EBC Markets Briefing | Oil prices little affected by fresh EU sanction

Oil prices were little changed in early Asian trade on Thursday as forecasts of weak demand and a higher-than-expected rise in US inventories outweighed EU sanctions that threatened Russian oil flows.

EU ambassadors have agreed to a new raft of sanctions against Russia because of its war on Ukraine, mainly targeting Russia’s massive shadow fleet of ships, the EU’s Hungarian presidency said.

OPEC cut its demand growth forecasts for 2025 for the fifth straight month on Wednesday and by the largest amount yet due to weak demand, particularly in top importer China, and non-OPEC+ supply growth.

Chinese crude imports grew annually for the first time in seven months in November, up more than 14% from a year earlier. But its exports slowed sharply and imports unexpectedly shrank in the month.

US crude stocks fell 1.4 million barrels in the week ending 6 December, compared with analysts' expectations for a 901,000-barrel draw, while gasoline and distillate inventories surged, the EIA said.

US oil majors are working on deals to use natural gas and carbon capture to power the technology industry's AI data centres, which could brighten the fossil fuel outlook.

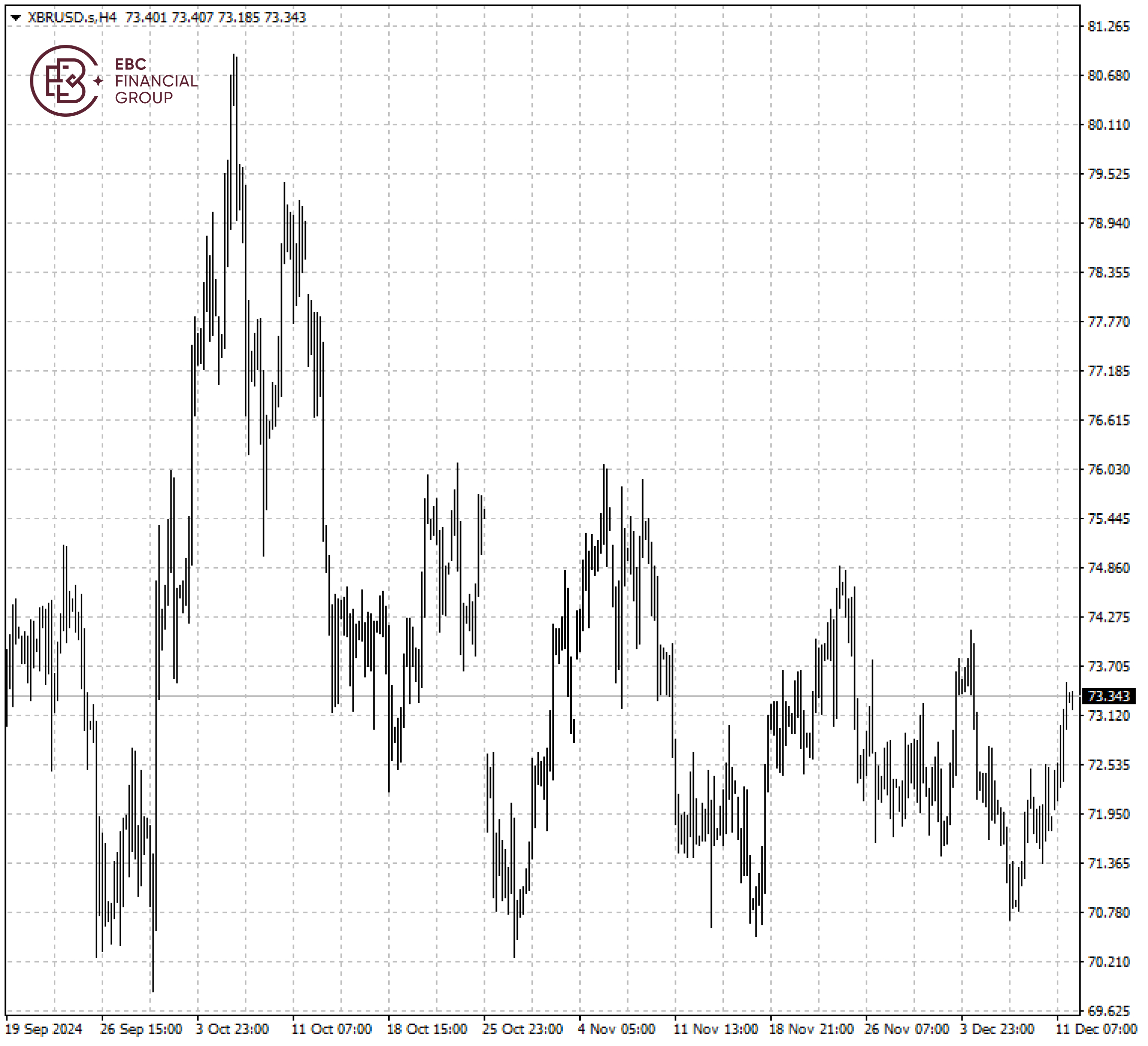

Brent crude has failed to break out of its trading range and a wedge pattern is in sight. As such its risk is skewed towards the downside in the medium term.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.