Oil reaches resistance

Market picture

Crude oil posted gains at the end of last week thanks to optimism on global platforms. The beginning of the new week was also favourable for the bulls, as the government of east Libya, where almost all the country's reserves are concentrated, announced the suspension of oil production and exports.

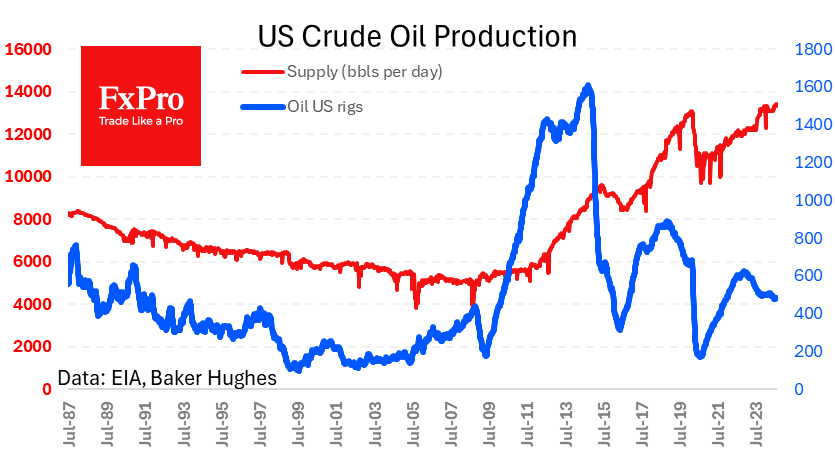

In the US, despite low drilling activity, production rates have remained at an all-time high of 13.4 million barrels per day. Industry experts note that productivity is increasing as more oil is extracted from each well. This is good news for oil companies' profitability, but it barely masks a reluctance to increase investment in production and global market share.

Meanwhile, US commercial inventories remain below last year's levels, albeit within the norm of recent years.

Technical analysis

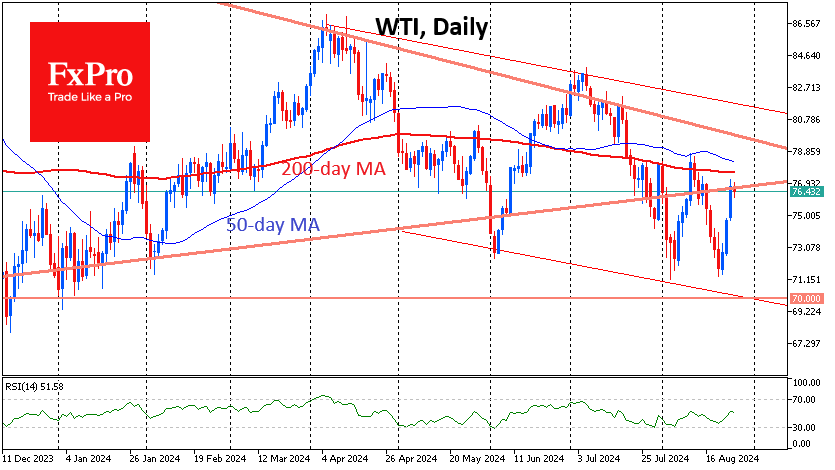

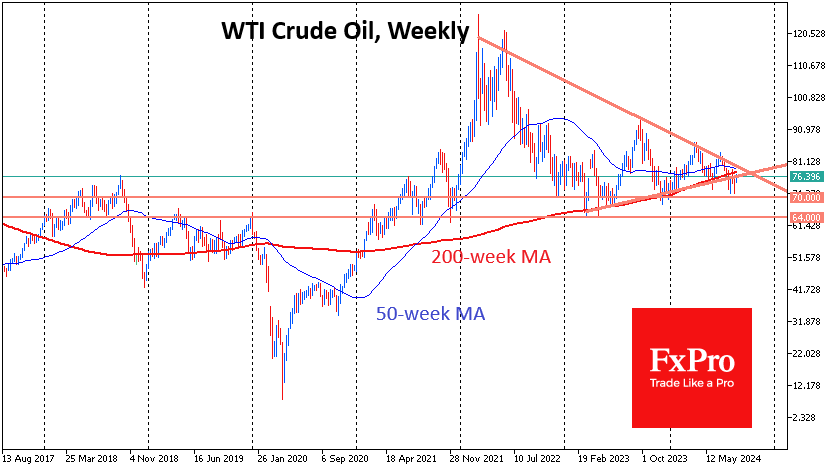

Short-term technical factors have come into play, and the three-day rally has lost momentum as the price of a barrel of WTI has risen above $77. Former long-term support lies in this area, and above, in the $77.6-78.2 range, are the 200 and 50-day moving averages. Also, near $77.9 and $78.6 are the 200 and 50-week moving averages. The former has been a key support level for several years and could now act as resistance.

If the pressure intensifies, the price may not find significant technical support until the $70-71 area, where the area of the lows from the end of 2022 is located. The next support level is at $64, which has acted as a turning point several times over the past seven years.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)