Dollar Strengthens, Euro Faces Further Downside

Fundamental Analysis EURUSD Key Takeaways

Differential drives the US dollar: the European Central Bank will cut interest rates sharply in 2025. The market has priced in at least four 25 basis point interest rate cuts, and there is still uncertainty in the market as to whether the Federal Reserve will make two similar interest rate cuts. The US dollar index touched the 109 mark upward, continuing to hit a new high since November 2022.

ECB Governing Council member Stournaras: The European Central Bank’s interest rate is expected to be lowered to 2% by the fall of this year. The US benchmark 10-year Treasury yield closed at 4.5680%; the two-year Treasury yield, which is more sensitive to monetary policy, closed at 4.2620%.

Technical Analysis EURUSD Daily Chart Insights

(EURUSD Daily Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator: The indicator sent out a short signal again before reaching the 50 median line, suggesting that the current short force has the upper hand, and traders should pay attention to short opportunities.

Market structure SHIFT: EUR/USD fell rapidly yesterday, and the final closing price closed below the long-short conversion line of 1.03403. The strong downward trend indicates that there is a high probability of a correction in today’s Asian session, and then the downward trend will continue.

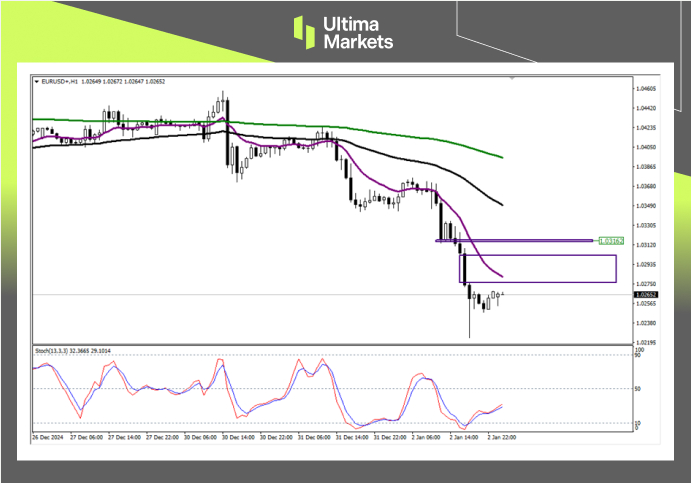

EURUSD 1-hour Chart Analysis

(EURUSD H1 Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator: The indicator sent out a bullish signal during the US trading session yesterday. Today, the indicator will most likely continue the upward trend during the Asian trading session. Pay attention to the exchange rate performance when the indicator is near the 50 median line.

KEY resistance above: The EUR/USD price is about to approach the purple 13-period MA. Since the MA is inside the fair value gap, the first target of the exchange rate rebound is more likely to look at the upper edge of the fair value gap, and the second target is near the opening price of the order block of 1.03162.

EURUSD Pivot Indicator

(EURUSD M30 Price Chart, Source: Ultima Markets APP)

According to Pivot Indicator in Ultima Markets APP, the central price of the day is established at 1.0239,

Bullish Scenario: Bullish sentiment prevails above 1.0239, first target 1.0299, second target 1.0315;

Bearish Outlook: In a bearish scenario below 1.0239, first target 1.0211, second target 1.0195.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.