Fed rate cut bets grow but dollar steadies, BoC to likely cut

All eyes on ISM services PMI after soft data run

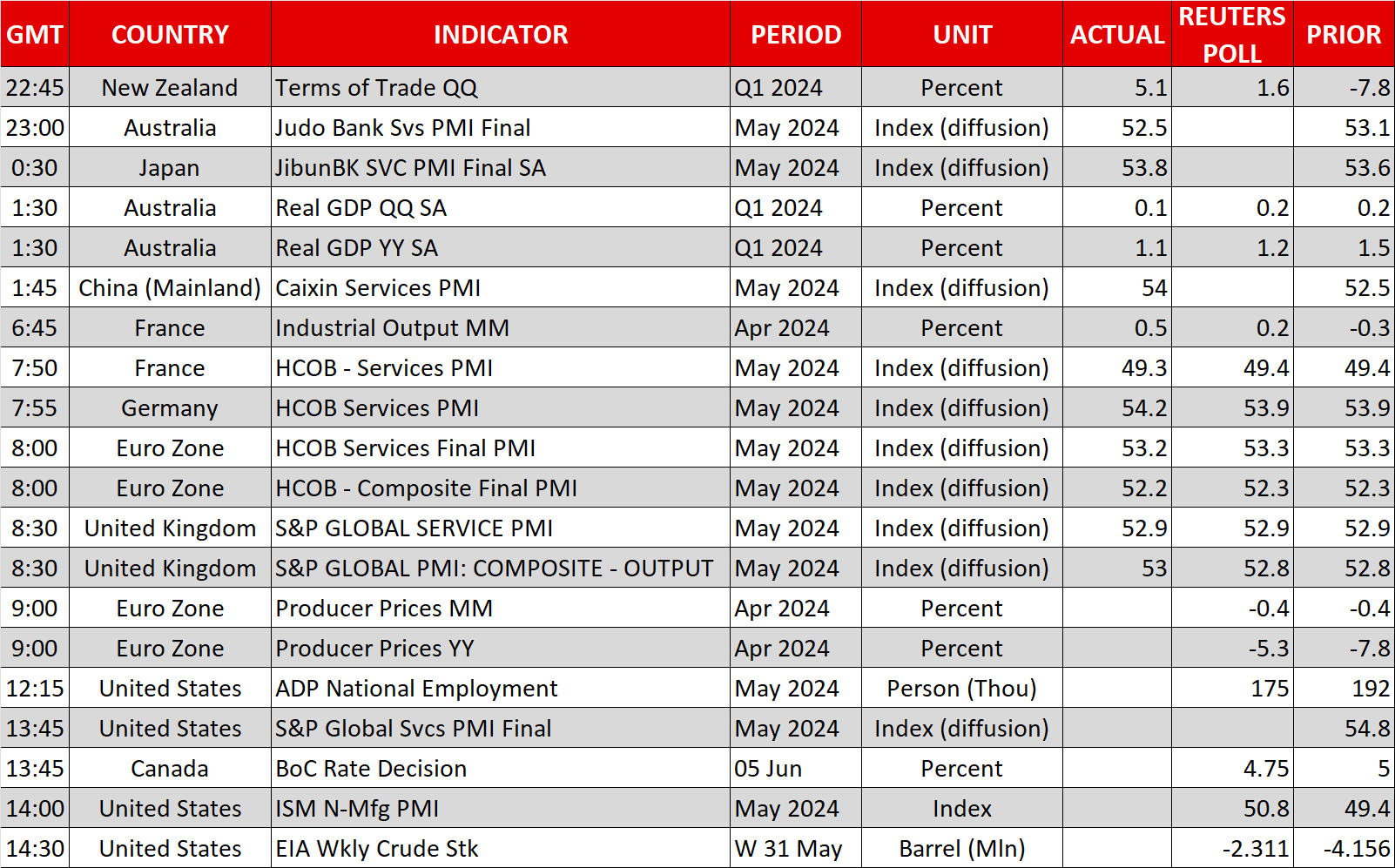

After repeated setbacks, the needle finally seems to be shifting for the Fed to start cutting rates soon, with bets for a September move gaining significant traction in recent days. Last week’s slight miss in core PCE came on the back of a similarly pleasing CPI report. The data continued to move in the right direction this week with Monday’s ISM manufacturing PMI pointing to easing price pressures, while yesterday, it was the decline in the JOLTS job openings to a more than three-year low that added fresh impetus to hopes of an imminent Fed pivot.

