EBC Markets Briefing | Yen extends rally after Japan struck trade deal

The dollar was on a shaky footing against the yen on Wednesday with a major trade deal sealed. Treasury Secretary Scott Bessent said the quality of trade agreements outweighs the timing.

Trump on Tuesday stateside announced a "massive" deal with Japan that includes "reciprocal" tariffs of 15% on the country's exports to the US, with car duties reportedly being lowered to the level as well.

He said that Japan and the US were also concluding an additional deal involving LNG, adding that "we have Europe coming in tomorrow," without specifying any details.

The cheerful headlines come just days after Ishiba's governing coalition lost its majority in the country's upper house elections that raised concerns about the country's negotiating power.

Japan's core inflation cooled to 3.3% in June, coming down from a 29-month high of 3.7% as rice prices showed signs of easing. The truce with Washington will help rein in sticky inflation.

The Ishiba administration could also expand fiscal spending to cooperate with the opposition party amid predictions that the BOJ's further rate hike will lose its strength due to political uncertainty.

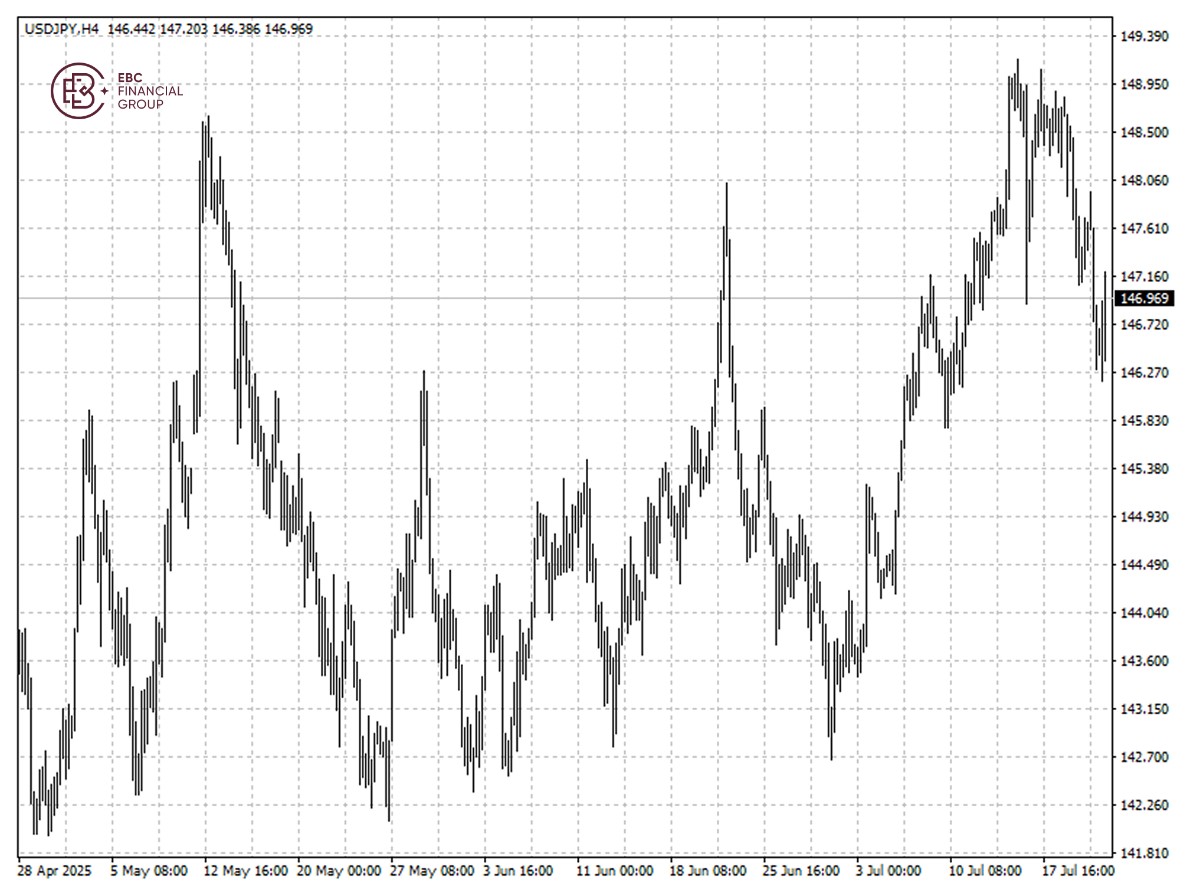

The yen has been in an upside spiral since bottoming out around 149.2 per dollar. Technical indicators are yet to show signs of reversal, so further gains towards 145.75 are likely.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.