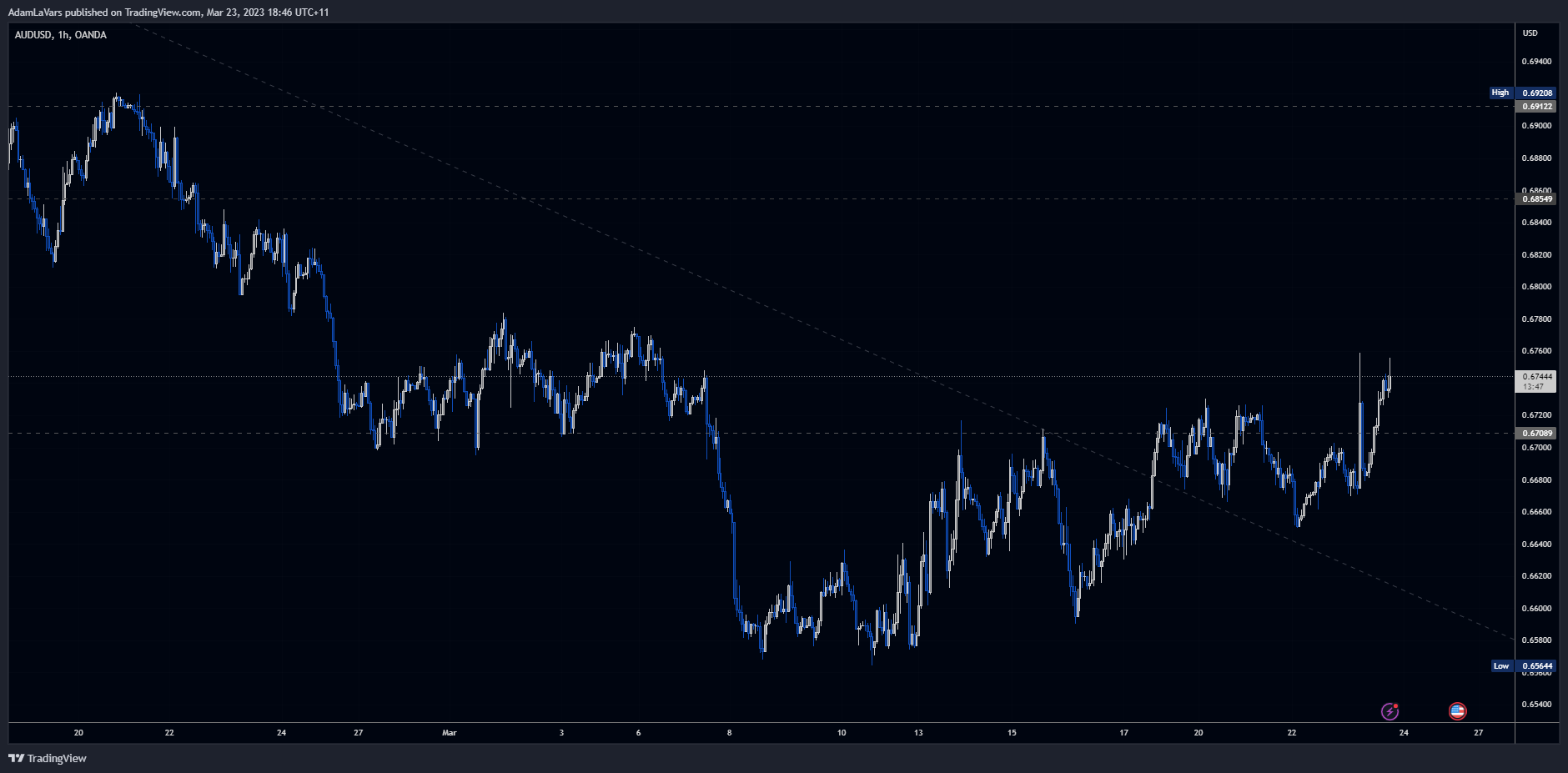

Rising Australian Dollar, Federal Reserve's Decision and Jerome Powell comments

The Australian dollar's retracement from mid-term lows continues, as it inches closer to multi-week highs with global central banks' reaction to shifting economic landscapes. The Federal Reserve in the United States and the Reserve Bank of Australia have both made important decisions regarding interest rates, whilst concerns about the banking sector persist. In this article, we will discuss these factors and their impact on the Australian dollar.

Rising Australian Dollar and Federal Reserve's Decision

The Australian dollar has appreciated past the $0.67 mark, as the Federal Reserve delivered a widely expected 25 basis point rate hike. This decision was made in response to mounting inflationary pressures in the United States. The Fed also signalled that the end of its tightening campaign could be near, which has contributed to the rise of the Australian dollar.

Fed Chair Jerome Powell's Comments

Despite the optimism generated by the potential end of the tightening campaign, caution still prevails in the market. Federal Reserve Chair Jerome Powell has stated that officials do not foresee rate cuts this year. In addition, Powell mentioned that they are prepared to raise rates higher than expected if necessary, reflecting the uncertainty in the current economic climate.

US Treasury Secretary Janet Yellen's Remarks

Concerns about the banking crisis have been reignited by recent comments from US Treasury Secretary Janet Yellen. Her statements on the financial sector have made traders wary, leading them to seek safe-haven assets like the Australian dollar.

Reserve Bank of Australia's Rate Hike and Reassessment

The Reserve Bank of Australia (RBA) has also been active in addressing inflationary pressures. In its March meeting, the RBA delivered a widely expected 25 basis point rate hike, raising the cash rate for the 10th consecutive decision. This move has brought borrowing costs to an almost 11-year high of 3.6%.

Moreover, according to the latest policy meeting minutes, the RBA is set to reconsider the case for a pause at its April meeting. This is in order to reassess the economic outlook and determine the next steps in monetary policy.

In conclusion

The Australian dollar's appreciation is a reflection of the complex interplay between central bank decisions, economic uncertainty, and concerns about the financial sector. As the Federal Reserve and the Reserve Bank of Australia continue to adapt their monetary policies to address inflation, it remains to be seen how the Australian dollar will fare in the coming weeks and months. Traders and investors should keep a close eye on these developments to make informed decisions in the foreign exchange market.