Dollar slides as US government shutdown looms

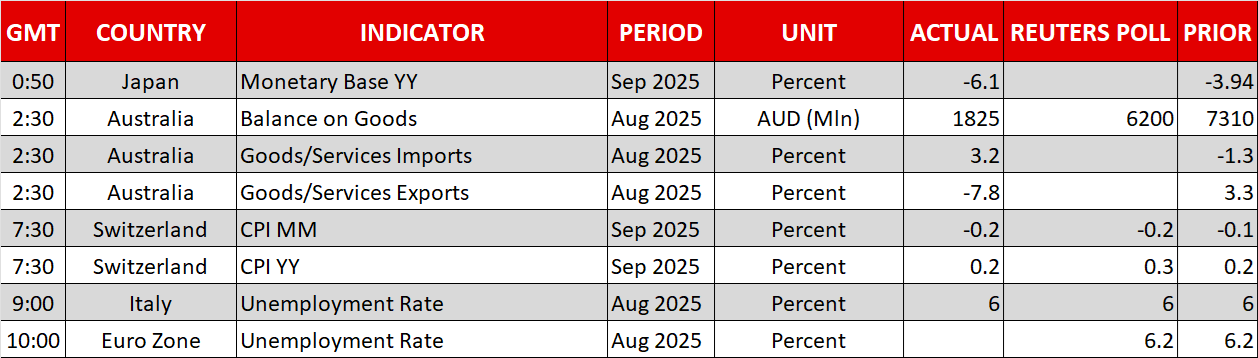

US government shuts down, economic data suspended

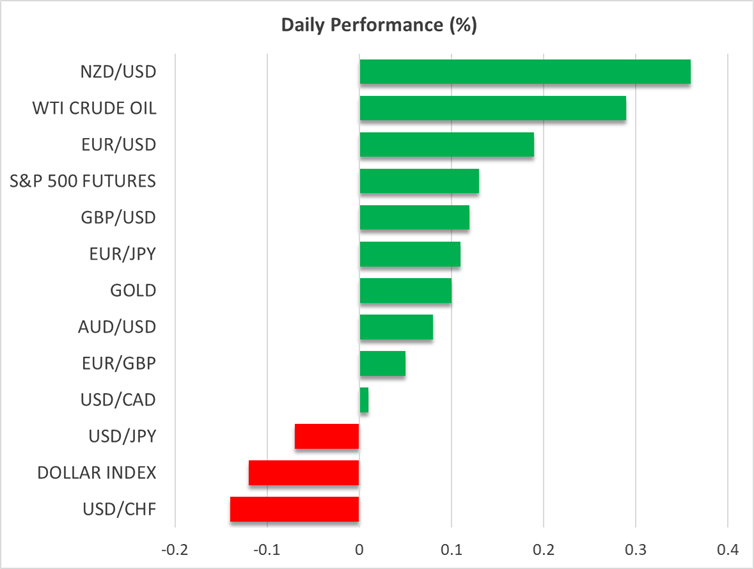

The US dollar traded lower against most of its major peers yesterday and continued to struggle today. Although it tried to regain some lost ground after the US Supreme Court decided to hear arguments over Fed Governor Cook’s case in January, leaving her in her post for now, the dollar’s four-day losing streak continued.

With the US government shutting down yesterday and the Supreme Court kicking the can down the road in Cook’s case, market concerns about the Fed’s independence could take the back seat for a while.

Investors may be more worried about not getting enough economic data due to the shutdown, to make a proper assessment of the US economic outlook and how the Fed could move forward with monetary policy. However, for now, market moves are far from suggesting panic.

Disappointing ADP report attracts special attention

The US dollar may have stayed on the back foot not because the US government shut down, but because, due to the suspension of Friday’s jobs data, traders may have decided to pay more attention to the ADP report to get an idea of how the labor market performed in September.

The report revealed that the private sector lost 32k jobs instead of gaining 52k as forecast, adding to concerns about a deeper slowdown in the jobs market. The ISM manufacturing PMI came in better than expected, but the employment subindex remained in contractionary territory, and prices charged slowed, perhaps giving an extra reason for dollar traders to maintain their short positions.

Expectations of how the Fed may move forward were also affected. A 25bps rate cut in October is fully priced in, while another one in December remains almost a done deal. As for 2026, from expecting two additional quarter-point reductions, the market is now penciling in almost 70bps worth of additional cuts.

S&P 500 and gold hit fresh record highs

On Wall Street, all three main indices closed in positive territory, with the S&P 500 hitting a fresh record high. This isn’t a surprise, even with the US government suspending most of its operations. History has shown that investors are not worried about brief shutdowns. They start being nervous and concerned when a shutdown turns out to be a prolonged one with the Congress not getting close to passing a funding bill.

Investors seem to have remained willing to buy dips, despite signs that a slowing labor market could squeeze consumer demand and corporate profits, and despite already-high valuations. This could change if the shutdown extends beyond the period investors are estimating it to last. The betting website Polymarket suggests that the highest probability is assigned to a period between one or two weeks, but there is a decent more-than-30% chance of a longer standoff.

The resurgence of dovish rate cut bets after the disappointing ADP private employment report pushed gold to a new record high yesterday, slightly below the round figure of $3,900. What could also be true is that many traders that do not want to reduce their risk exposure, prefer to hedge it by buying gold, which appears to be the ultimate safe haven lately.