Japanese Yen Strengthens to a Monthly High as Markets Anticipate a Bank of Japan Rate Hike

The USD/JPY pair fell to 155.08 on Tuesday, close to the monthly low. The Japanese yen gained strength as speculation grew regarding a potential interest rate hike by the Bank of Japan (BoJ), driven by hawkish commentary from BoJ officials, which increased the likelihood of this action.

Key factors driving yen strength

A possible rate hike would raise Japan’s short-term borrowing costs to 0.5%, the highest level since the 2008 global financial crisis. This decision would align with recent optimism about the economy’s ability to achieve sustainable inflation. Markets also expect the BoJ to revise its core inflation forecast upwards, with confidence growing that wage increases will help maintain the 2% inflation target.

Additionally, Japan’s Finance Minister Katsunobu Kato reiterated the government’s readiness to take measures to support the yen, adding further strength to the currency.

In the broader market context, investors are also evaluating the actions of US President Donald Trump on his first day in office, which included signing several executive orders and discussing plans for trade tariffs. These developments contribute to broader uncertainty, indirectly favouring the yen as a safe-haven currency.

Technical analysis of USD/JPY

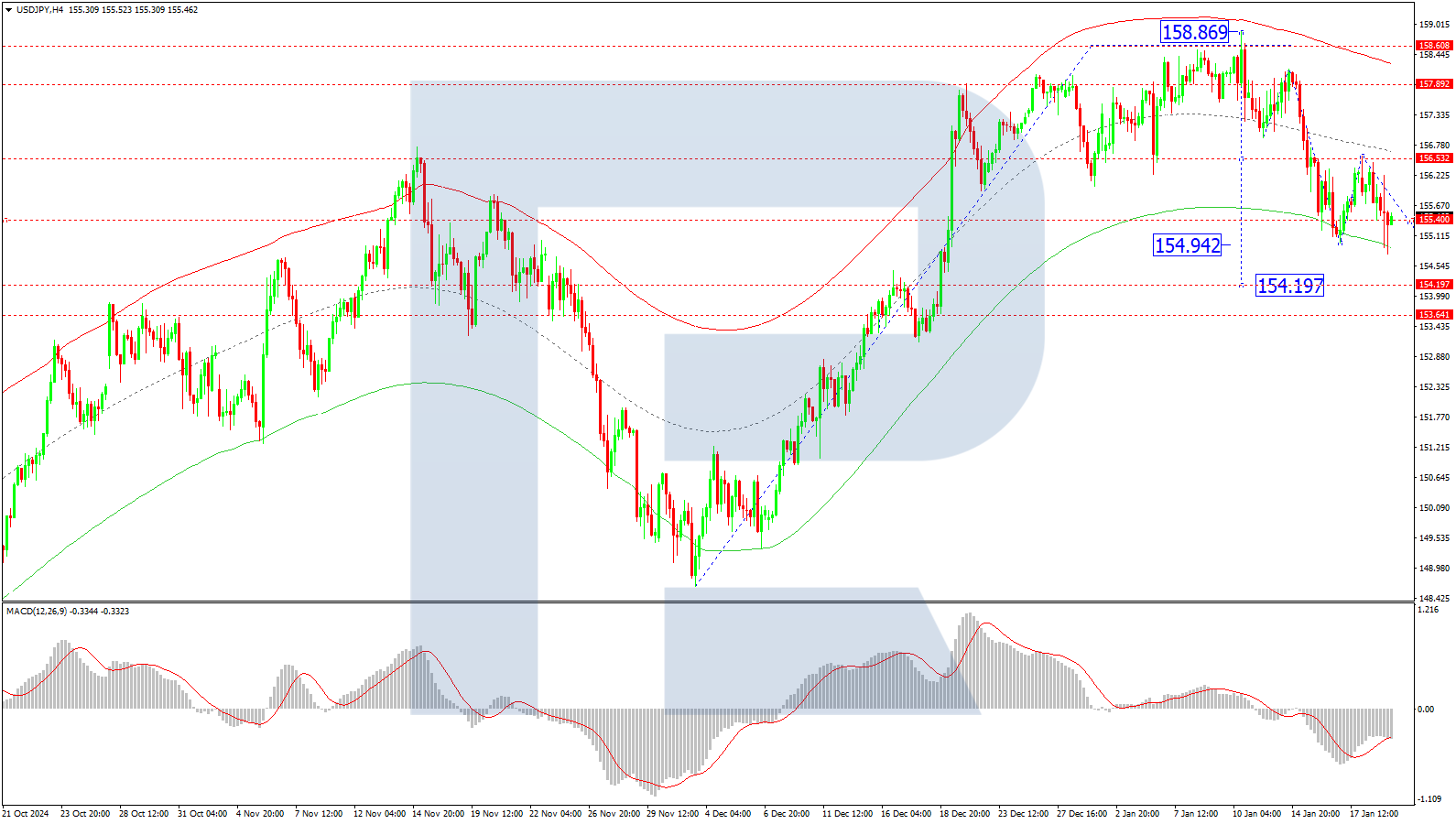

On the H4 chart, USD/JPY experienced a pullback from the 156.56 level and is extending its downward wave towards 154.20. After reaching this level, a growth wave back to 156.56 is possible. This USD/JPY forecast is supported by the MACD indicator, with its signal line below zero and pointing downwards.

