Germany's weakening business climate has cooled but is unlikely to turn the euro around

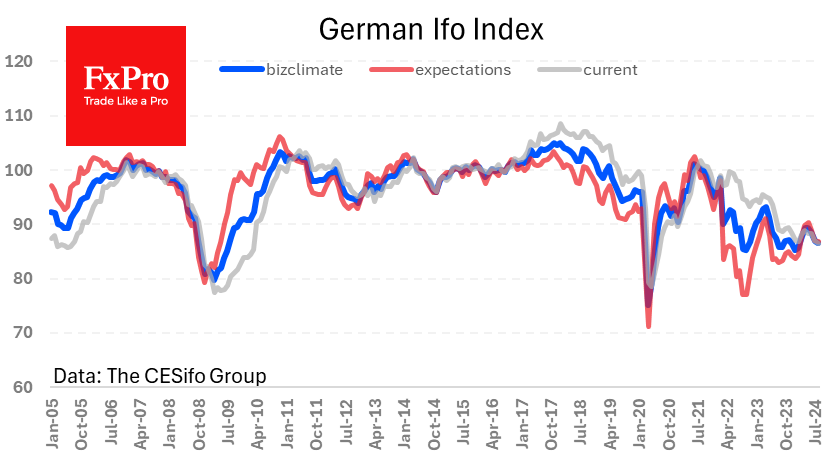

Germany's business climate

Germany's business climate deteriorated in August but was better than expected. The Ifo business climate indicator fell from 87.0 to 86.6, the fourth consecutive month of decline, but better than the forecast of 86.0. Both the expectations and components of the current conditions fell.

This is potentially negative news for the single currency, pointing to a deterioration in the macro-economy. However, markets have little doubt that the ECB will cut rates in September, so the short-term reaction has been limited. It is also worth remembering that the ECB does not target the labour market like the Fed but focuses solely on inflation. A slowdown in industry and services tends to keep prices in check, but this can be a rather long and indirect process. From this perspective, more attention will be paid to Thursday's preliminary inflation estimate for August.

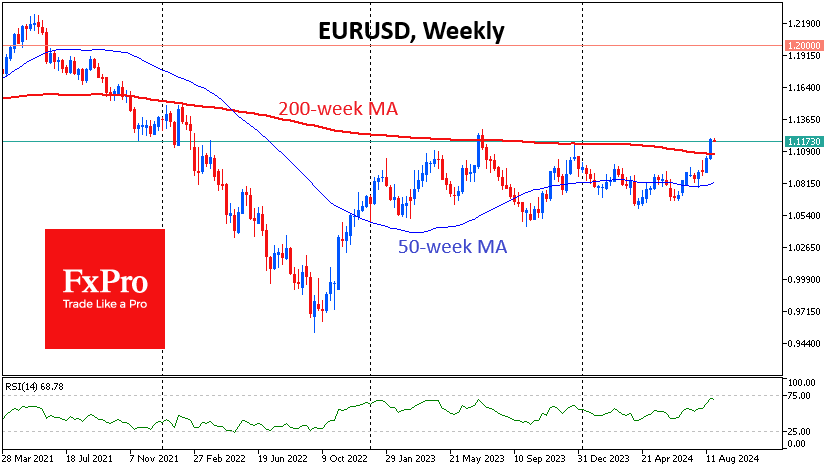

Nonetheless, any weakness in the macroeconomic data could trigger active profit-taking in the EURUSD, which climbed to 1.1120 at the start of Monday's trading, a 13-month high.

EURUSD Technical Analysis

Last week, the EURUSD made an important technical breakout, trading above its 200-week moving average by more than 1%. Four years ago, this breakout was followed by a four-week rally in the pair, which lasted for almost six months and totalled more than 9%. A similar magnitude of growth was seen in 2017.

In the current environment, this suggests upside potential above 1.20, mainly due to a weaker dollar, while weakness in the economy and government finances remains the single currency's Achilles' heel.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)