The Fed doesn’t meet until next week and there’s still three more sets of crucial data to go, the last being the May CPI report on the day of the FOMC decision. But before then, investors will be hoping that today’s ISM services PMI and Friday’s jobs report will not spoil the mood. In particular, an uptick in the services prices paid index would not bode well for a near-term dovish tilt by the Fed.

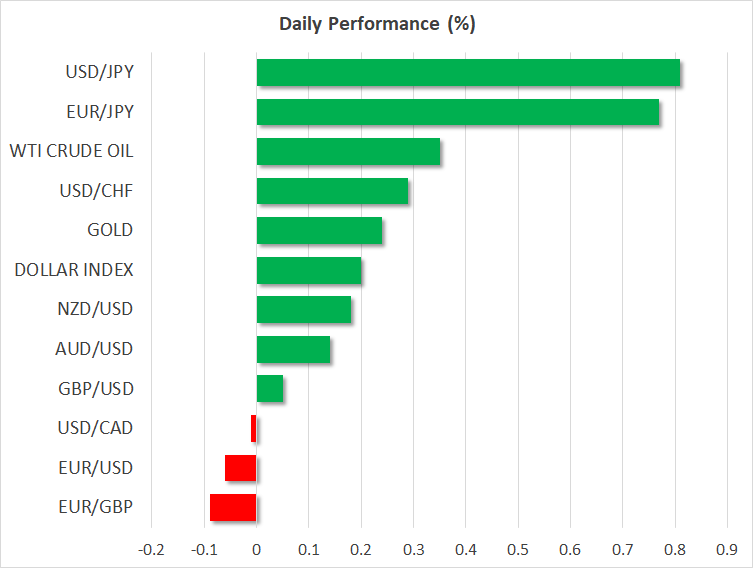

Dollar regains posture as yen skids

With Treasury yields taking a beating over the past week, the US dollar has come under pressure, falling to eight-week lows against a basket of currencies. However, both US yields and the dollar are somewhat firmer today, with the latter being supported by a pullback in the safe-haven yen and Swiss franc.

The battered yen caught some safety bids this week as the somewhat weaker economic indicators out of the US gave rise to worries about the growth outlook, while election surprises in Mexico, India and South Africa stoked global political uncertainty.

But aside from the improved risk sentiment today, the yen has taken a knock from underwhelming wage growth numbers out of Japan, casting doubt on the likelihood of the Bank of Japan hiking rates again this year.

BoC set to begin easing cycle

The Canadian dollar is little changed from yesterday’s close when it took a tumble against the greenback on rising expectations that the Bank of Canada will be one of the first of the major central banks to start cutting rates this week. The BoC decision is due at 13:45 GMT and investors have priced in around a 78% probability of a 25-bps cut.

The ECB is even more certain to cut rates by a similar amount tomorrow, but for both, the market reaction will more likely be driven by the forward guidance on the pace of subsequent cuts.

The Australian dollar, meanwhile, managed to edge higher, as a higher Chinese services PMI offset sluggish domestic GDP readings.

Oil and equity markets subdued amid uncertainties

Even oil prices attempted a rebound, recouping only a fraction of this week’s losses. OPEC+’s willingness to phase out its voluntary cuts sooner than anticipated hasn’t gone down well with the markets and renewed jitters about the US economy aren’t helping.

The latter point is also holding equities back, with trading on Wall Street being very choppy lately and the main indices diverging from one another. But uncertainty about Fed policy is probably the biggest culprit for Wall Street’s mixed performance and the incoming data may only go so far in removing the caution ahead of the June policy decision.

.jpg)