Stagflation fears keep dollar pinned near lows but stocks rebound

US economic concerns mount

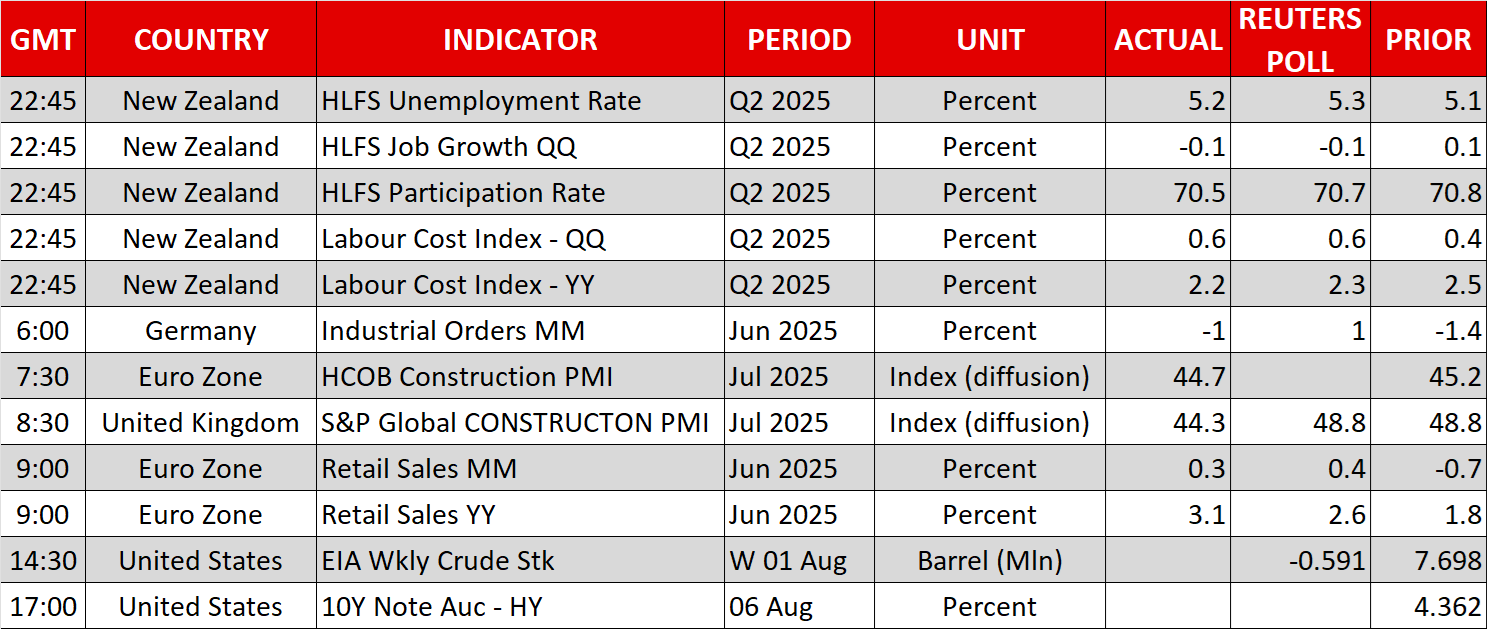

Fresh doubts about the strength of the US economy have hit sentiment, further denting the US dollar days after the poor jobs report, while renewed tariff fears are also keeping risk appetite in check. The ISM Services PMI continued the run of soft US data on Tuesday, slipping to 50.1 in July and sharply missing forecasts of 51.5.

With the services sector barely growing last month and the jobs market cooling off more rapidly than initially anticipated, the notion that President Trump’s tariffs won’t be damaging to the American economy is crumbling.

However, the slowdown isn’t the worst part of the data, as under normal circumstances, the Fed would be expected to step in and boost the economy by slashing interest rates. The PMI’s price component surged to the highest since October 2022, while the employment index dropped further below 50.0, corroborating the picture of rising price pressures and a weakening labour market seen in last week’s PCE inflation and nonfarm payrolls numbers.

Dollar wallows near lows, Treasury auctions eyed

The stagflationary conditions make it more difficult for the Fed to cut rates readily amid the real threat of inflation flaring up again. Rate cut expectations for September have fallen back to around 86% after rising to almost 95% on the back of Friday’s NFP report.

