Oil: the lost positive link

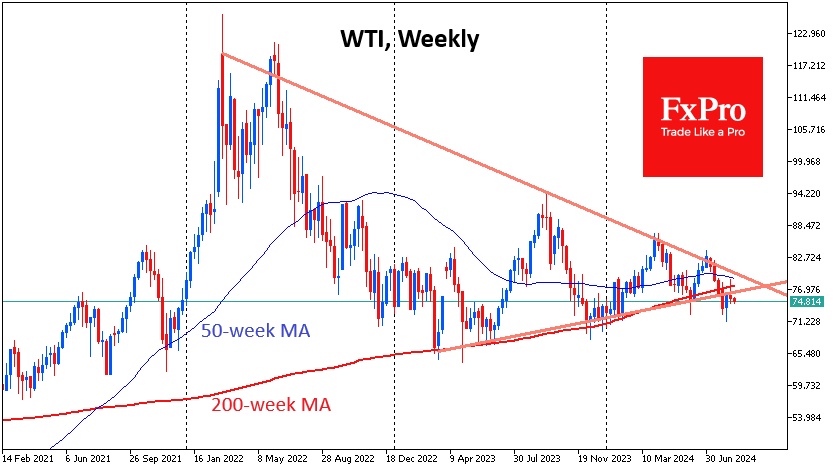

The cost of a barrel of WTI has fallen four out of the last five sessions, underlining the dominance of the bears. Selling is intensifying as the price rises above $78, which is close to important technical levels.

Last week, oil failed to maintain the positive momentum of the beginning of the month and fell due to active selling. The positive correlation between oil and equity indices broke down, with oil falling while equities posted their strongest gains in months. This was accompanied by a weakening dollar and historic highs in gold, the traditional companions of an oil bull market.

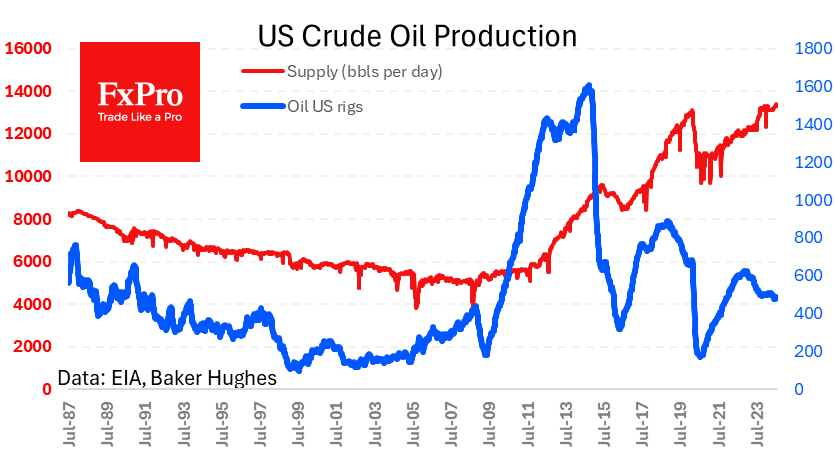

Drilling activity remains weak, with the oil rig count falling from 485 to 483 last week, and including natural gas, from 588 to 586. Oil supply fell from a record 13.4 million bpd to a more familiar 13.3 million bpd. Producers are maintaining maximum output with historically low drilling activity, more likely due to a reluctance to invest in production expansion rather than actively increased efficiency.

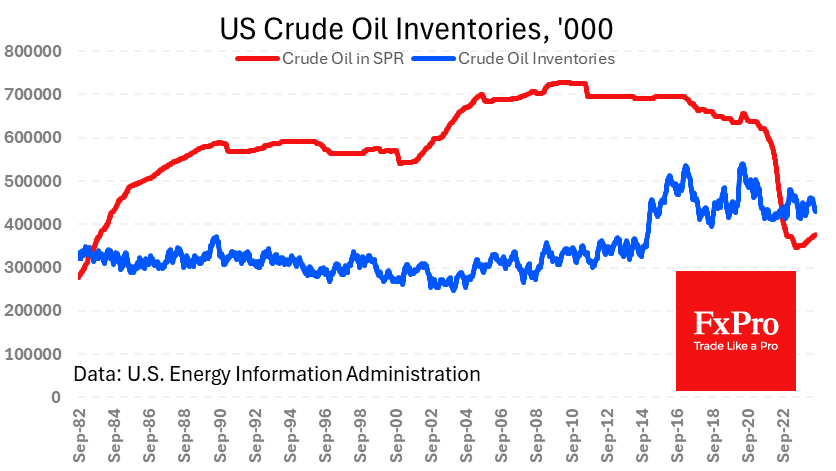

Commercial crude oil inventories are 2% lower than a year ago, which is within the normal range of fluctuations and has no visible impact on prices. Buying continues in the strategic reserve, which is up 8.5% from its lows of just over a year ago but remains 42% below its four-year low. At the current pace of buying, it would take almost ten years to bring the strategic reserve back to its early July 2020 level.

Subdued upstream investment, reserve replenishment and increased buying in related markets have failed to turn the tide against oil. Technical factors continue to dominate. At the beginning of last week, oil was above its 200-week moving average. At a high of $78.7, the price approached the 50-week moving average ($79.1). However, the weekly close was negative, and the decline continued Monday.

The 200-week moving average, which has been a strong support level for the past three years, now has a high probability of becoming serious resistance. At the end of July, oil broke out of the consolidation trend that had been forming since April 2022. An unsuccessful attempt to move higher could intensify selling and become an indicator of a reversal in the long-term trend.

In the short term, we are watching the bearish corridor that has been in place since April. Within this trend, a move to the lower boundary suggests a pullback to $70 by the end of the month.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)