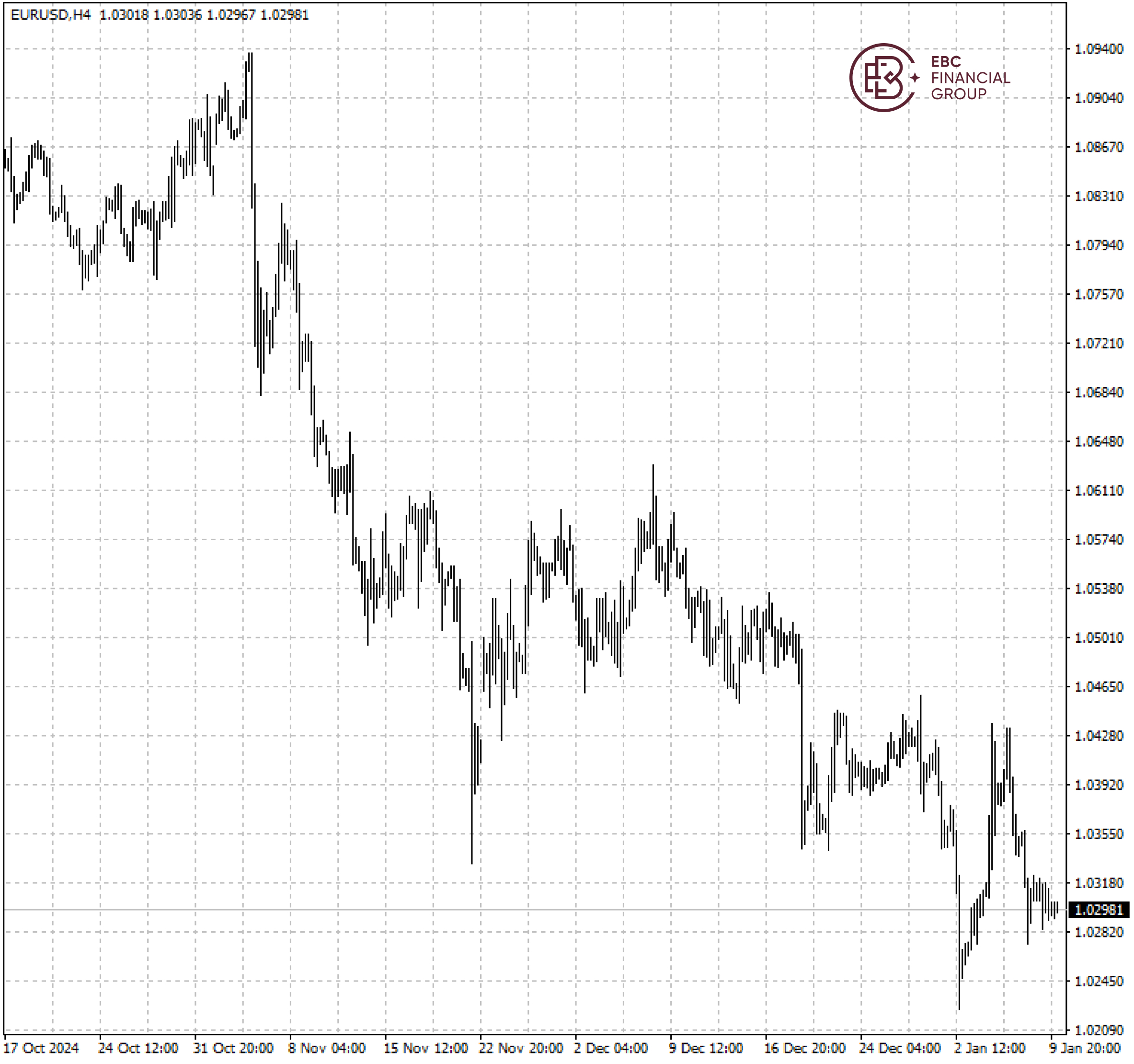

EBC Markets Briefing | Euro parity is back in sight as Trump 2.0 looms

The euro languished around its two-year low on Friday amid political and economic woes. As the US gets ready for Trump’s presidency, the currency market is preparing for further euro weaknesses.

Options markets imply around a 40% chance the currency pair will hit parity this quarter and trading of contracts that target that level surged last week. The single currency tumbled over 6% in 2024.

BNY and Mizuho anticipate Europe will be a casualty of a potential trade war and that divergent growth expectations between Europe and the US could usher in dollar strength rarely seen in two decades.

The parity last occurred in 2022 when Russia unexpectedly sent its troops into the territory of Ukraine. Russia cut off its last gas line to Europe this week, ending decades of the mutual-benefiting deal.

The composite PMI stood at 49.6 in December 2024 in the eurozone, following November's 48.3 figure. The contraction was entirely manufacturing-led, with a sharp drop in factory production.

The ECB is expected to reduce benchmark interest rate to 2.75% at its next meeting, while the Fed is expected to hold rates in a 4.25% to 4.5% range, highlighting the government yield spread.

The euro easily broke below the support around 1.0340, and the path of least resistance is going down with the next support around 1.2480.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.