EBC Markets Briefing | Funds flocked to US market last month

The Nasdaq 100 and the S&P 500 rose to record closing highs on Friday following upbeat outlook from some companies and as US jobs data fuelled expectations the Fed would cut interest rates this month.

Government data showed job growth surged in November, but an increase in the unemployment rate to 4.2% pointed to an easing labour market. Markets were pricing in a nearly 90% chance of a 25-bp cut later.

Investors have pumped almost $140 billion into US equity funds since last month’s election as Trump’s administration plans to unleash sweeping tax cuts and reforms in a boon to corporate America.

November was the strongest month for flows into equity funds globally since early 2021 as money was directed into the US from other markets that are seen as more vulnerable to a potential trade war.

With the end of a magnificent year close, a host of banks and asset managers predict further strong gains for US stocks in 2025. The targets for the S&P 500 set by most of them are above 6,500.

Profit margins are expected to rise and earnings growth is expected to broaden out. High valuations that limit upside potential may not necessarily mean weak returns over the next year.

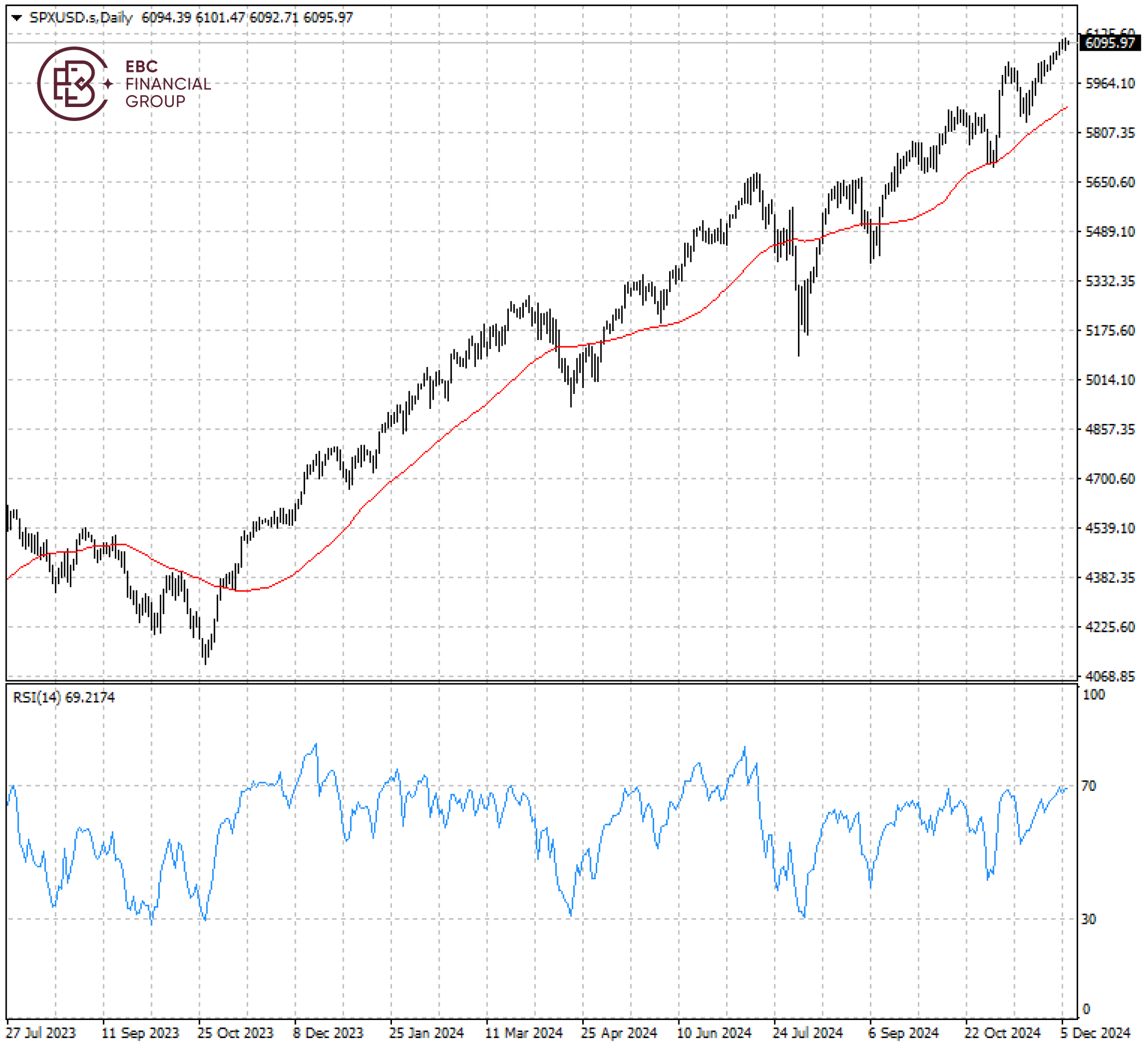

The S&P 500 shows a stable uptrend, trading firmly above the 50 SMA. However, there could be some downside risks around the corner considering RSI near 70.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.