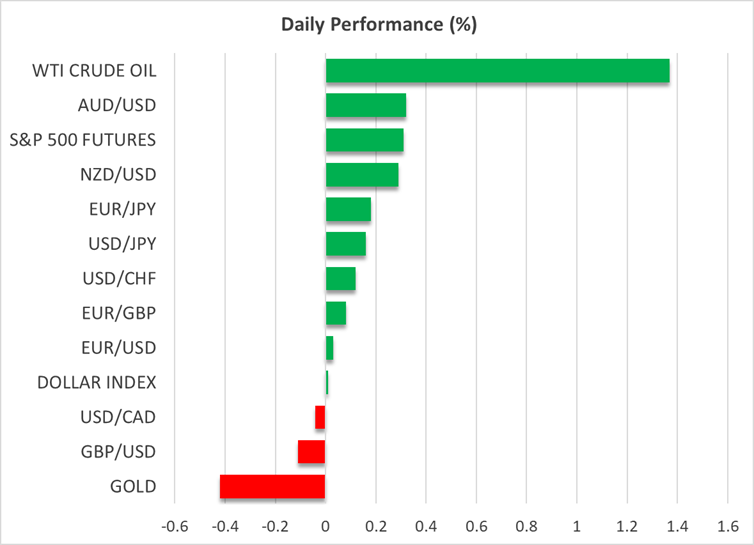

Yet, the US dollar is struggling today, with its index against a basket of currencies hovering near one-week lows, even as Treasury yields are edging higher following yesterday’s auction for three-year notes that saw soft demand.

There’s a risk that yields could jump higher further should today’s 10-year auction and tomorrow’s 30-year auction also suffer from weaker demand.

Tariff and Fed uncertainties heighten again

Adding to the dollar’s headaches are Trump’s latest tariff threats and speculation about who the President will nominate to replace outgoing Fed Governor Adriana Kugler. Speaking to CNBC on Tuesday, Trump confirmed that sectoral tariffs on pharmaceuticals and semiconductors are on their way, saying that he will make an announcement “within the next week or so”.

Levies on the pharmaceutical sector are expected to start at low levels before rising to 150%, or even higher. But Trump offered fewer details for chips, keeping investors guessing.

He did, however, shed more light on the potential nominees for Powell’s replacement, saying that there are four runners-up. Treasury Secretary Scott Bessent has apparently said he does not want to become Fed Chair, but Kevin Warsh and Kevin Hasset remain strong contenders.

In the more immediate term, Trump has signalled that an announcement on a new Fed governor to fill Kugler’s seat could come by the end of the week. Markets are anxiously waiting to see whether he will appoint a partisan candidate, amid his ongoing feud with Chair Powell.

Stocks markets bounce back

Equity markets appear to be mostly shrugging off the developing risks, as they’ve turned positive again, with US futures rising modestly after Tuesday’s losses. Tech stocks have been very choppy in recent days as the broadly upbeat earnings outlook is being frequently tested, the latest doubt coming from AMD’s mixed earnings results overnight. Disney and McDonald’s earnings will be in the spotlight today.

One reason for the optimism is that investors are hopeful that the trade war will de-escalate further over the coming weeks, despite Trump’s pledge for more sectoral duties and the likelihood of secondary tariffs on Russia. Trump told CNBC that a deal for extending the trade truce with China was “getting very close”.

Meanwhile, Japanese and Swiss negotiators are making fresh bids at trying to reduce US tariff levels, with Japan aiming to lower the duties on auto imports and Switzerland hoping to bring down the steep 39% rate that Trump imposed on the country.

Gold subdued but oil rebounds

Gold is pulling back from yesterday’s high of just above $3,390, as the market mood improves somewhat, although it’s too soon to rule out another leg higher in the near term, especially if the dollar comes under renewed pressure.

The stronger risk appetite is helping oil prices to recover from the recent dip. WTI futures came close to breaching $65 on Tuesday. Expectations that President Trump will soon unveil new restrictions against Russian oil, either in the form of secondary tariffs or sanctions on Russia’s ‘shadow fleet’ of oil tankers is lifting prices today.

.jpg)