Japanese Yen Hits Three-Week Low as Bank of Japan Holds Rate Steady

By RoboForex Analytical Department

The USD/JPY pair climbed to 153.77 on Monday, reaching a three-week high. This movement reflects growing investor sentiment that the Bank of Japan (BoJ) will maintain its current interest rate level and continue its pause on monetary policy tightening at this week's meeting. Recent statements from the BoJ have indicated a need for more evidence to substantiate wage increases before considering rate changes.

Expectations of a BoJ rate hike had previously supported the yen, mitigating external pressures. However, confidence in the BoJ's commitment to tightening seems to wane as time progresses.

Despite this, Japan's domestic economic indicators appear positive. October's primary machinery and equipment orders surpassed expectations, and recent reports have shown improvement in both manufacturing and service sector activity in December.

BoJ policymakers are increasingly unconcerned about the weakening yen's potential to accelerate inflation, which is already at desirable levels. However, further yen depreciation could push inflation higher, a scenario that remains on the central bank's radar.

Technical analysis of USD/JPY

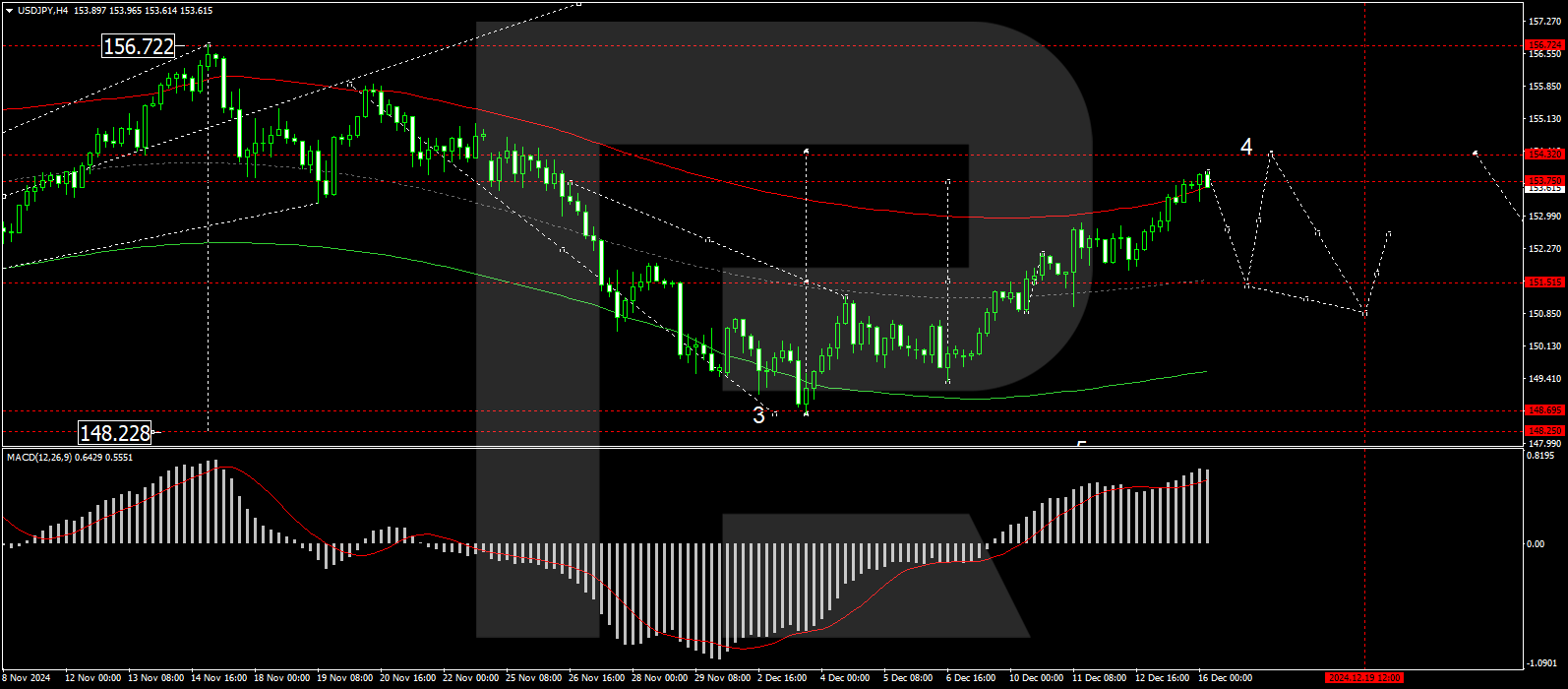

H4 chart: USD/JPY has established a consolidation range around the 151.51 level, from which it has continued its upward trajectory. The pair recently touched 153.93, and current technical setups suggest a potential consolidation below this peak. Should the price break downward, a corrective movement to retest 151.51 is possible, followed by another potential rise towards 154.40. The MACD indicator supports this view, with its signal line well above zero but indicating readiness for a downward correction.

