EURUSD bulls hold ground; but can they break through in Q4?

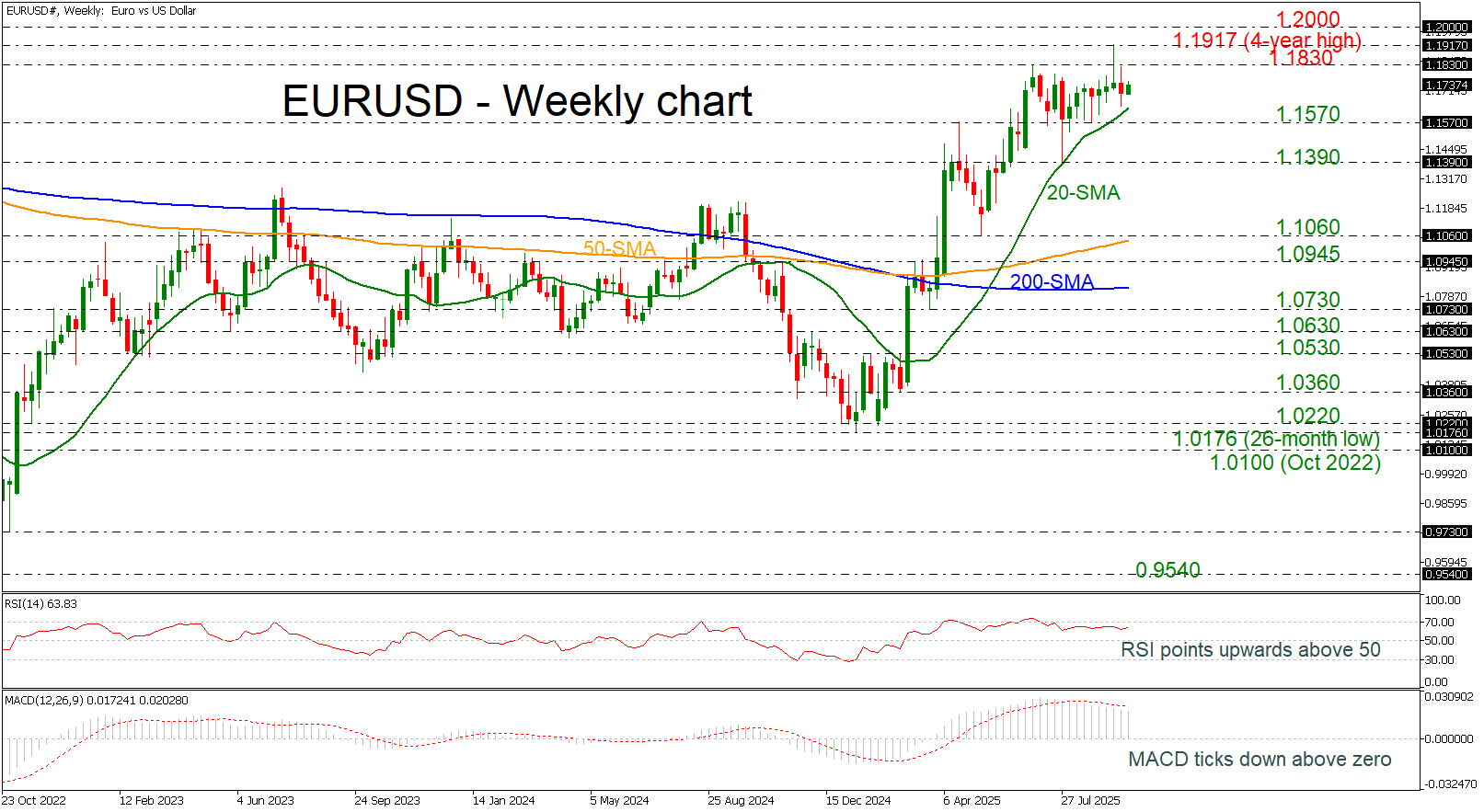

EURUSD has climbed nearly 13% in the year to date, supported by diverging central bank policies. The ECB paused its rate-cut cycle amid stable inflation, while the Federal Reserve began easing, lowering rates to 4.00–4.25% in September, which weakened the dollar. The euro gained further as markets priced in Fed dovishness and Eurozone resilience. However, the Q4 outlook remains uncertain, with EURUSD expected to fluctuate between 1.1570 and 1.1830.

A potential US government shutdown adds volatility, possibly delaying key data releases like nonfarm payrolls and complicating Fed decisions. If prolonged, it could further pressure the dollar, offering short-term support to the euro.

From a technical perspective, the pair is consolidating after spiking to a four-year high of 1.1917 in mid-September. A weekly close above the immediate resistance at 1.1830 could extend the bullish structure toward 1.1917 and the 200-month SMA at 1.2000.

Conversely, a drop below the 1.1570 support may trigger selling interest toward 1.1390, with further downside risk to 1.1060.

Momentum indicators are mixed, with the RSI marginally above 50, suggesting mild bullish bias, while the MACD is trending lower below its trigger line but remains above zero.

In conclusion, EURUSD’s bullish momentum in 2025 has been largely driven by central bank divergence. However, downside risks remain if the pair breaks below 1.1570, especially amid rising uncertainty over a possible US government shutdown.