Financial Market Stall Ahead of CPI

- Gold Prices are sideways at near $2185 levels ahead of the U.S. CPI reading today.

- Japanese 10-year bond yield has climbed to the highest level in 2024, anticipating the first BoJ rate hike in decades.

- BTC surge passes $72000 mark while bullish momentum remains intact.

Market Summary

The U.S. financial markets are in a state of poised observation as they await the imminent release of the Consumer Price Index (CPI) data later today. This crucial piece of inflationary data is poised to significantly influence market conjecture regarding the Federal Reserve's potential timeline for adjustments in its monetary policy framework. This speculative environment is further compounded by anticipations surrounding the Bank of Japan (BoJ), with widespread expectations of an impending rate hike—the first of its kind in several decades. This anticipation has propelled Japan's 10-year bond yield to its peak level in three months, simultaneously strengthening the Japanese Yen in its performance against the dollar.

Stability marks the tone in the oil sector, with prices hovering around the $78 benchmark. Stakeholders in the oil market are keenly awaiting the U.S. CPI figures and the forthcoming monthly discourse from OPEC+. The insights derived from these reports are anticipated to shed light on the evolving dynamics of demand and supply within the crude oil landscape.

In contrast, the cryptocurrency domain, led by Bitcoin (BTC), showcases a vibrant uptick, breaching the $72,000 threshold for the first time. This rally underscores the crypto market's growing divergence from conventional financial markets, buoyed by substantial capital inflows through BTC exchange-traded funds (ETFs). A notable shift in the market dynamics is attributed to the London Stock Exchange's recent policy to entertain applications for BTC and ETH ETFs, coupled with Thailand’s securities regulator green-lighting retail investor participation in overseas crypto ETFs.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

The Dollar Index, tracking against a basket of major currencies, exhibited a stable performance with limited market catalysts from the US. Investors' attention is now laser-focused on the upcoming release of the Consumer Price Index (CPI) data for February. This critical inflation report takes centre stage, carrying substantial weight on the Federal Reserve's prospective interest rate decisions in 2024, as emphasised by Chair Jerome Powell and other key officials in recent statements.

The Dollar Index is trading flat, while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 38, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 102.90, 103.70

Support level:102.10, 101.35

XAU/USD, H4

In a day marked by subdued market activity, the gold market exhibited resilience, maintaining a predominantly bullish outlook. The precious metal's positive trajectory is underpinned by concerns surrounding lacklustre economic performance in the US and escalating tensions in the Middle East. With recent economic data falling below expectations, driving Treasury yields lower, gold continues to shine as a safe-haven asset, drawing investors seeking stability.

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 84, suggesting the commodity might enter overbought territory.

Resistance level: 2235.00, 2350.00

Support level:2150.00, 2080.00

GBP/USD,H4

The Pound Sterling's recent bullish trajectory paused at its highest point since last August, as the dollar held steady in anticipation of the upcoming U.S. Consumer Price Index (CPI) data set for release later today. Additionally, Pound traders are keenly awaiting the release of employment data from the UK, including figures on average earnings growth and the unemployment rate. These indicators are crucial for assessing the health of the UK economy and could influence the Bank of England's monetary policy decisions moving forward.

GBP/USD has been trading strongly but experienced a technical retracement at the top but has found support at 1.2805 levels. The RSI has dropped out from the overbought zone, while the MACD has crossed on the above, suggesting the bullish momentum has eased.

Resistance level:1.2905, 1.2995

Support level: 1.2785, 1.2710

EUR/USD,H4

The EUR/USD pair persists in its upward trajectory, challenging a robust resistance level at 1.0955 despite the headwind. The dovish stance from the Federal Reserve is contributing to the pair's upward momentum. Traders are currently awaiting the U.S. Consumer Price Index (CPI) reading scheduled for later today, a crucial economic indicator that can significantly influence currency movements. Simultaneously, the release of German CPI data today may also impact the strength of the euro.

EUR/USD bullish momentum has eased slightly but remains hovering at its recent peak, suggesting that it remains intact. The MACD has crossed on the top, while the RSI remains hovering in the upper region, suggesting that bullish momentum is easing slightly.

Resistance level: 1.0955, 1.1040

Support level: 1.0865, 1.0775

USD/JPY,H4

The Japanese Yen has shown strength against a subdued dollar, fueled by speculation of a potential Bank of Japan (BoJ) rate hike in March. This anticipation has invigorated the Yen, with the 10-year Japanese bond yield reaching its highest point in 2024, potentially acting as a bullish catalyst for the currency. Meanwhile, traders are also closely watching the U.S. Consumer Price Index (CPI), which may serve as a critical indicator for the Federal Reserve in deciding the timing of its first rate cut in the post-pandemic period.

The USD/JPY was trading with strong bearish momentum but experienced a technical rebound and may be facing a strong resistance level at below the 148 mark. The RSI has raised beyond the oversold zone, while the MACD has crossed at the bottom, which suggests the bearish momentum is easing.

Resistance level: 147.65, 149.45

Support level: 146.30, 145.00

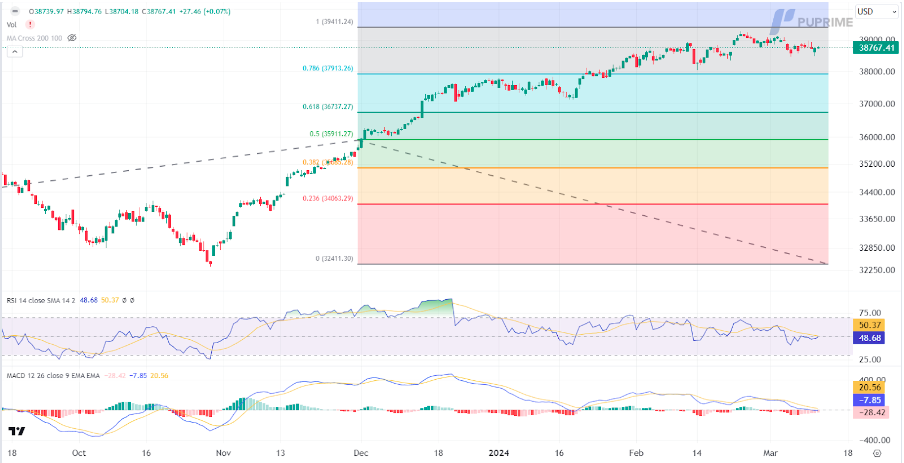

Dow Jones, H4

The US equity market displayed a flat performance, coupled with a marginal dip, reflecting a prevailing sense of caution among investors. Diminishing risk appetite looms large in anticipation of pivotal events on the horizon. Market participants are anxiously awaiting the Consumer Price Index (CPI) data, which is poised to provide critical insights into the future trajectory of US interest rates and the broader economic landscape. Any deviation from expectations in this report is likely to trigger noteworthy movements in interest rate expectations and subsequently impact US Treasury yields, influencing equity markets.

The Dow is trading flat while currently near the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 39400.00, 40000.00

Support level: 37915.00, 36735.00

CL OIL, H4

Crude oil prices experienced a decline as investors opted for a selloff strategy to navigate potential market volatilities. Attention is now turned towards the release of monthly reports from OPEC and the International Energy Agency later in the week. These reports promise an updated perspective on the global crude demand and supply dynamics. Concurrently, a crucial US Consumer Price Index (CPI) inflation report looms large, offering additional cues on the future direction of interest rates. The decisions on interest rates will likely ripple through the oil market, influencing demand and prices. Investors are advised to stay vigilant and closely monitor these developments for nuanced trading signals.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 46, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 78.00, 80.20

Support level: 75.95, 73.45