GBP/USD tries to strengthen bullish move above SMAs

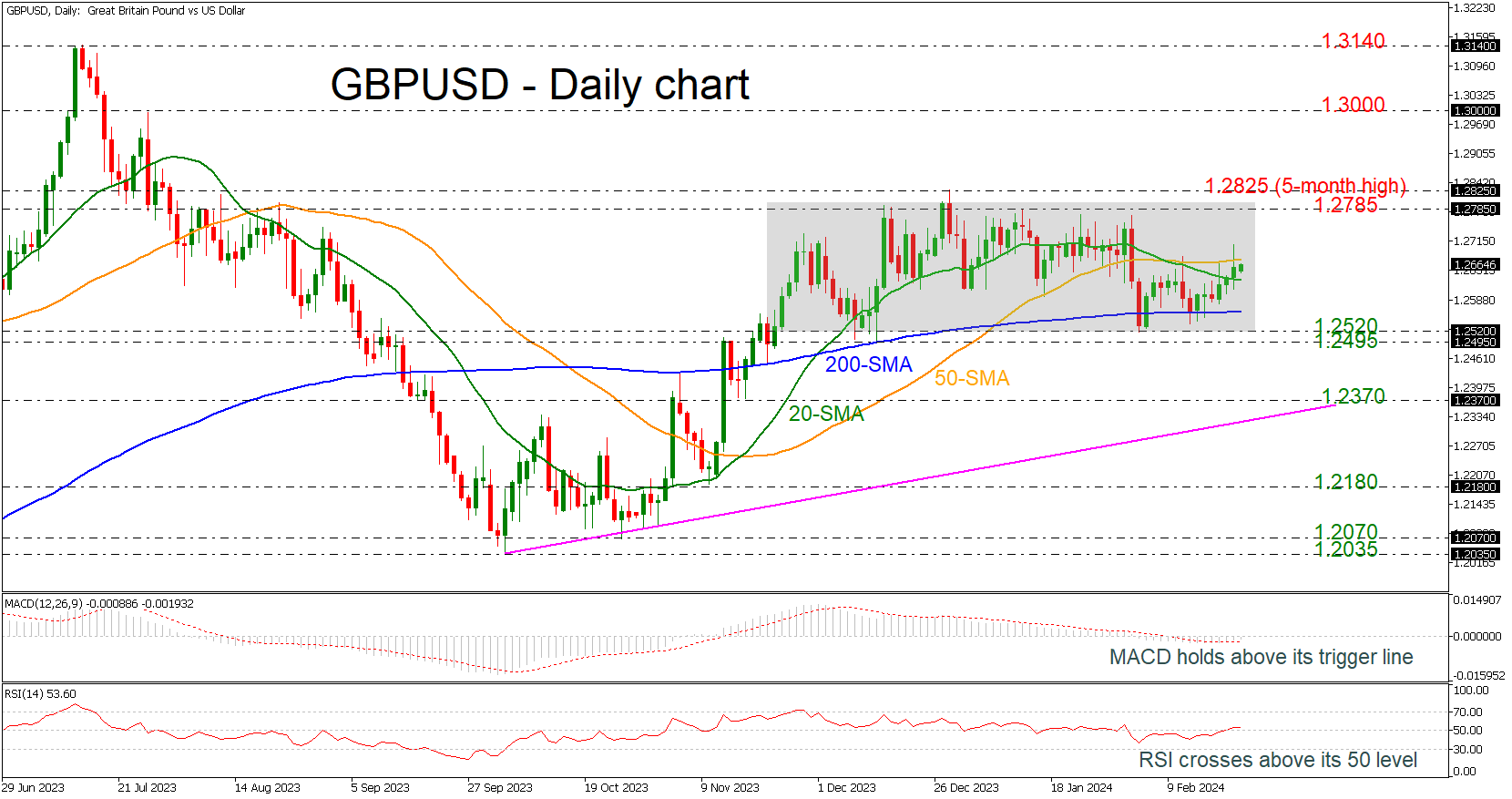

GBP/USD is making an attempt to climb above the short-term simple moving averages (SMAs), posting three straight green days but is still developing within the three-month trading range of 1.2520-1.2785.

According to technical oscillators, the MACD jumped above its trigger line but is still standing beneath its trigger line with weak momentum, while the RSI is moving sideways above its neutral threshold of 50.

If the price extends above the SMAs, then it may again challenge the upper boundary of the channel at 1.2785 and the five-month high of 1.2825. Steeper increases may change the outlook to a bullish one, heading towards the 1.3000 psychological mark.

On the other hand, a drop below the 200-day SMA at 1.2560 could open the way for a rest near the 1.2495-1.2520 support area, which encapsulates the lower boundary of the range, before meeting the medium-term uptrend line at 1.2370. Any losses below this line could switch the picture to bearish, hitting the 1.2180 barricade.

All in all, GBP/USD has been trading within a consolidation area since November 24 and only a break above 1.2825 or below 1.2495 could clear the next direction in the near-term view.

.jpg)