Dollar rebounds, yen off highs after suspected intervention

Yen on edge as no word on intervention

FX markets remained wary but were steadier on Tuesday following yesterday’s rollercoaster ride for the Japanese currency. After months of constant pushing and prodding by traders, Japanese authorities likely saw red when the yen crossed the 160 per dollar level. Although there’s been no official confirmation by the Ministry of Finance nor the Bank of Japan, sources suggest this was intervention according to the Wall Street Journal.

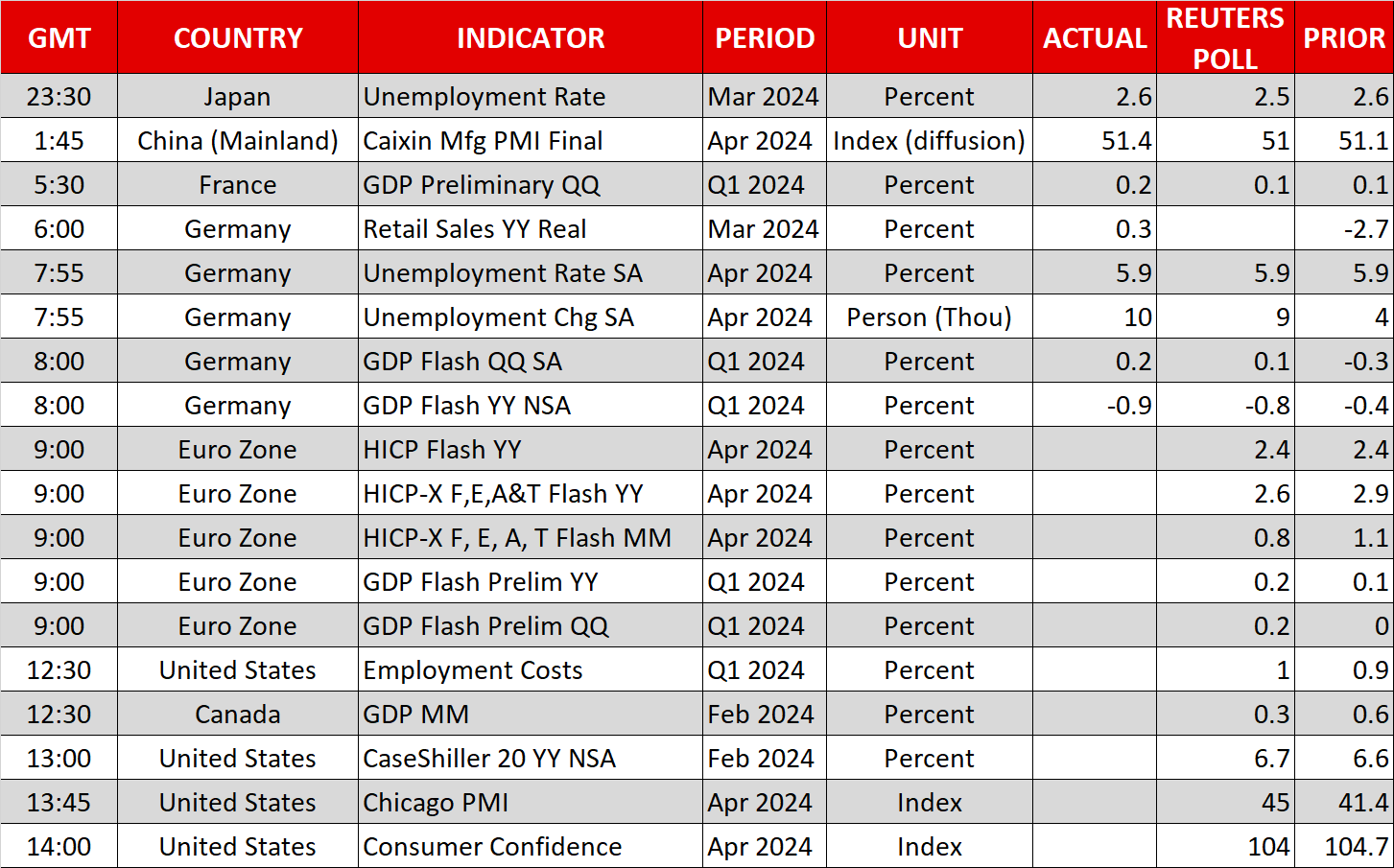

After fluctuating by around 500 pips on Monday, the yen is so far holding in a narrower range today, trading around 156.80 to the dollar.

