EBC Markets Briefing | Wall St slumps as hedge funds beat a retreat

US major stock indexes continued to plummet on Monday, with the Nasdaq 100 down 3.8%, amid fears that Trump's tariff policy will drive the world's largest economy into a recession.

Hedge funds unwound positions in single stocks on Friday at the largest amount in over two years, with some activity comparable to March 2020 when the pandemic burst, Goldman Sachs said in a note on Monday.

A separate note showed overall hedge funds' leverage in equity positions was at 2.9 times their books, a record level over the last five years. The sizable bets might result in a selloff when market sentiment turns sour.

China and Europe’s massive stimulus added to the selloff. But some Wall Street watchers say now is the time to take advantage of lower valuations, with the resiliency picture largely still intact.

Citigroup’s strategist Stuart Kaiser is cautiously optimistic and emphasized the importance of staying selective, leaning towards opportunity in large-cap, high-quality stocks in the financial and tech sectors.

The Dow’s outperforming the S&P 500 this year underlines rotation to value stocks. Notably, Lockheed Martin and RTX group have defied the trend as they are expected to benefit from a surge in Europe’s defines spending.

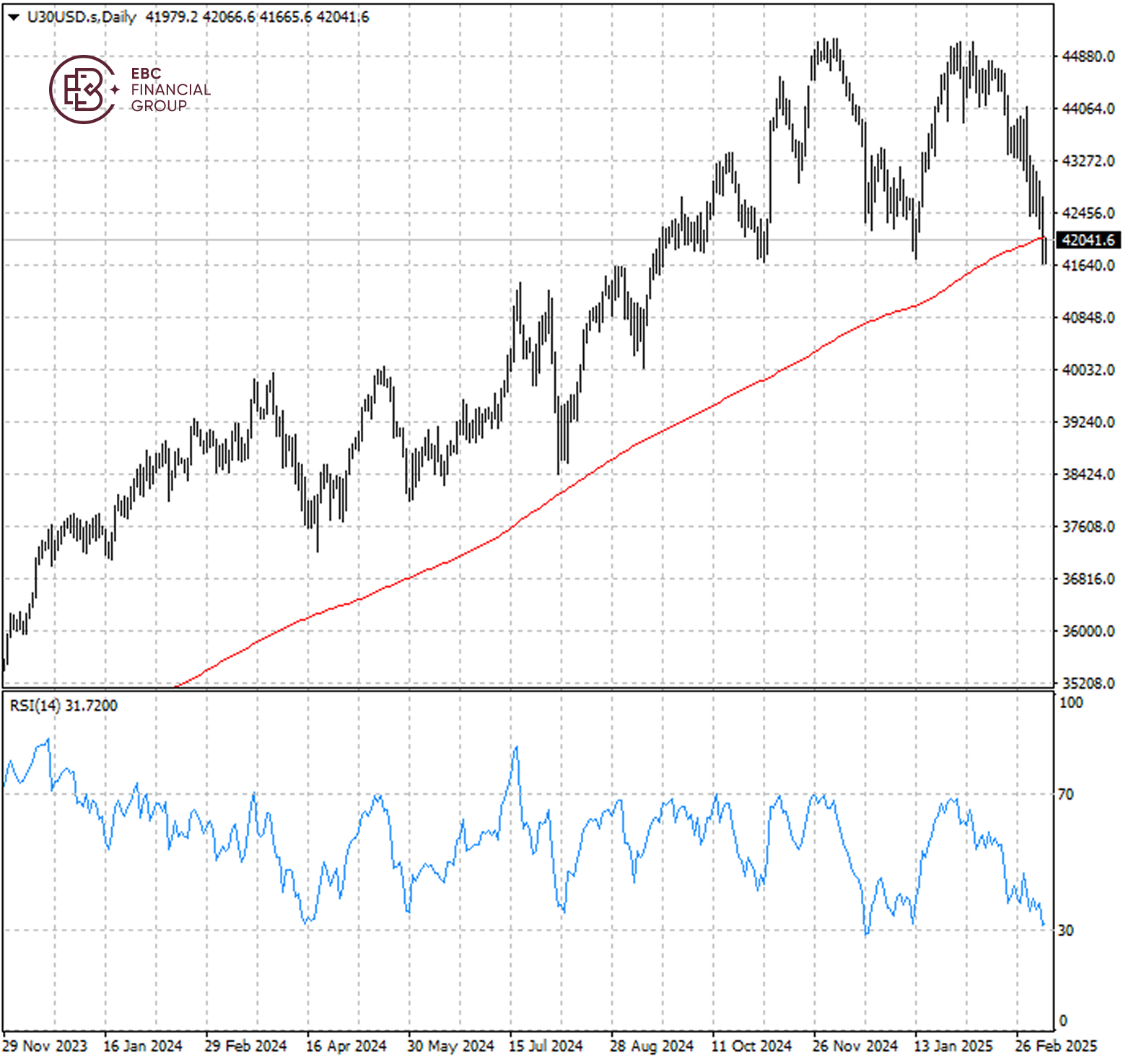

The Dow has fallen below its 200 SMA, but there are signs of a double bottom pattern. Given RSI near the oversold territory, we see the index find some support around January’s low around 41,760.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.