Euro area Manufacturing brightens

Euro area Manufacturing brightens

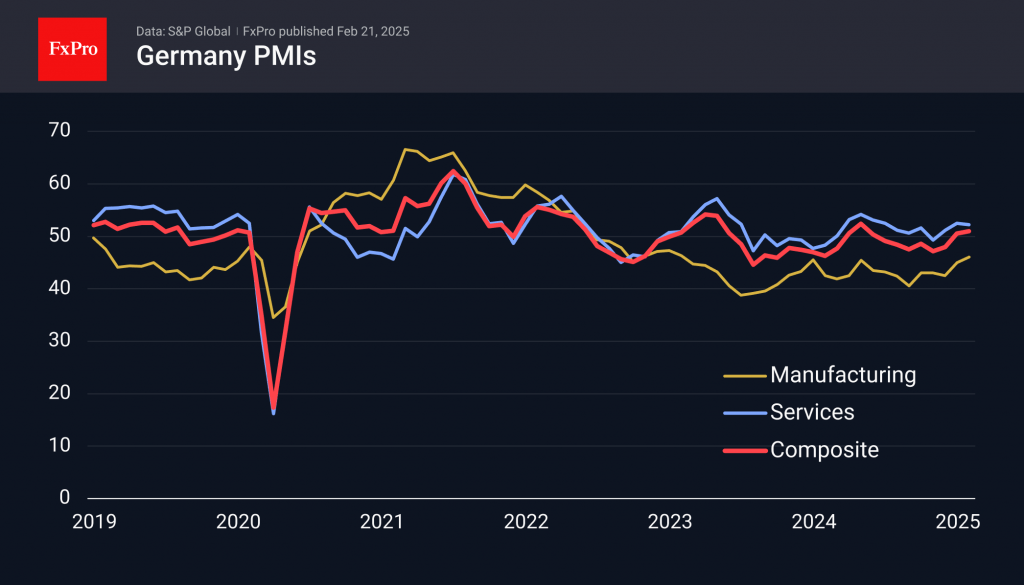

Preliminary estimates of PMI business activity indices for eurozone countries came in below expectations, taking away about a third of a per cent from EURUSD in the first hours after the release. However, the rebound in manufacturing activity reinforces expectations of economic acceleration in the coming months.

For France, Germany and across the eurozone, manufacturing PMIs exceeded expectations and earlier estimates, pointing to a further pickup in the recovery. Their upward trend is an important positive for Europe, where the manufacturing sector remains an important leading indicator for the overall economy.

The services sector, meanwhile, disappointed, posting figures below expectations and weaker than earlier figures. The PMI for the services sector is above 50, i.e. in growth territory. Its slowdown was a negative for the Euro, as it does not prevent further key rate cuts in the Eurozone, as low activity does not create pro-inflationary risks.

However, in the longer term, the recovery in manufacturing activity is positive news for the euro, which is closely correlated with economic activity - much better than the dollar. However, while EURUSD remains persistently below 1.05, we see more chances of failure under the parity level. The rise could well turn out to be just a corrective bounce.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)