EBC Markets Briefing | Oil prices down on US inventory build

Oil prices fell on Thursday, extending losses from the previous day, pressured by large builds in US fuel inventories last week, though concerns over tighter supplies from OPEC+ capped the decline.

Gasoline stocks rose by 6.3 million barrels last week, the EIA said, well above analyst forecast of a 1.5 million-barrel gain. Crude inventories fell by 959,000 barrels, compared with expectations for a 184,000-barrel drop.

OPEC’s crude output fell in December after two months of increase, a Reuters survey showed. Field maintenance in the United Arab Emirates offset a Nigerian output hike and gains elsewhere in the group.

Oil has had a strong start to 2025 following a disappointing year, but many analysts continue to warn of a glut this year with stalling Chinese demand and non-OPEC+ output increase.

WTI’s prompt spread retreated from a 3-month high, indicating optimism was fading. Hoverer, Saudi Arabia hiked oil prices to Asian customers earlier this week, a vote of confidence for crude demand.

Trump on Monday denied a Washington Post report that said his aides were exploring tariff plans that would only cover critical imports, deepening uncertainty among business leaders about future economic policies.

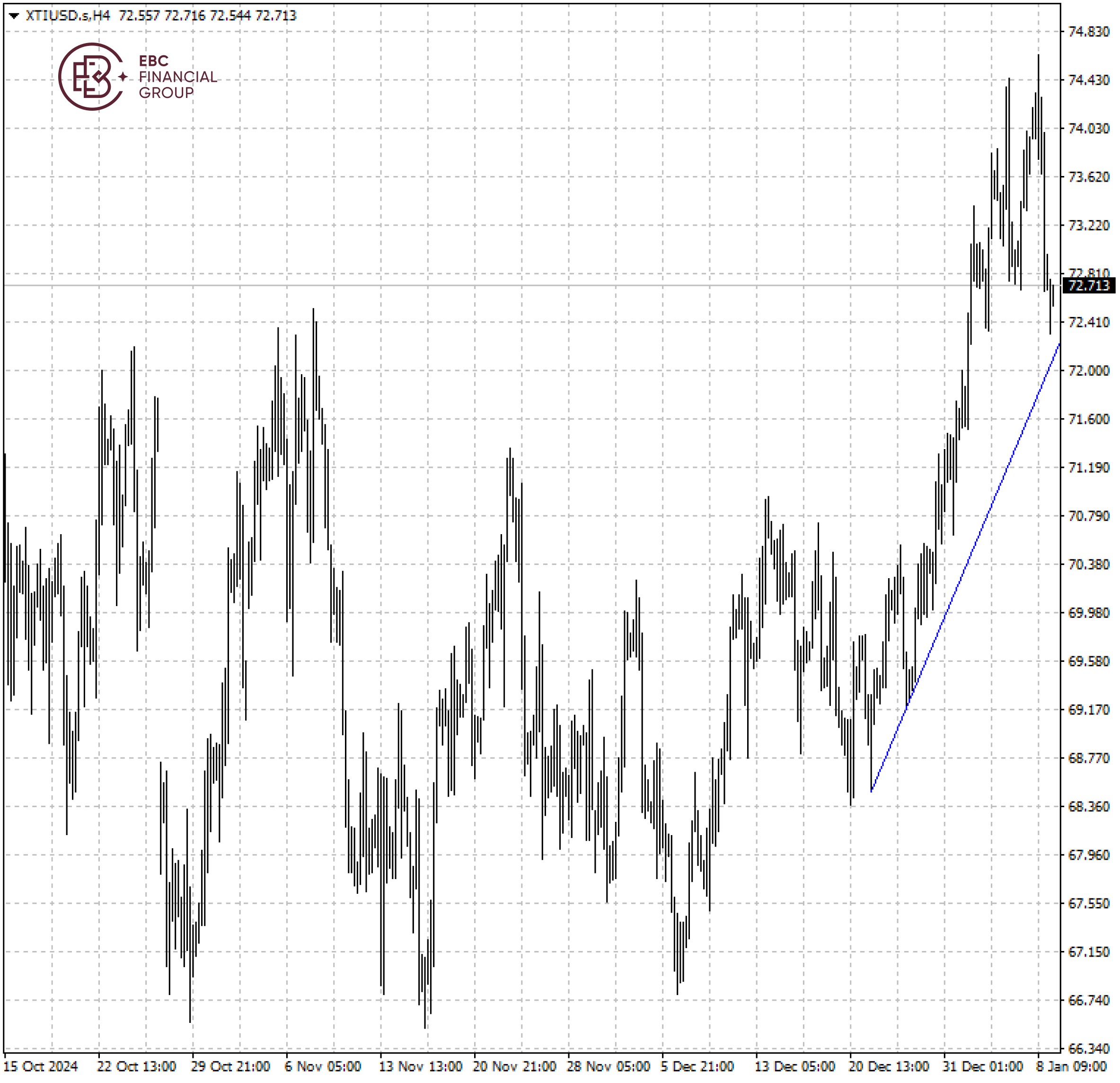

WTI crude broke out of its three-month range, but it lost momentum near 200 SMA. It is critical to hold above the ascending trendline, otherwise we could see another leg lower.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.