Geopolitics and Fedspeak keep stocks under pressure

Stocks remain under pressure across the globe

The market’s attention remains firmly on Middle East developments. With Israel opting for a low-key verbal reaction over the past 24 hours, the market is trying to feel a bit more confident that the situation will not escalate further. However, the possibility of retaliation remains very strong and thus could catch some market participants by surprise.

Amidst these events, US stock indices had a mixed performance on Tuesday. Interestingly, the S&P 500 index recorded its third consecutive negative session with a cumulative correction of 3%. This sequence has taken place only three times during 2024 with an average drop of around 1.1% each time. Surprisingly, four negative sessions in a row have not been recorded since the 2023 festive period.

The main reason for this continued weakness is the strong US data releases and Fed officials' commentary. While stopping short of mentioning rate hikes, Chairman Powell on Tuesday highlighted that “the recent data have not given greater confidence in inflation”.

With Vice Chairman Jefferson indirectly stating that rate cuts could be a long way off, Bowman and Mester could also appear hawkish today and potentially inflict further damage to market sentiment amidst a very light US data calendar.

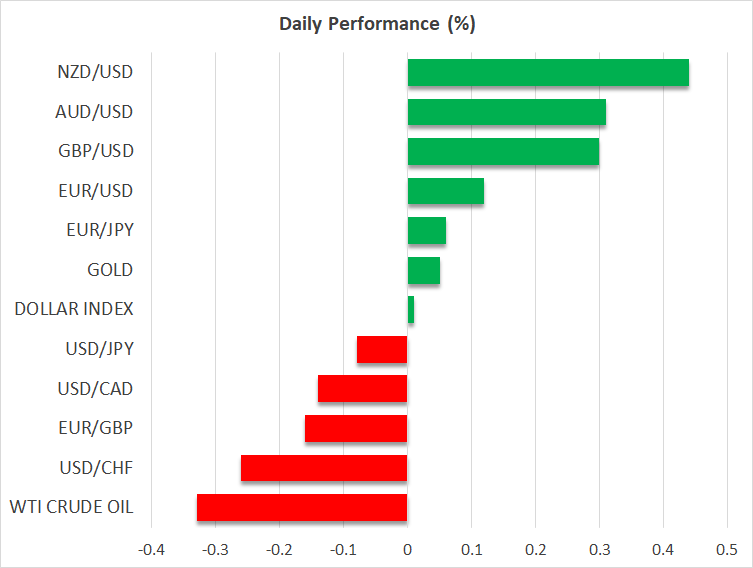

Dollar remains dominant

The euro/dollar pair is hovering at a 5-month low as the market has been forced to react to the divergent monetary policy outlooks. With most ECB members, including President Lagarde, highlighting the June rate cut as the baseline scenario, and the mostly soft euro area data releases, there is scope for another dollar rally today. Especially as ECB members Schnabel, Cipollone and de Cos are unlikely to differ much from the prevailing tune in their scheduled appearances today.

Yen suffers; is intervention imminent?

Dollar/yen is in the red today, but it remains just a tad below its 34-year high of 154.78. Pressure is mounting on the Japanese authorities for a response, despite the BoJ smiling about the potentially higher imported inflation. In a common statement, South Korea and Japan expressed serious concerns on their depreciating currencies, but the market will likely keep testing them until they intervene, or an external event causes a retracement of the recent moves. Maybe Friday’s Japanese inflation report and next week’s BoJ meeting could turn the tide in favour of the yen.

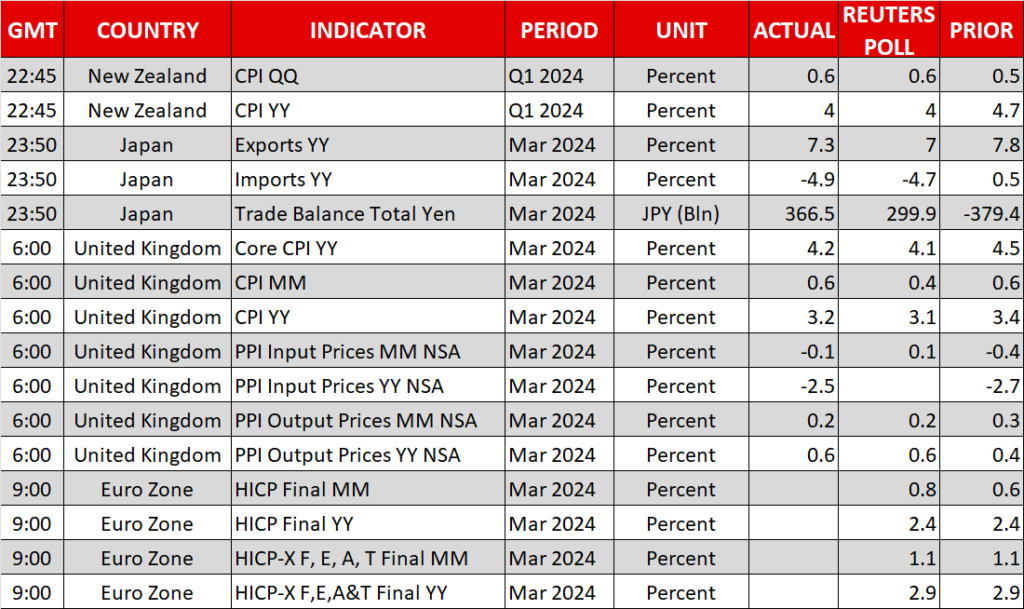

GBP tries to benefit from the UK CPI prints

The UK’s headline and core inflation indicators recorded sizeable drops earlier today, but they managed to surprise on the upside. The pound is trying to make gains against both the dollar and euro, but today’s performance might quickly reverse when commentary from three BoE members, including Governor Bailey, hits the newswires. With core inflation north of 4%, oil prices remaining high and a general election campaign gradually getting at full swing, BoE members might find it difficult to justify the current rate cut expectations.

.jpg)