EBC Markets Briefing | German election soothe investor nerves

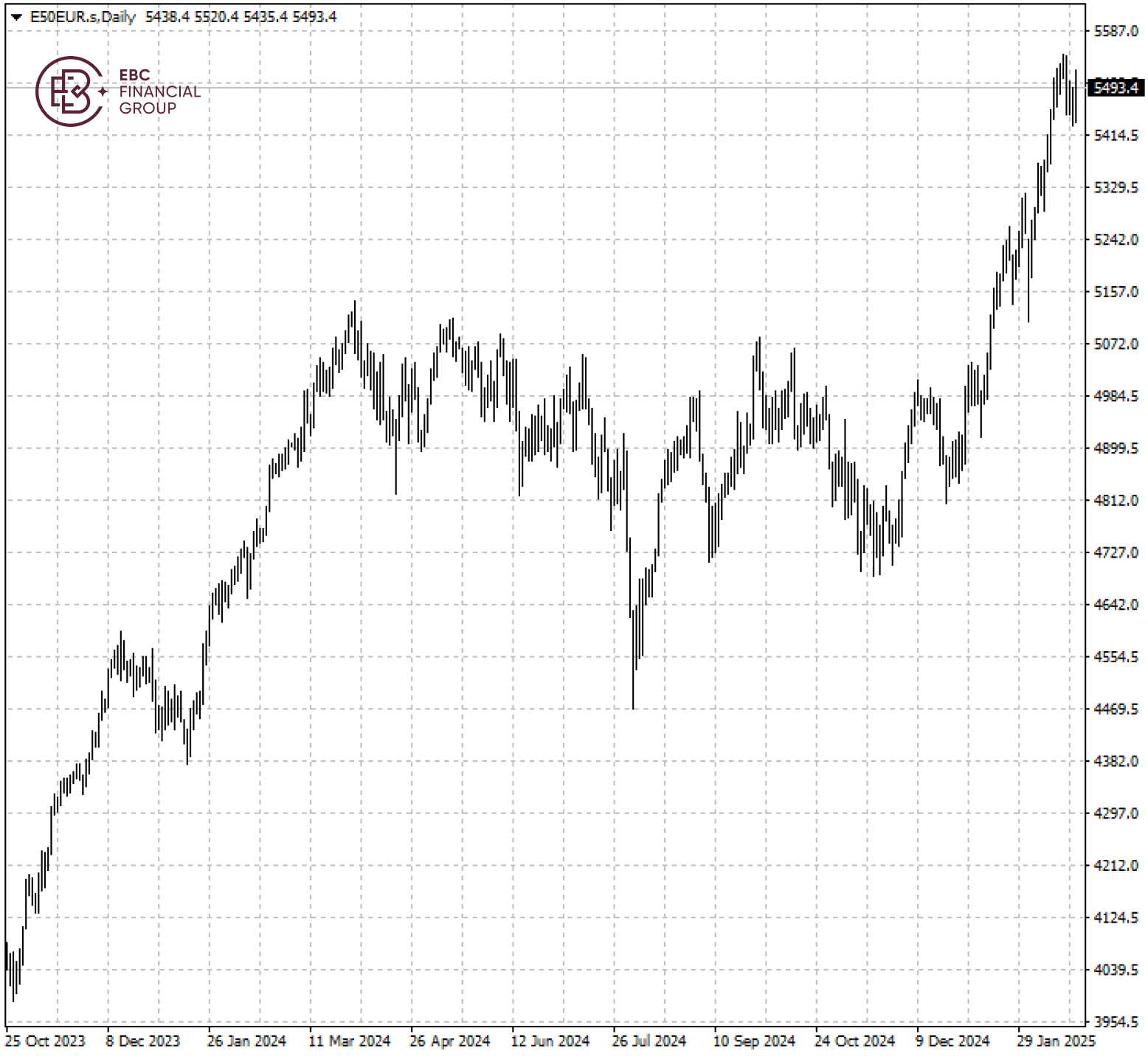

European stocks have hit record highs this month, as companies have beat Q4 revenue expectations, but the topic that dominates the conversation among executives in the region is US tariffs.

According to LSEG I/B/E/S, earnings are expected to have increased 5.4% from the same period a year ago, while sales are forecast to have risen 4.7%, the highest quarterly growth rate since Q4 2022.

German's new conservative leader Friedrich Merz has to form a coalition government and it is not yet clear whether that will include one or two partners, with the latter likely to take more time and horse trading.

The uncertainty comes as EU leaders are drawing up a plan to hold an extraordinary summit next month to discuss additional support for Ukraine and how to pay for European defence needs.

Private-sector business activity in France unexpectedly slumped to its lowest level since 2023 in February on a prolonged political crisis, which could prompt the ECB to speed up interest-rate cuts.

PM Francois Bayrou’s government remains vulnerable with no clear majority in parliament with tensions with opposition parties likely to return in the coming months in terms of legislation.

The Stoxx 50 looks neutral consolidating below its peak. The yearly uptrend remains interrupted as long as 5,360 is respected.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.