EURUSD is trying to break the 5-month downtrend

The US dollar has been under relentless pressure since last Thursday, approaching more than one-month lows against the euro and the pound.

In general, we can identify a downward trend of the dollar against a basket of six developed country currencies since 16 April. This momentum has become more evident since the first days of May, although we have seen a couple of days of dollar strength.

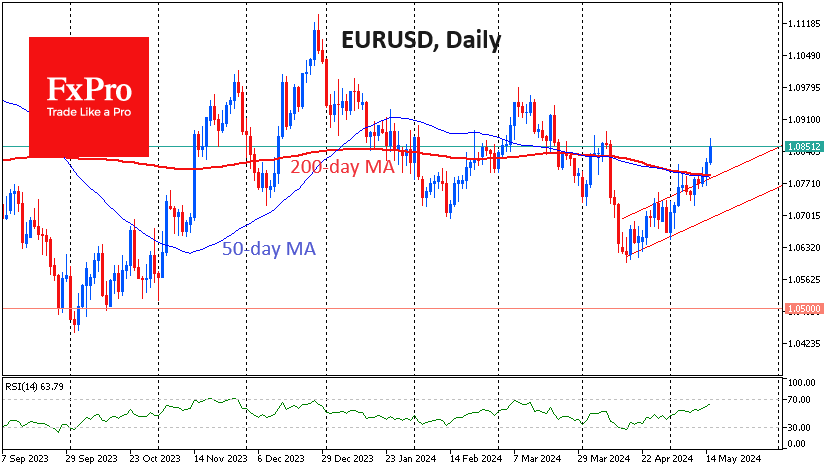

Earlier this week, EURUSD quietly made an important technical breakout. In addition to accelerating the upward trend, over the past two days, the major pair has consolidated above the 50- and 200-day moving averages, which have almost merged into one since early April.

EURUSD has been adding for almost a month and has nearly fully recovered to local peaks in the first half of April. It would be a mistake to think that the dollar is easily rising and slowly retreating. If we take trading volumes into account, we see significant net selling of the dollar, as it takes much less liquidity to cause the pair to collapse over two days than to form a smooth upward trend over a month.

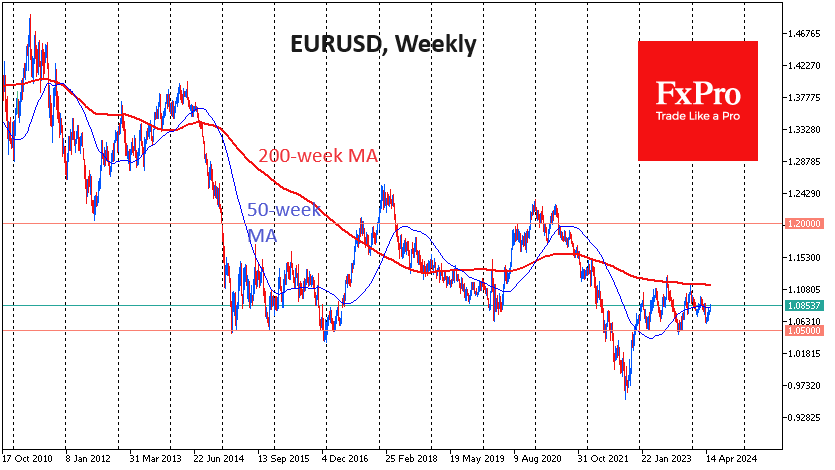

Thus, EURUSD has successfully withstood another test of the 1.05-1.06 support area, which has endured the onslaught of sellers since early 2023. The first significant target of this rise looks like the upper boundary of this range of the significant round level of 1.10. Or even higher - to 1.1150 with a new attempt to overcome the 200-week moving average, which has turned EURUSD three times since the beginning of 2022.

An even more ambitious but realistic task for the bulls could be a new attempt to consolidate above the 1.20-1.25 area, a crucial historical area that served as support between 2004-2014 and resistance for the last 10 years.

Confirmation of a bullish reversal in EURUSD will be a sustained growth above 1.0860 - the April highs area. This ability to rise further will break the downtrend that has been forming since the final days of last year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)