The dollar pauses after a climb

The US dollar is losing 0.2% since the start of the day on Wednesday against a basket of major currencies, signalling traders' eagerness to lock in some profits after a 2.5% rally over the previous seven days.

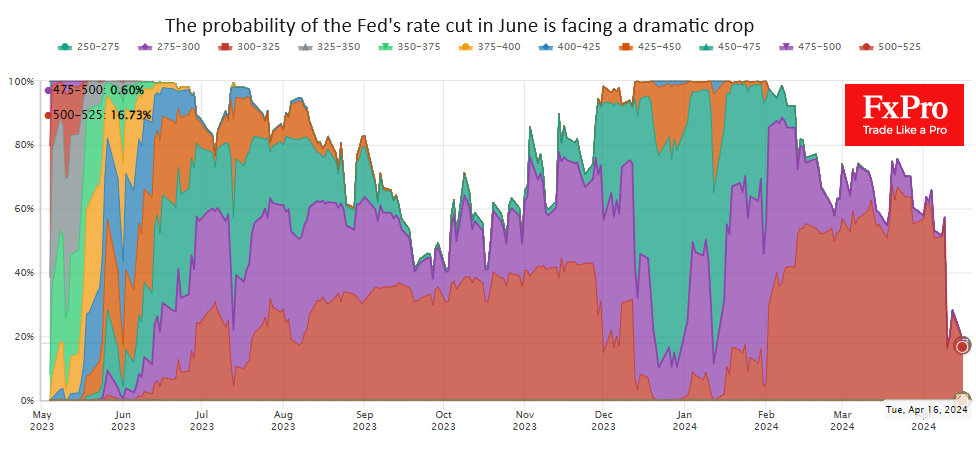

Interestingly, dollar fatigue was evident shortly after Powell's admission that inflation was on a higher trajectory than the central bank expected. The Fed is so far following market expectations, which have changed impressively since 8 March, when a pro-inflationary jobs report turned the dollar higher. The dollar's upward momentum got a fresh boost after last week's inflation report, as it was "bought on rumours" of a change in Fed sentiment. In this context, Powell's words are seen as "selling the fact".

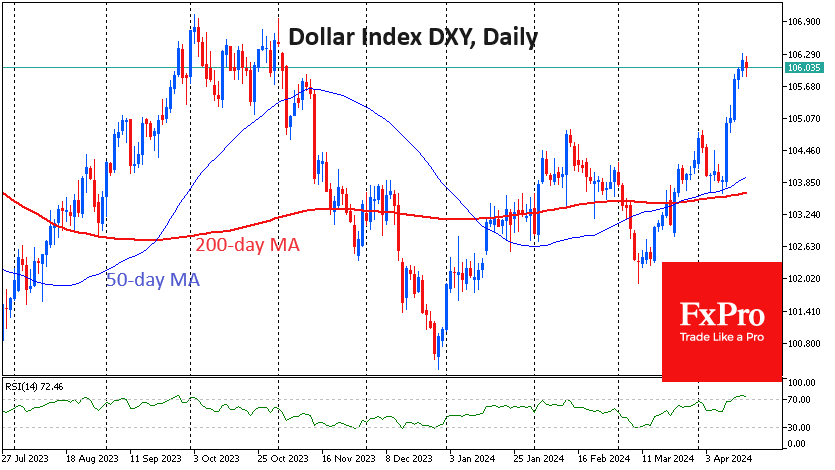

Technically, DXY signs of fatigue are rising near the October reversal area. On the daily timeframes, the RSI has entered the overbought territory. This was the case just before the start of the September 2022 and 2023 corrections, albeit noticeably below the price peak.

The overbought dollar accumulated from the gains since early March sets up a period of dollar consolidation from the current 106.0 to 104.5-105.0. This would be a classic correction, opening the way for a new wave of DXY growth to the 110 or even 115 area. But this will be a story with a different information narrative, as the current driver is exhausted.

A reversal after some fluctuations is possible, as was the case in October last year. In our view, the chances of such a scenario will increase if the global economy stays on the path of moderate growth, which will reduce the difference between the dynamics of the US economy and the rest of the developed world.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)