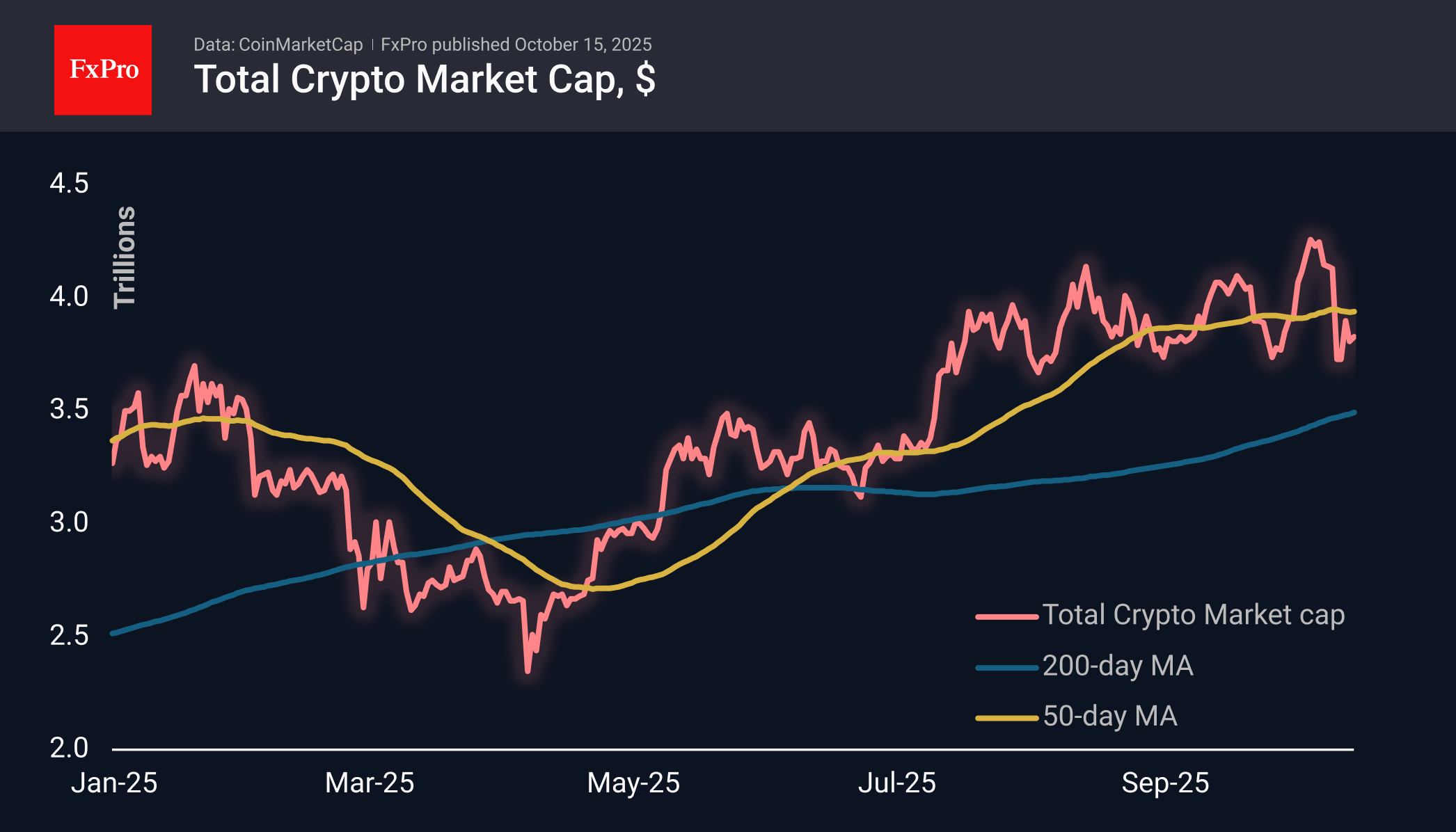

The crypto market remains stable but has no reason to grow

The crypto market capitalisation has changed slightly over the past day, adding 0.1% to $3.83 trillion. Monday's recovery was interrupted by a new wave of sales, albeit less intense. The bears seem to have had their fill and are already losing some of their strength. However, potential buyers prefer to wait for a reason to buy, and trading disputes do not yet provide such a reason.

The sentiment index has fallen back to 34 (fear) from 38, where it had remained for the previous two days. Away from the ‘extreme fear’ zone, the market does not attract the most desperate speculators, leaving room for further decline.

Bitcoin is trading at $112K, recovering some of Tuesday's losses, during which the price fell from $115.6K to $110K. Since the start of the day on Wednesday, selling has prevailed again, but our focus remains on the $109–110K zone, where BTCUSD has found support in recent months. Has buyer interest remained at these levels, or has the balance of power shifted lower?

BNB is trading at $1180, almost 15% below Monday's peak. This dynamic eloquently points to a change in cryptocurrency trading volumes, where a sustained decline is a sign of waning trading activity. From a technical analysis perspective, BinanceCoin has the potential to decline to the $1050-1100 range.

Fear and uncertainty among retail investors remain one of the most accurate signals for BTC accumulation, according to Santiment. Negative sentiment among small players has reached an annual high, which is often a signal of a reversal.

The recent market decline was not a panic sell-off, but rather a controlled deleveraging — the liquidation of leveraged positions, according to CryptoQuant.

Bitcoin's correlation with gold has approached a historic high of 0.9. The narrative of digital gold is still alive, and the demand for protection against inflation has not disappeared, notes CryptoQuant CEO Ki Young Ju.

Ethereum developers have successfully deployed a test version of a major Ethereum update called Fusaka on the Sepolia network. The next step is to test the upgrade in Hoodi, scheduled for 28 October.

The Kingdom of Bhutan will migrate its national digital identity (NDI) system from Polygon to Ethereum to improve data security. The complete transition of the platform is expected by the first quarter of 2026.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)