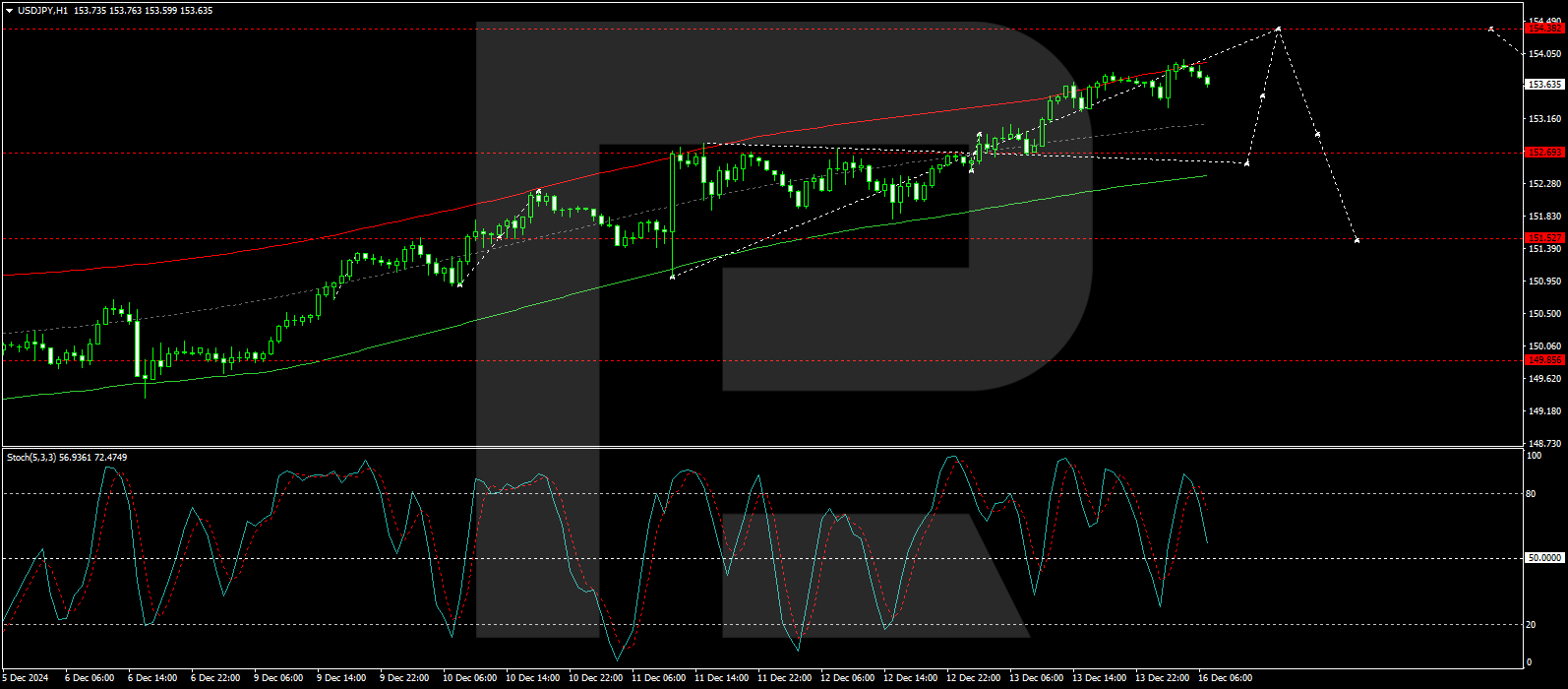

H1 chart: The shorter-term H1 chart shows the USD/JPY forming a growth structure aimed at 154.40. After completing a consolidation around 152.70 and achieving a local high at 153.93, a correction back to at least 152.70 is anticipated. Following this correction, the market may initiate a new growth phase targeting 154.40. The Stochastic oscillator aligns with this analysis. It is currently positioned below 80 and poised to move down towards 20, suggesting an impending correction before further upward movement.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.