The US index's demise has accelerated after confirming the downtrend

The US index's demise has accelerated after confirming the downtrend

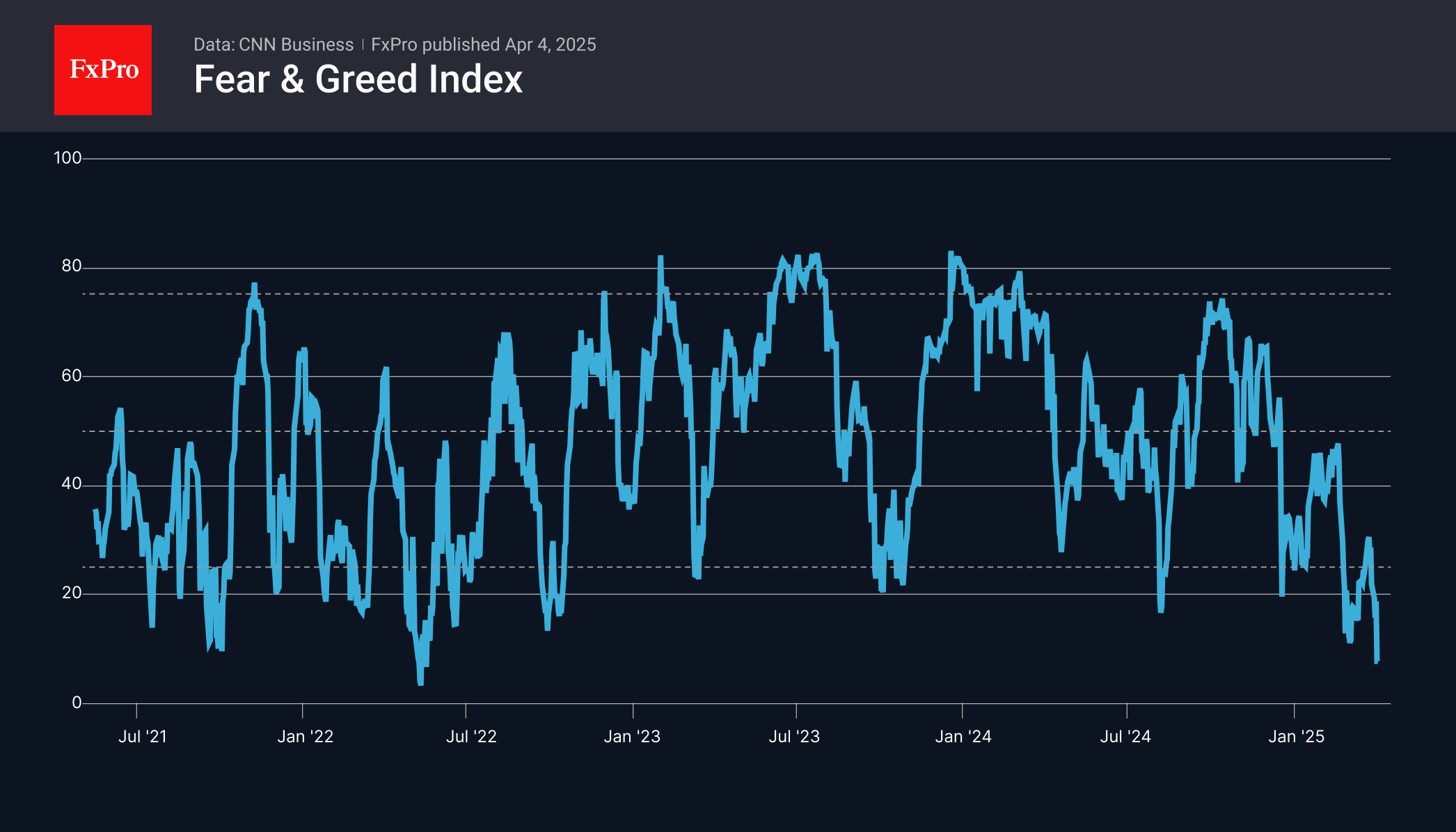

The tariffs announced by Trump were tougher than expected and were not immediately followed by talks on easing them. This triggered a negative reaction in stock markets around the world, including the US. An important barometer of sentiment, the Fear and Greed Index, plummeted to 6, to a 3-year low. This is considered a time for bold buying. However, it is more prudent at times like this to wait for the indicator to move back from the extreme fear zone below 25.

The S&P500 moved to renew multi-month lows after consolidating and rebounding in the second half of March. The technical turning point was the touch of the 200-day moving average near 5800. This level also coincided with a corrective bounce to 61.8% of the decline from the second half of February. A decisive affirmation of the downtrend opens the way to the 5100 area, taking the US market back to the lows of last August.

There is a very similar technical picture in the Nasdaq100. On the recovery to 20400 at the end of last month, momentum lost strength. The 200-day moving average and 61.8% of the first impulse of the fall, which started in late February, are concentrated near this level.

The dynamics of the last two weeks showed and confirmed that the key US indices are moving within the downtrend. The turning point in such situations comes only sometime after aggressive monetary policy easing.

Tariff shocks, elevated inflation expectations and full employment may tighten the hands of the Fed.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)