The cryptocurrency market soared to extremes

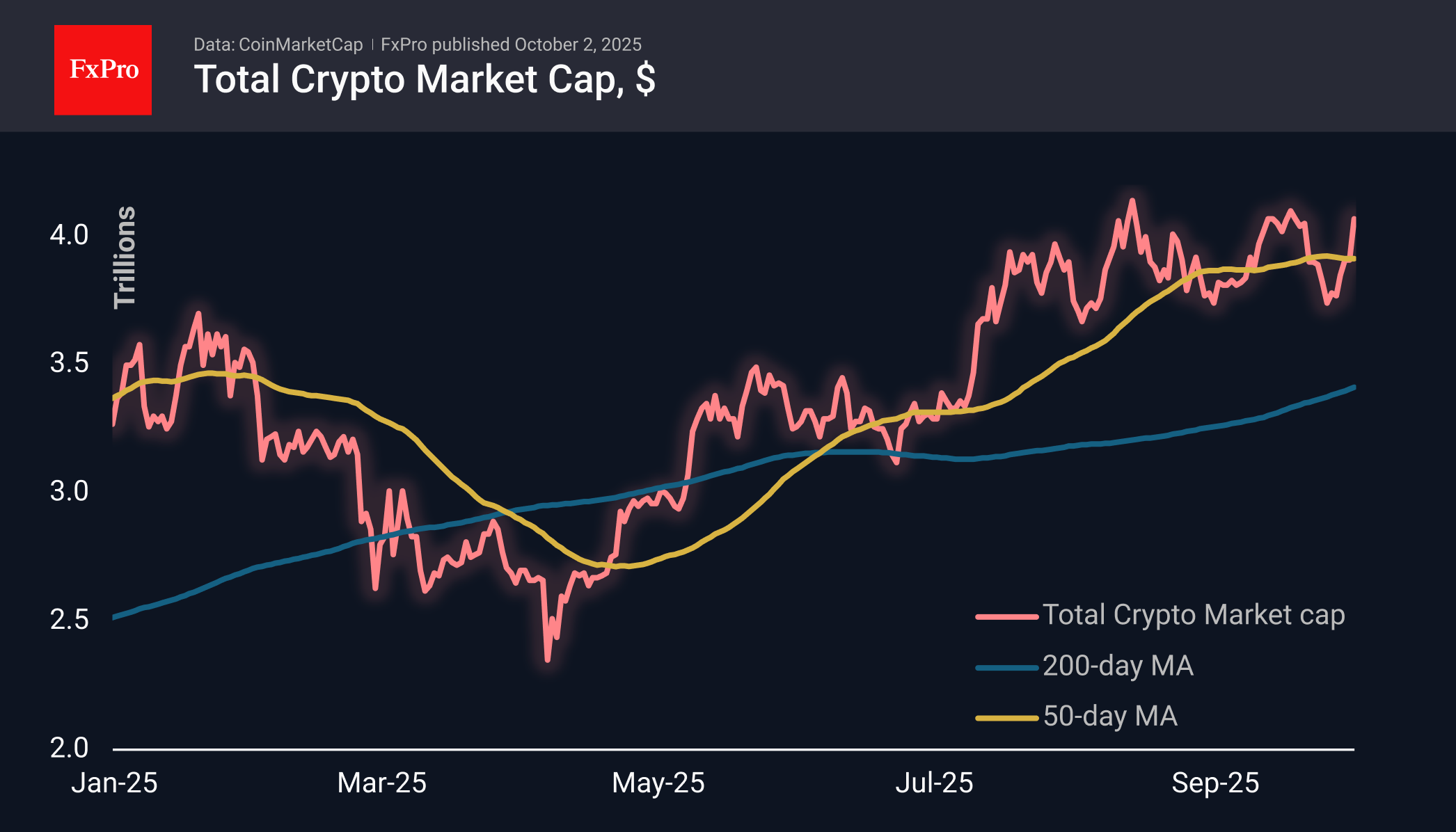

The cryptocurrency market capitalisation soared by 4% over the past day to $4.07 trillion. The capitalisation has soared into the extreme zone, above which it was only briefly in mid-August and mid-September. Cryptocurrency investors are convinced that the US government shutdown is not dampening risk appetite, and macroeconomic data is pushing the Fed to ease its policy further.The sentiment index rose to 64 (greed), reaching its highest level in the last six weeks. However, the index is far from extreme greed, leaving significant potential for further strengthening.

On Thursday morning, Bitcoin exceeded $118K, surpassing the previous highs, which indicates an important technical breakthrough of the established range. The next step could well be an attempt to update historical highs approaching $125K. At the same time, it is worth paying attention to the activity of long-term sellers, who have been actively selling near these levels since July: we may see a new episode of selling on the rise.

The total supply of stablecoins grew by a record $45 billion in the third quarter, according to CEX.io. At the same time, 69% of the ‘printed’ volume was issued on the main Ethereum network.According to CryptoQuant, the growth in the supply of stablecoins creates a powerful foundation for a bull market. Historically, Bitcoin has rallied not only in October but throughout the last quarter of the year.

The main factors that could trigger a crypto market rally in the fourth quarter could be changes in digital asset regulation in the US and expanded access to the crypto market through products on stock exchanges, according to Grayscale.

The main factors that could trigger a crypto market rally in the fourth quarter could be changes in digital asset regulation in the US and expanded access to the crypto market through products on stock exchanges, according to Grayscale.

The total Bitcoin reserves of Japanese company Metaplanet reached 30,823 coins, placing it in fourth place among all corporate BTC holders.According to Onchain Lens, Tether, the issuer of USDT, has replenished its Bitcoin reserve with 8,889 BTC worth $1 billion. Since May 2023, the company has been allocating 15% of its net profit to the purchase of BTC as part of its long-term asset diversification strategy.Stani Kulechov, founder of leading lending platform Aave, said lower interest rates by global central banks will create favourable conditions for yield growth in the DeFi sector and may drive renewed interest in decentralised finance.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)