GBP/USD consolidates near October lows

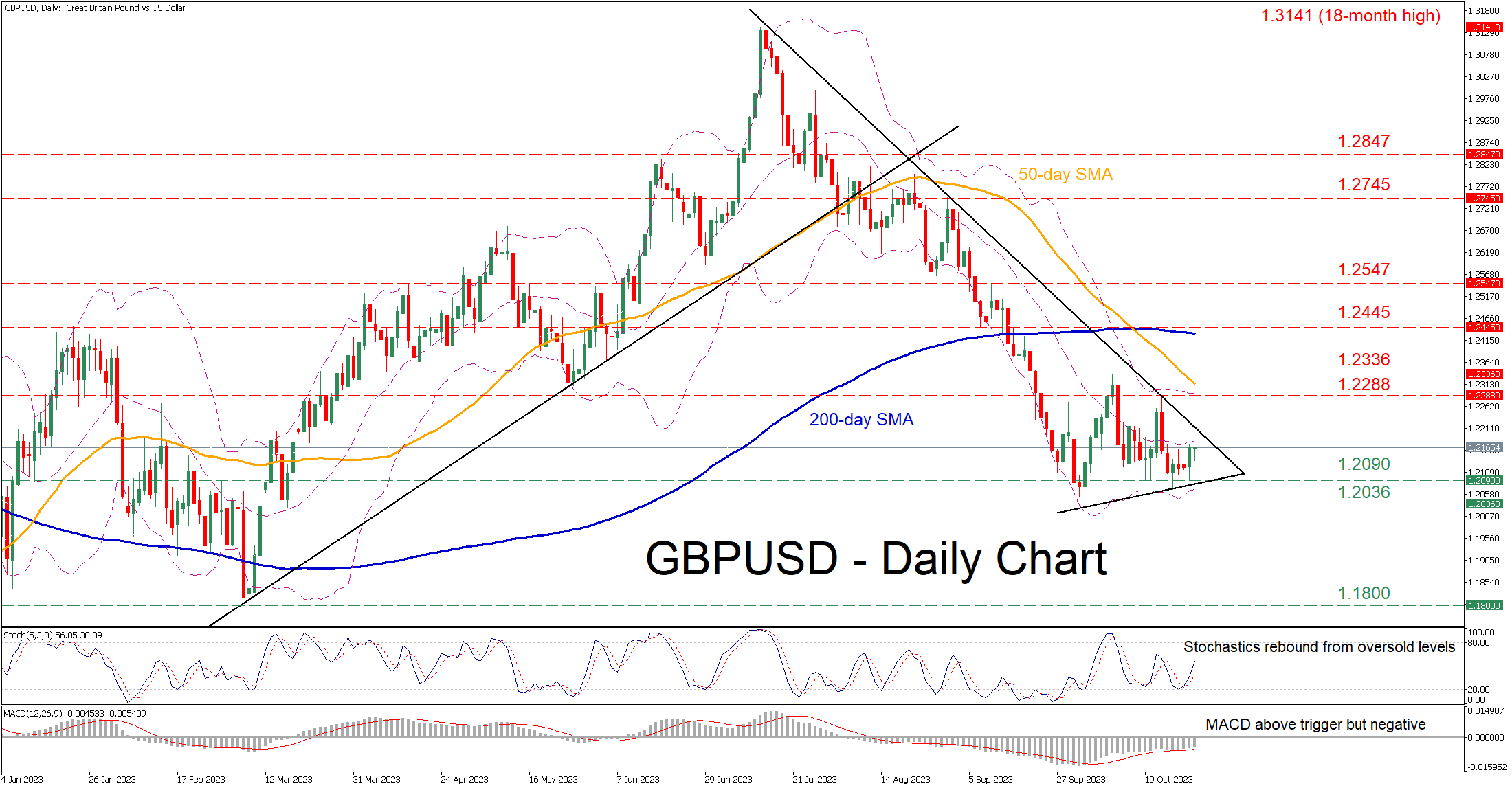

GBPUSD had been forming a profound structure of lower highs and lower lows since its 18-month peak of 1.3141. Although the pair managed to find its feet at the seven-month low of 1.2036, it has been rangebound for almost a month, failing to stage a solid recovery.

Should buying interest intensify, the recent resistance of 1.2288 could act as the first barrier for the bulls to clear. Surpassing that zone, the price could advance towards the October peak of 1.2336. A break above that level could open the door for the December-January resistance zone of 1.2445, which lies close to the 200-day simple moving average (SMA).

Alternatively, if the price moves lower, initial declines could cease around the 1.2090 support territory. Failing to halt there, the pair may challenge the seven-month low of 1.2036. Even lower, the March bottom of 1.1800 could provide downside protection.

Alternatively, if the price moves lower, initial declines could cease around the 1.2090 support territory. Failing to halt there, the pair may challenge the seven-month low of 1.2036. Even lower, the March bottom of 1.1800 could provide downside protection.

In brief, GBPUSD remains a prisoner within its tight range, appearing unable to erase part of its steep retreat. However, the pair has been forming a pennant in the short term, raising the odds for a breakout move towards either direction.

.jpg)