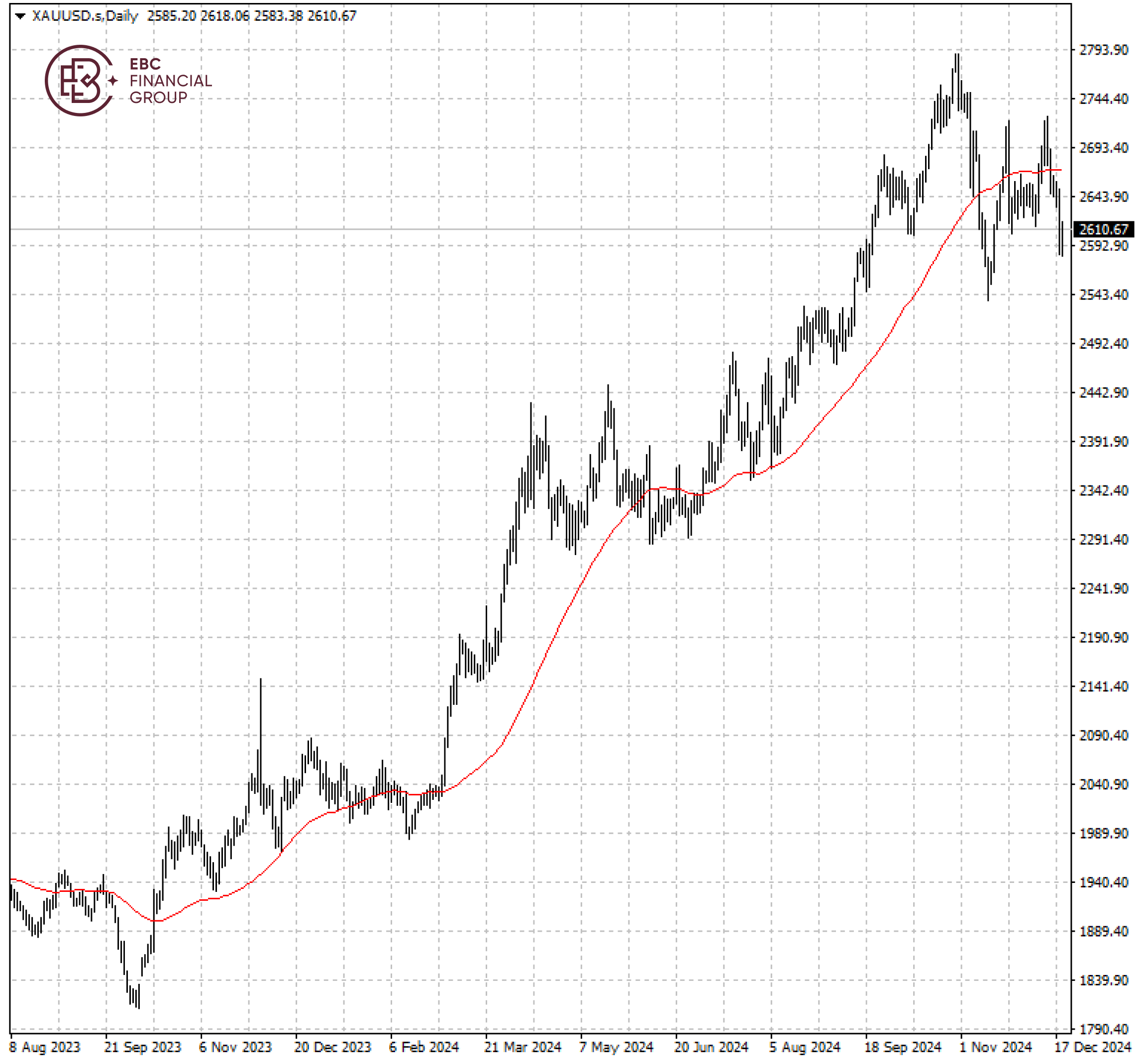

EBC Markets Briefing | Gold licks wounds after Fed turns hawkish

Bullion rallied more than 1% on Thursday in early Asian hours as the market was calming down ahead of a key inflation report. The metal was up over 30% year to date, easily outperforming US stocks.

Gold slipped more than 2% to a one-month low after the Fed lowered interest rates as expected, but noted it will slow the pace at which borrowing costs fall any further, boosting the dollar and bond yields.

The central bank issued fresh projections indicating two 25-bp rate cuts next year amid rising inflation. It is expected to take a wait-and-see approach after Trump was sworn into office in January.

According to futures on the federal funds rate, the Fed will leave interest rates unchanged next month. Disinflation has largely stalled in the recent months, which was also reflected in forecast for the PCE readings due Thursday.

India's gold imports are poised for a sharp slowdown this month following record purchases in November, in the absence of any major festival. That could cap a rally in global prices.

Investors have withdrawn more than $300 million from ETFs that hold physical gold in the first half of December - a drastic shift in their behaviour this year. Tump’s pro-dollar policies helped spur the outflow.

Gold looked gloomy below 50 SMA given its vulnerability to bad news. We see it as unlikely that the price will move well beyond $2,620 unless the PCE price index undershoots expectations.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person