The dollar is overbought and vulnerable to a pullback

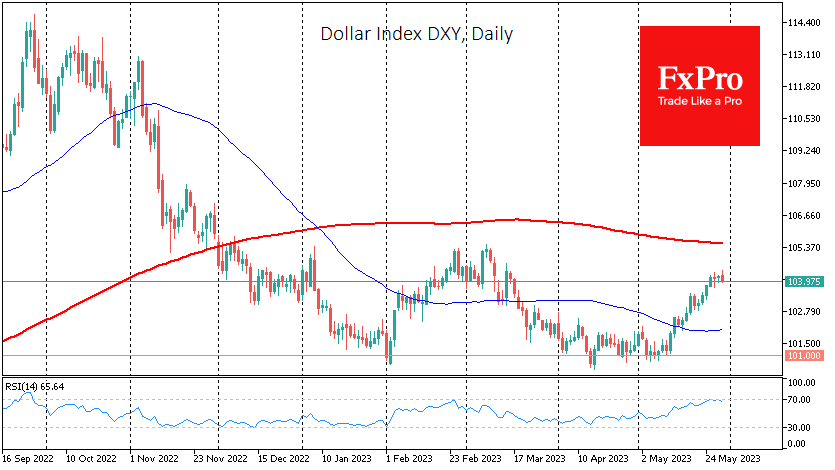

The dollar continues to rally, having gained around 3.4% from its early May lows, and has hovered around 104.2 for the past four trading sessions. The dollar is in locally overbought territory against a basket of major currencies, the euro and the yen.

The main reason for this is the increase in expectations that the Fed will raise interest rates again in mid-June. As of Tuesday morning, the odds of this outcome are above 64%, compared to almost zero at the start of the last rally in early May. A rate hike is expected to attract capital into the dollar from which it fled during the regional banking crisis.

The last time we saw a similar rise in rate expectations was in early February. Interestingly, the dollar index then fell into the same area around 101 but turned sharply on a strong jobs report, which was later supported by inflation.

The reversal was due to the regional banking crisis, which sent investors looking for alternatives, including gold and bitcoin. The regional banking problems disappeared from the agenda and no longer weighed on the markets. But we have only stopped seeing the symptoms, while the disease is unlikely to be cured as the Fed has raised interest rates.

The Fed is probably aware of this and is sounding increasingly cautious about future rate hikes.

At the same time, the USD index has entered the over-bought territory on the daily RSI. Technically, the signal for the beginning of the correction will be a decline at the end of the day with a return to normal territory. If this happens from the current level of 104.20, it would be a lower local high than the March peak above 105. In turn, such a reversal would be a reason to look for the Dollar Index to rewrite local lows in the coming weeks, approaching or falling below 100.

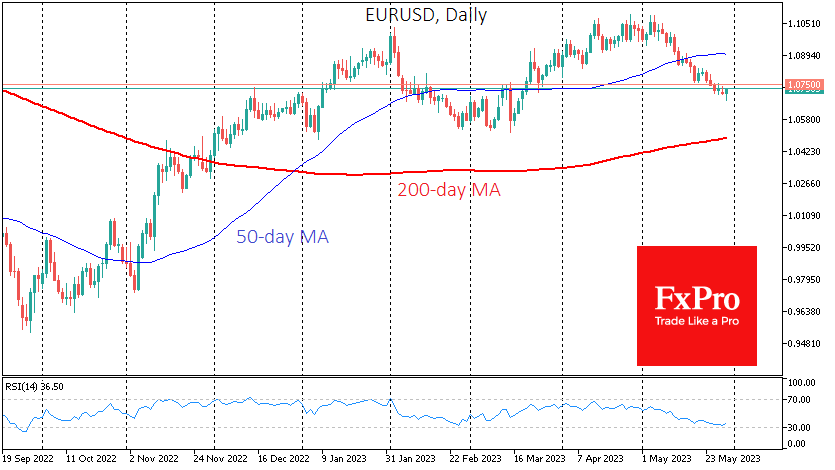

The EURUSD is now trading around the same level as it was at the start of the year and a year ago, trying to break below 1.07 and struggling with an oversold RSI on the daily time frames. The USDJPY traded above 140 on Monday and early Tuesday, reaching highs not seen since last November. Overbought dollars have also accumulated, which has become a concern for Treasury and central bank officials.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)