It’s likely that investors will have to wait for official figures on foreign-exchange reserves for the month that won’t be due until late May to know for certain that the BoJ carried out intervention. But whilst the move has made it somewhat riskier for traders to keep testing authorities’ nerves, it will be difficult for the yen to stage a meaningful rebound without substantial weakening in the US dollar.

Dollar firms ahead of key events

The Federal Reserve begins its two-day monetary policy meeting today and all the indications are that Chair Powell will maintain a hawkish stance amid a strong US economy and persistent inflationary pressures. Although there’s a risk that Powell might explicitly open the door to a rate hike, it’s doubtful he will want to rattle the markets and any hawkish remarks might be offset by an announcement on reducing the pace of quantitative tightening.

The bigger uncertainty is probably what the data will reveal. If for example, a robust payrolls report is balanced out by softer ISM PMIs, markets will choose to keep their hopes up that rate cuts are on the way, albeit delayed.

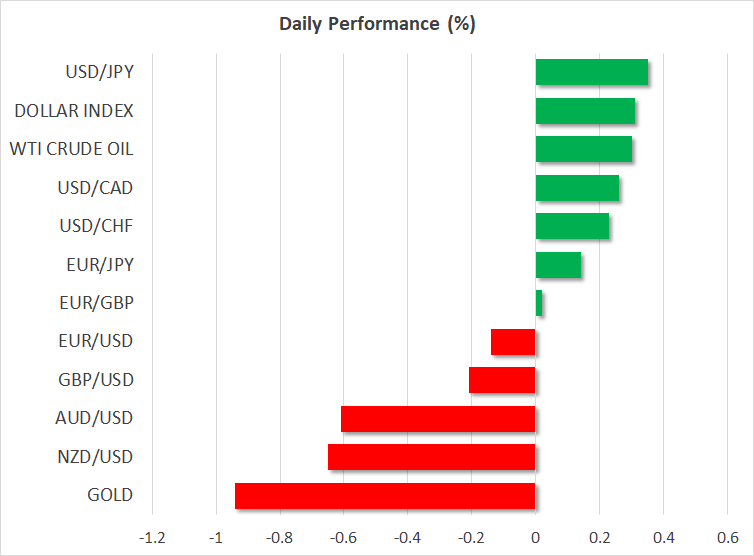

The dollar is edging broadly higher today, tracking the uptick in Treasury yields, which reversed their two-day slide after the US Treasury Department upped its borrowing estimate for the second quarter by a sizeable $41 billion.

Gold slips, euro shrugs off GDP rebound

Gold came under pressure from both the firmer dollar as well as from growing signs that Israel and Hamas are on the verge of agreeing to a ceasefire in the fighting in Gaza. The precious metal was last down by almost 1%.

The euro, meanwhile, was struggling to hold onto the $1.07 handle even as Eurozone growth appears to be rebounding. Nevertheless, upbeat GDP readings are not seen as jeopardizing the ECB’s expected rate cut in June, so the euro will probably remain on the backfoot for now, especially as inflation continues to recede.

Headline CPI was unchanged at 2.4% in April's flash estimate, in line with expectations, but core measures eased slightly.

Stocks lack direction ahead of major earnings

In equity markets, European and Asian shares were mixed as US futures lost steam after yesterday’s modest gains on Wall Street.

The day ahead is looking to be a busy one for US earnings, with Amazon, AMD, Coca-Cola and McDonald’s being some of the big names that are due to report their results. First quarter earnings growth for S&P 500 companies are forecast at 5.6% year-over-year, up from the previous estimate of 4.3%.

If earnings continue to impress, markets may not take such a downbeat view of rate cut expectations being trimmed further from a potentially hawkish Fed this week.

.jpg)