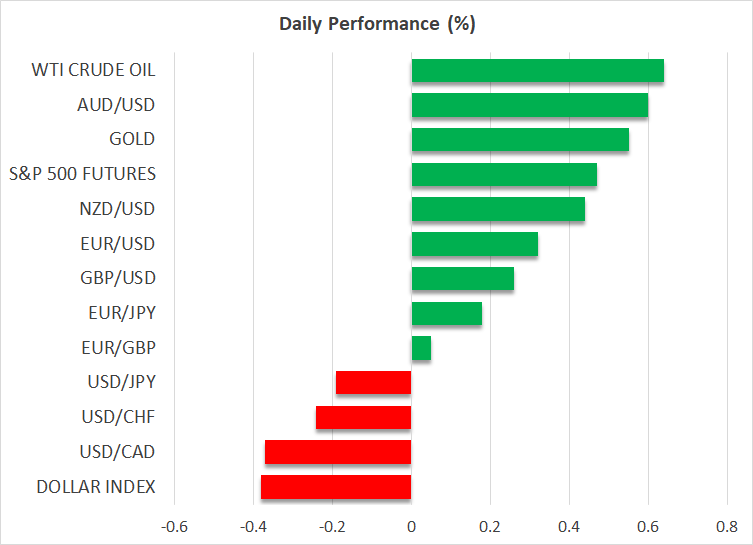

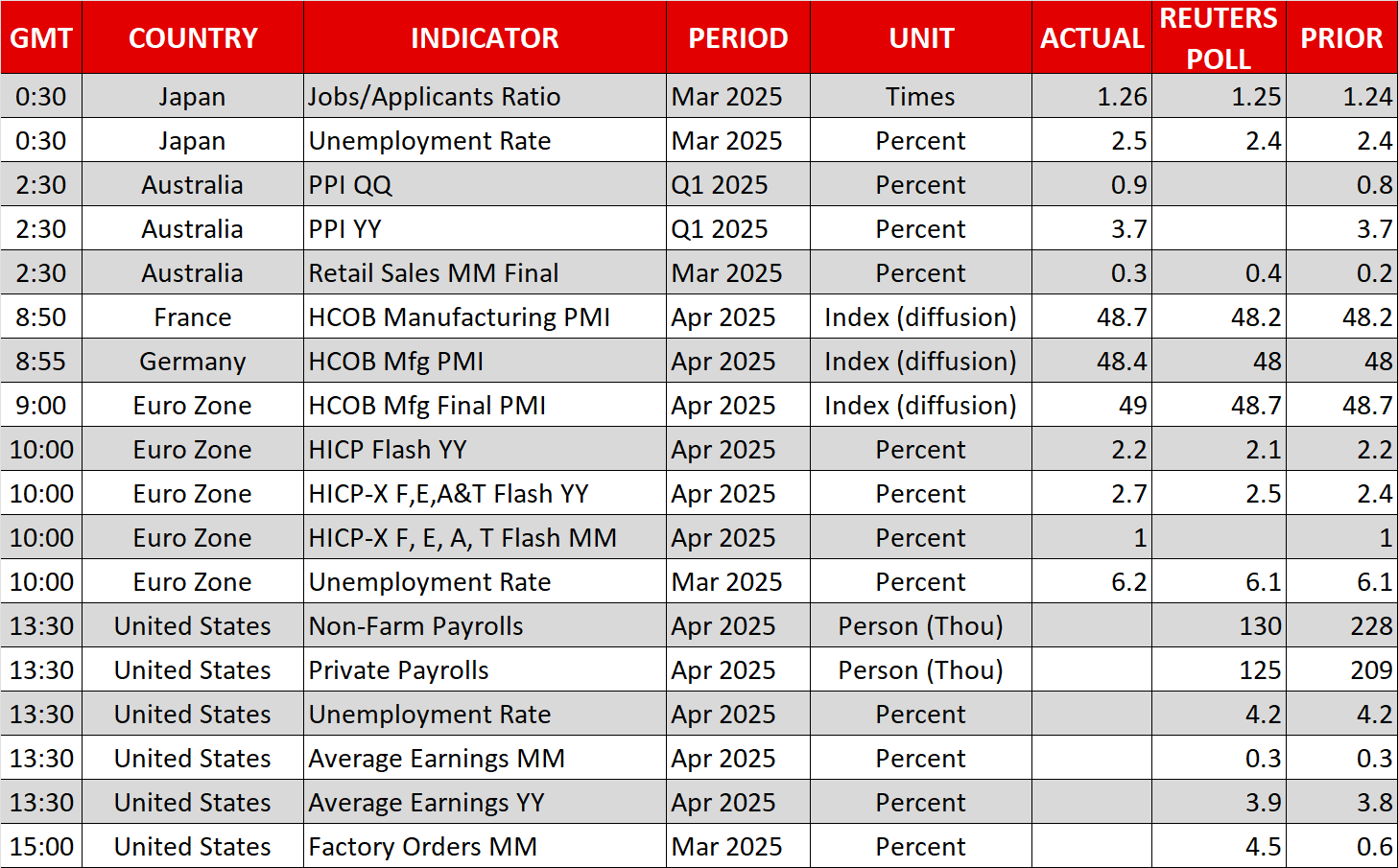

Dollar eyes NFP data, yen struggles

It's been a good week for the US dollar too, although it’s edging lower today as some caution sets in before the April jobs report, which is due at 12:30 GMT. Nonfarm payrolls likely rose by 130k in April but following the weak ADP report and yesterday’s jump in the weekly jobless claims, a negative surprise is possible.

However, a small miss in the headline figure might be good for sentiment as it would increase the urgency for the Fed to cut rates. The danger is if the data is bad enough to raise recession alarm bells, in which case, risk appetite would flounder again and the dollar could resume its downtrend.

Hence, the greenback is far from being out of the woods and its gains this week have been overstated by weakness in the Japanese yen. The Bank of Japan cast doubt about further rate hikes at its meeting on Thursday and Japanese officials have signalled that a trade deal with the US probably won’t be possible before June.

More worryingly, Japan’s finance minister has raised the prospect of using the country’s holdings of more than $1 trillion in US Treasuries as leverage in the trade negotiations, pointing to fraught talks.

Aussie up ahead of elections, gold pares losses

Elsewhere, the Australian dollar is one of today’s stronger performers, benefiting from the improved market mood and despite indications that Australia’s federal elections tomorrow will fail to produce a decisive win for either the incumbent Labor party or the opposition Coalition.

Gold, meanwhile, is bouncing higher on the back of the dollar’s retreat. The precious metal has been under pressure all week, ravaged by the de-escalation in global trade frictions. Further positive headlines on trade could steepen gold’s correction.

.jpg)