S&P500 affirms positive outlook

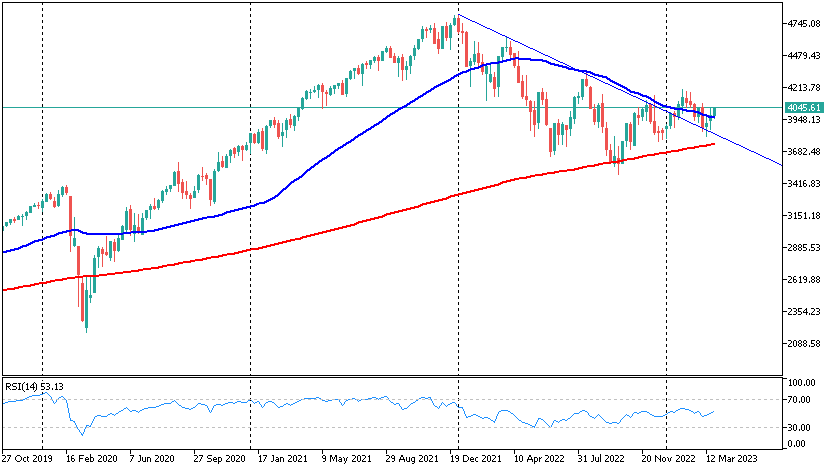

S&P 500 futures are currently trading at a 3-week high. Returning to the territory above 4000 and exiting above the previous week's highs set up optimism. Since March 13, the S&P 500 daily candlesticks have been showing an uptrend.

The index is trading above levels reached as a first reaction to the Fed's comments last Wednesday. The subsequent selloff at the end of last week drew more buyers into the stock.

The positive momentum is supported by the stabilisation of the financial sector (no new bankruptcies) and growing expectations that the Fed has finished raising rates along with solid macroeconomic data.

On the technical side, the bulls managed to keep the S&P500 above the 200-day moving average last week. As a result of trading on Wednesday, the index closed above the 50-day, which failed last Wednesday. Entering territory above this curve triggered relatively deep selloffs in March, so cautious traders may prefer to wait until Thursday or Friday's close (the last trading day of the month and quarter).

However, we are optimistic this time, as the S&P500 has been actively buying back on dips below the 200-day average earlier this month, and the curve has been upward-looking since last week.

On the weekly timeframes, we note that this year's rally has pushed the market above the downtrend line that formed last year's downtrend. The March decline was an attempt to return to this trend, but it did not work out - the S&P500 was redeemed on touching this line.

In addition, the bulls managed to stretch out last week, closing it above the 50-week average. To a large extent, the buying strength this week is supported by the confidence of long-term investors that the market has not fallen into a tailspin. We are now in the early stages of a bull market, the low point of which nicely coincided with the touch of the 200-week average and 50% correction from the post-COVID growth.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)