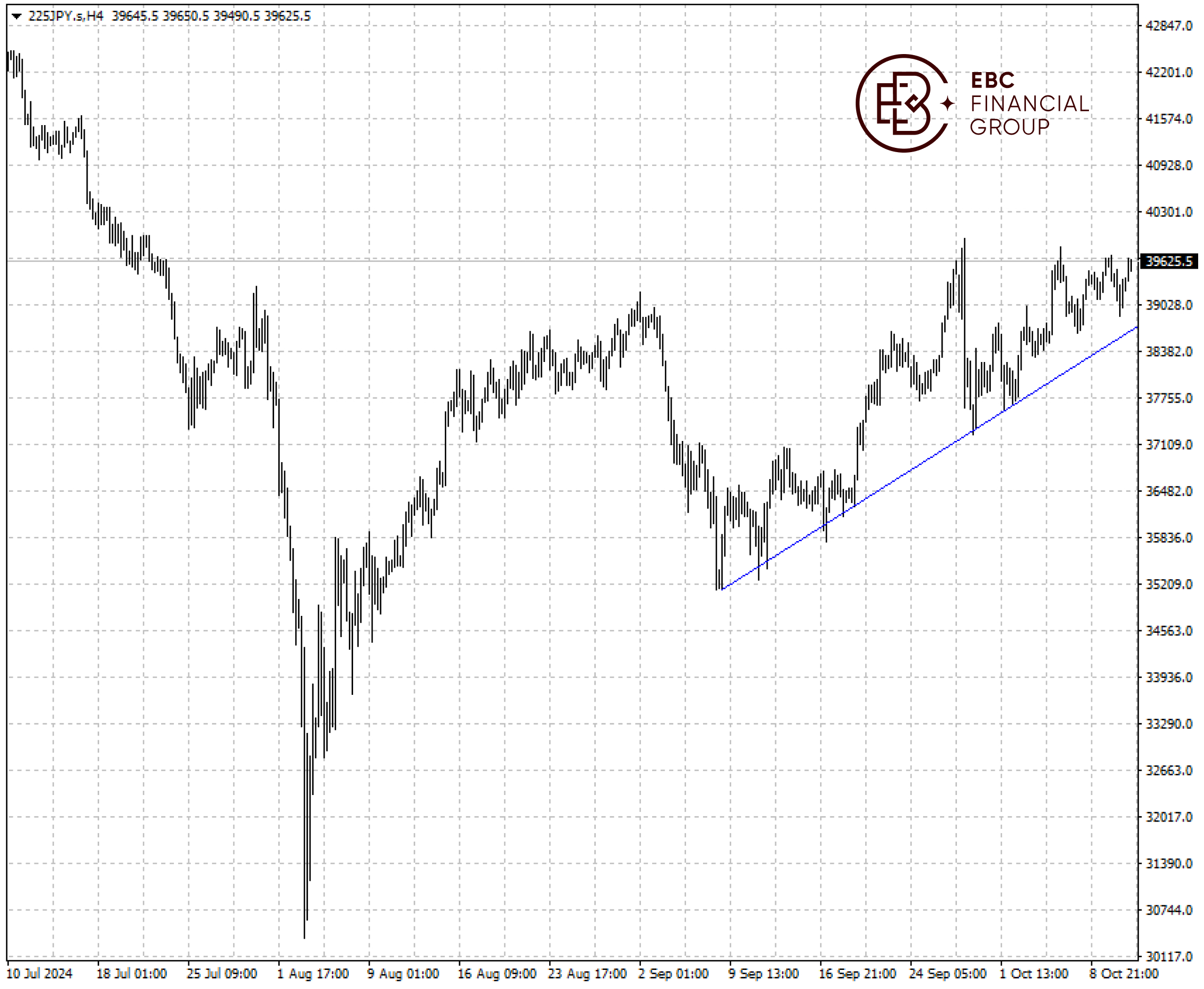

EBC Markets Briefing | Nikkei 225 recovers from Aug rout

The Nikkei 225 index remained on the front foot on Friday, while Chinese stocks lost some of its lustre. The Japanese market has restored some calm with the index recouping most of August's rout.

Investors are counting on solid earnings to help Japanese shares hold their gains in the final stretch of a volatile year that saw the market go from one of the world’s top performers to a laggard.

Analysts have been raising their outlooks for company profits more than lowering them, according to an earnings revision index compiled by Goldman Sachs. The biggest threat to earnings would be a resurgence in the yen.

A significantly dovish shift in rhetoric from BOJ Kazuo Ueda and surprising opposition to further rate hikes by new PM Shigeru Ishiba have cast doubts over when the central bank would act next time.

Despite that, Japan's improving economic conditions and receding US recession worries are likely to bring prospects of a December or January interest rate hike back into view.

Base salaries rose at the fastest pace in nearly 32 years in August, reflecting this spring's labour-management pay negotiations that led firms to deliver bumper pay hikes.

The Nikkei has fluctuated above ascending trendline, so it looks bullish in the short term. The key resistance is seen at the 40,000 level, followed by 41,600.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.