Spotlight falls on the latest Bank of England rate decision

OVERNIGHT

Equities edged lower across Asia markets as weaker than expected inflation prints added to growth slowdown fears. CPI dropped to 0.1%y/y in China in April, from 0.7% in March, while producer price inflation fell further into deflationary territory, moving from -2.5%y/y to -3.6% in April. Domestically, the RICS UK house price balance improved to -39 in April, from -43% in March.

THE DAY AHEAD

After recent updates from the US Federal Reserve and the European Central Bank (ECB), the spotlight shifts to the Bank of England (BoE) policy announcement at noon (BST) today followed by Governor Bailey’s press conference from 12:30BST. Financial markets are pricing in a high probability that a majority of the nine-member MPC will vote for a 25bp increase to 4.5%. That would be the twelfth consecutive hike since the first rate increase in the current cycle in December 2021, representing 440bp of tightening in total. The backdrop to the decision is that current CPI inflation is significantly stronger than the BoE predicted. Headline CPI in March fell but it remained in double digits at 10.1% in contrast to the BoE staff forecast of 9.2%, while core CPI remained ‘sticky’ at 6.2%, and the latest wage data was stronger than forecast. The economy also appears to be showing more resilience than expected with the latest data suggesting slightly positive growth in Q1 rather than the BoE’s previous forecast for a marginal contraction.

New BoE economic forecasts will provide an update on the medium-term growth and inflation outlook. In February, the Bank predicted a technical recession with the economy contracting in every quarter of 2023. But now, in addition to the possible rise in GDP in Q1, survey evidence suggests that economic confidence and activity continued to improve at the start of Q2. Moreover, fiscal measures announced in the March Budget will likely boost GDP and lower energy prices than previously assumed will also support real incomes. Overall, it seems likely that GDP forecasts will be revised higher. All else being equal, that would lead to a higher medium-term inflation profile although not sufficiently to prevent an undershoot of the 2% target in 2024 and 2025. That said, the projected undershoot should not be taken for granted because risks to the inflation forecast will probably be seen as skewed to the upside. Markets will also be looking for any changes to the BoE’s current forward guidance which stated that evidence of more persistent inflation would require further policy tightening.

Elsewhere, it is a relatively quiet data day with only US producer prices and weekly initial claims figures due. A number of major central bank officials are due to speak with the Fed’s Waller and ECB members De Cos, Schnabel and Guindos due to speak. Early tomorrow, the ONS will release UK March and Q1 GDP figures. For March, we have pencilled in a 0.2% fall reflecting weaker construction and industrial output, partly related to the unusually wet conditions. Service sector output was probably flat with a fall in public sector activity due to strikes offset by stronger private sector output particularly in non-consumer-facing sectors. Overall, owing to a strong start to the quarter, we expect Q1 GDP to have risen by 0.1%q/q.

MARKETS

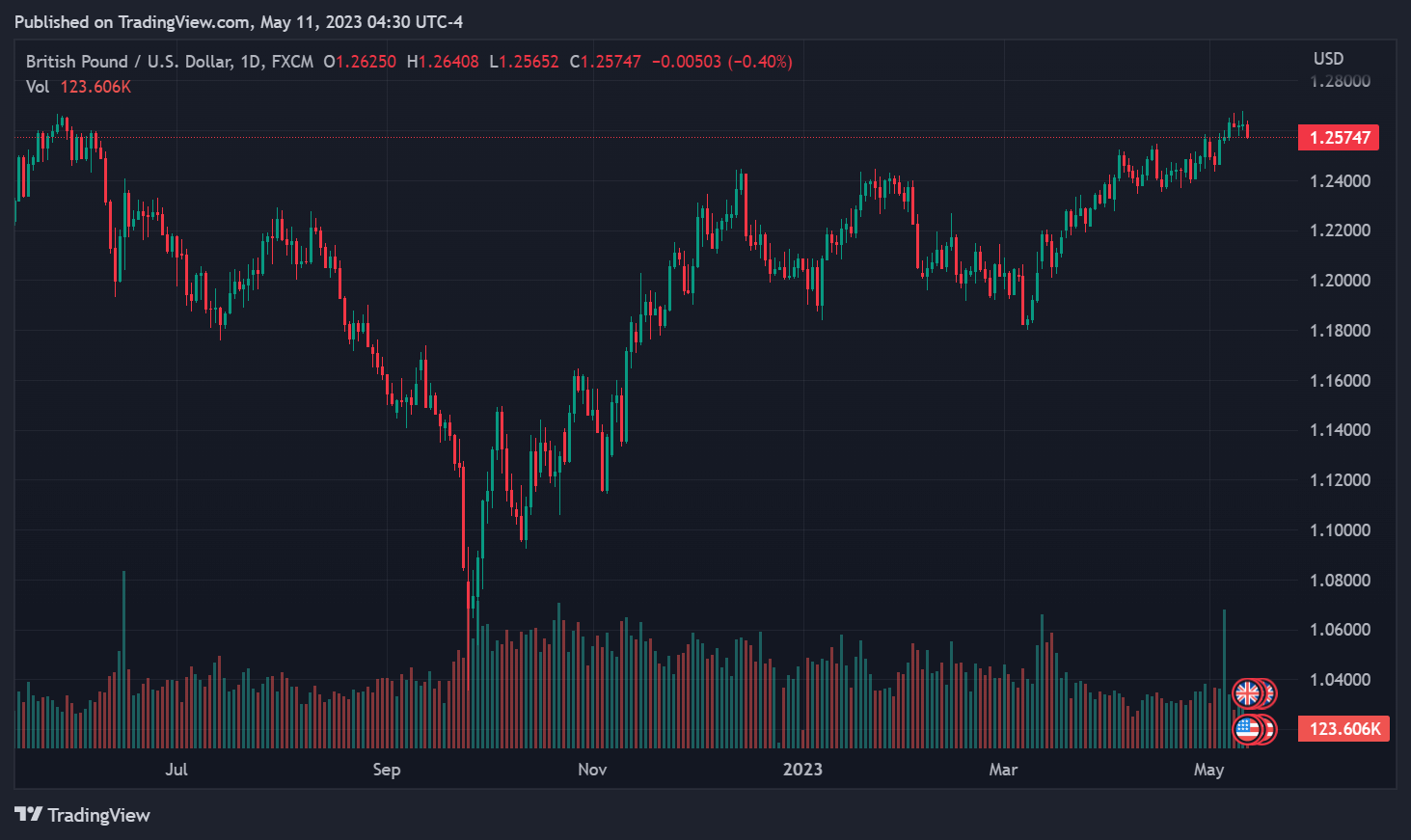

Following yesterday’s mildly weaker-than-expected US CPI report for April, GBP/USD has continued to hold above the 1.26 level ahead of today’s Bank of England rate decision.