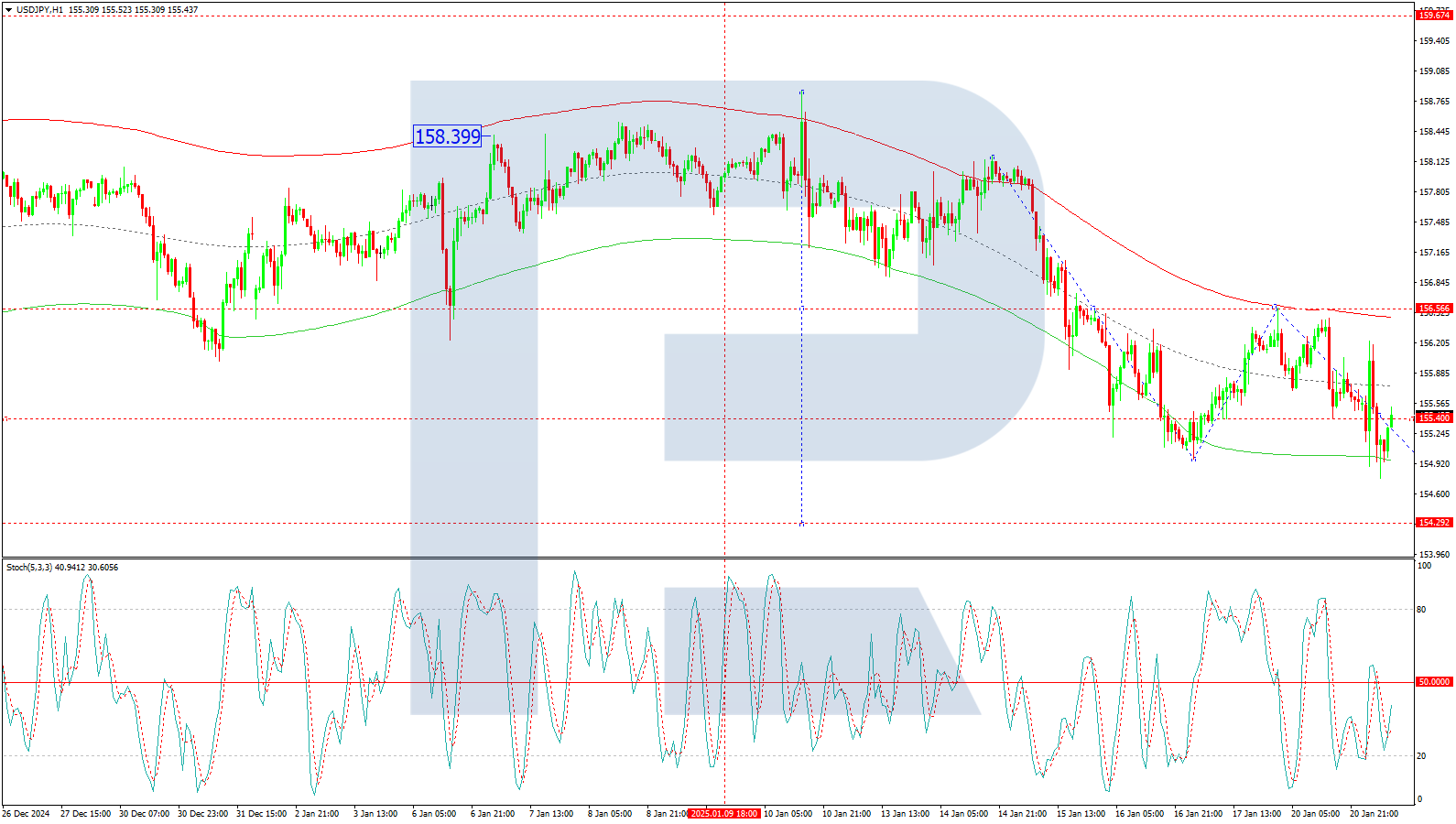

On the H1 chart, the pair is consolidating near 155.40, with expectations of a downward breakout to 154.20. After hitting this target, a corrective wave to 156.56 (a test from below) is possible. Further development of the downward wave could push the pair to 154.00. The Stochastic oscillator confirms this scenario, with its signal line below 50 and trending sharply downwards.

Conclusion

The strength of the Japanese yen reflects the growing expectations of a BoJ rate hike and supportive government policy. While technical analysis points to a further downside potential for USD/JPY in the short term, the pair’s movement will hinge on the BoJ’s upcoming decisions and broader market dynamics. On the downside, key levels to watch are 154.20 and 154.00, with 156.56 acting as a potential corrective target.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.