Markets adjust to the revised Fed rates outlook

Market reset underway after the Fed meeting

The last Fed meeting of 2024 was more exciting than expected, with Chair Powell announcing a 25bps rate cut and, with the help of the dot plot, pointing to a less aggressive easing pace during 2025. With inflation being closer to the 2% target and the labour market not fueling inflation at this stage, Fed members penciled in two rate cuts in 2025. This outlook is actually quite far from what the market was pricing in ahead of the November US Presidential election.

The market reacted sharply, with an aggressive risk-off reaction. Euro/dollar tested the November 22 low of 1.033, while US stock indices suffered significant losses, led by the Nasdaq 100 index. Drilling down the S&P 500 sectors, yesterday’s weakness was evident across the board, with the consumer discretionary and the real estate sectors posting the strongest losses.

Interestingly, the stronger dollar left its mark on both gold and bitcoin. Gold dived to $2,584 before recovering a tad above the $2,600 mark, while bitcoin has returned above the key $100k threshold. The king of cryptos has been hovering above this threshold, with the bulls taking advantage of any corrections, such as yesterday’s.

BoJ keeps rates unchanged

Compared to the Fed gathering, today’s announcements from the BoJ proved less exciting. Despite the buildup of expectations for a rate hike in early December, driven by the positive economic data and Governor Ueda’s willingness to gradually tighten the BoJ’s monetary policy stance, calmer heads prevailed, keeping rates unchanged.

Based on Ueda’s press conference, the BoJ has decided to wait for further positive information on the wages front, which means that the door is open for a rate hike in March. Interestingly, Ueda also focused on overseas uncertainties. Apart from Trump’s imminent second presidency, Wednesday’s Fed announcement has also played a key role in today’s BoJ stance, with the market now fully pricing in a 25bps rate hike in May 2025.

The end-product of today’s BoJ meeting is that the yen is under pressure again. Dollar/yen is testing the resistance set by the November 15 high of 156.74, with the current pace of the rally potentially sounding the alarm at the Japanese Finance Ministry halls. Hence, it won’t be surprising to see another barrage of verbal interventions during today’s trading session.

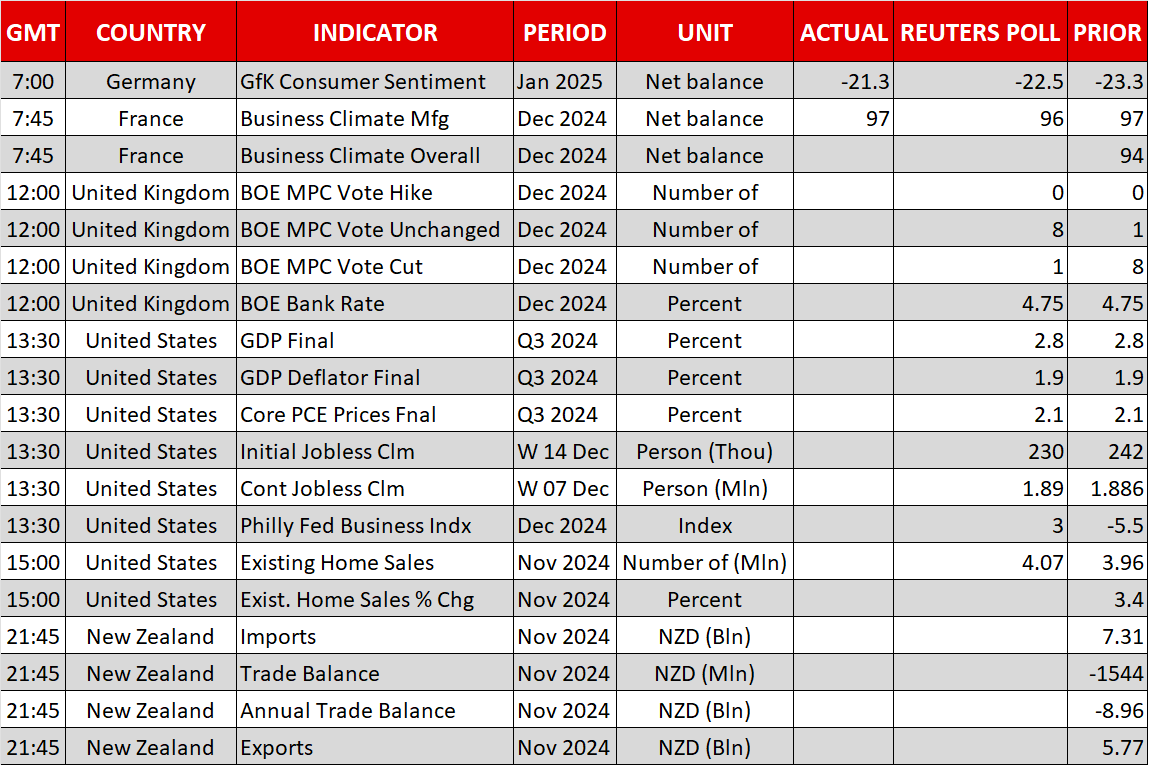

The BoE is next to announce its decision

Following the hawkish Fed rate cut, the path is clear for the BoE to announce a similar decision. However, the recent mixed set of economic data and the lack of quarterly economic projections means that Governor Bailey et al are probably going to keep their powder dry this time around. The market has endorsed this possibility, as it is currently pricing in only a 1% chance of a 25bps rate cut

Interestingly, following this week’s strong labour market data and inflation report, the market is pricing in just two rate cuts for 2025. Considering the wider environment, this looks too optimistic, especially since the impact of the 2025 budget remains uncertain. Intriguingly, despite the opposing trends in central bank expectations, the euro/pound pair has, up to now, failed to decisively trade below the 0.8220 level.

.jpg)