EBC Markets Briefing | Wall St rises but carmakers suffer

US stocks notched record highs on Tuesday as technology stocks rebounded, while investors digested Donald Trump's tariff pledges on top trade partners and the latest minutes from the Fed.

US short-term interest-rate futures pared earlier losses after the Fed's latest minutes showed officials appeared divided over how much further they may need to cut interest rates.

Trump said he would impose a 25% conditional tariff on Canadian and Mexican imports, which could violate a free-trade deal he negotiated during his previous term. That came as some surprise.

The tariffs will remain in place until the two countries clamp down on drugs, particularly fentanyl, and migrants illegally crossing the border, Trump said in a post on his Truth Social platform.

Even prior to Trump’s Monday announcement, new tariffs were projected to increase inflation and cost American shoppers up to $78 billion in spending power each year, per the National Retail Federation.

The top 10 car manufacturers with Mexican plants collectively built 1.4 million vehicles over the first six months of this year, with 90% heading across the border to US buyers, according to the Mexican auto trade association.

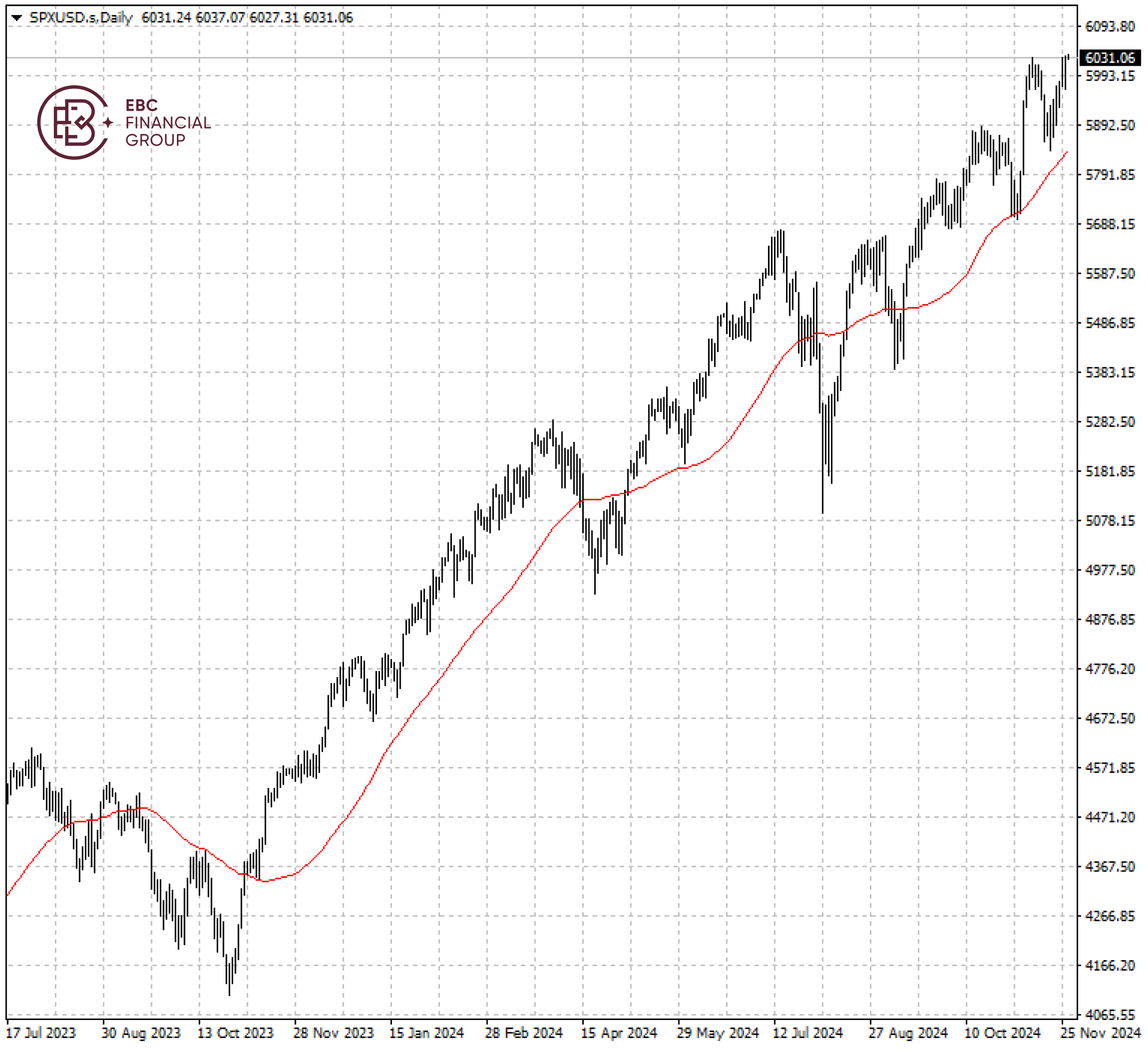

The S&P 500 stayed comfortably above 50 SMA and technical indicators suggest more room for upside down the road. A pullback may take place after the RSI gets close to the overbought territory.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.