Trump promises tariffs on Canada and Mexico

Dollar in rollercoaster mode as Trump takes office

As projected by the 1-week expiry FX options, the hours before and after Trump’s inauguration have been rather volatile, with the US dollar coming under strong pressure ahead of the event and paring a portion of its losses overnight after Trump’s official inaugural speech.

The first reaction was the result of headlines saying that the new US administration will not impose tariffs on day one, which corroborated previous news reports that Trump may choose to proceed gradually on tariffs to avoid fueling inflation.

And indeed, although Trump mentioned tariffs during his official inaugural address, saying that he will create a new agency to collect “massive amounts” of tariffs, he did not say how he plans to proceed.

Trump threatens Canada, Mexico and China… again!

Having said that though, later in the day, during the early Asian session today, the new US President said that his team was thinking of levies around 25% on imports from Canada and Mexico, and that those charges could be announced on February 1. He also added that if China does not sell TikTok to the US, they will likely be hit with major tariffs as well.

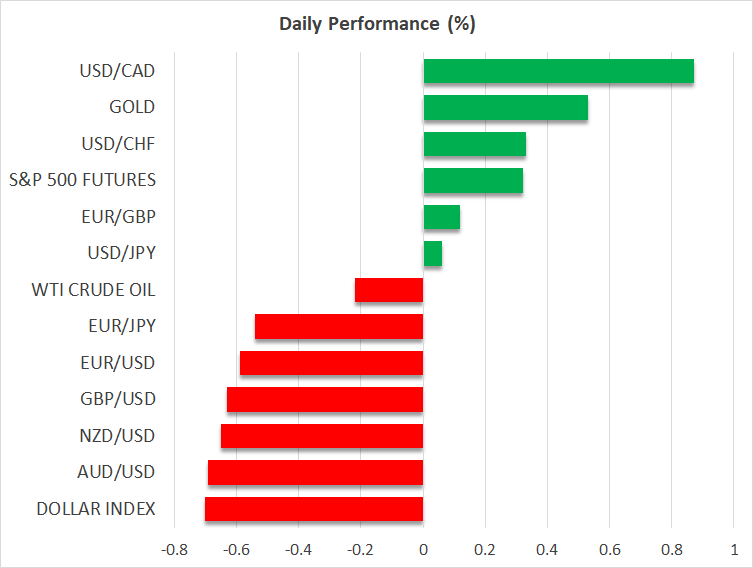

The US dollar rebounded following these comments, with the Canadian dollar and the Mexican Peso falling much more than other major currencies. That doesn’t mean that other currencies will not be affected in the future. The EU runs a sizable trade surplus with the US, and that’s why it remains a big tariff target for Trump, something that leaves the euro vulnerable to further declines. What’s more, overnight Trump said that a universal tariff on all countries is also on the table but added that the US is not ready for such a move yet.

Taking all that into account, whether Trump proceeds with massive tariffs in five or 10 or 20, days, it probably doesn’t make much difference. Fears about a resurgence of inflation could be intensified again, prompting market participants to scale back their Fed rate cut bets. According to Fed funds futures, investors are currently penciling in around 40bps worth of reductions in 2025.

Stock futures slip, gold gains, oil pulls back

Wall Street remained closed yesterday due to Martin Luther King Day, but stock futures slipped following Trump’s tariff threats. However, they were quick to recover a large portion of their losses, confirming the notion that Trump’s plans are not solely negative for Wall Street. His corporate tax cut agenda and his deregulation pledges may keep any additional tariff-related losses limited and short-lived.

Gold rebounded yesterday and is extending its gains today, even after the dollar’s overnight rebound. That could be due to investors adding to their safe-haven positions, as the first day of Trump’s presidency gave a fair taste of how unpredictable his term may be.

Oil slipped ahead of Trump’s inauguration on expectations that Trump will relax energy-related sanctions on Russia in exchange for ending the Ukraine war, but also due to traders locking profits ahead of the event. Trump has promised to expand oil and gas drilling, which he highlighted during his inaugural address by reiterating his energy motto “Drill baby, drill”.

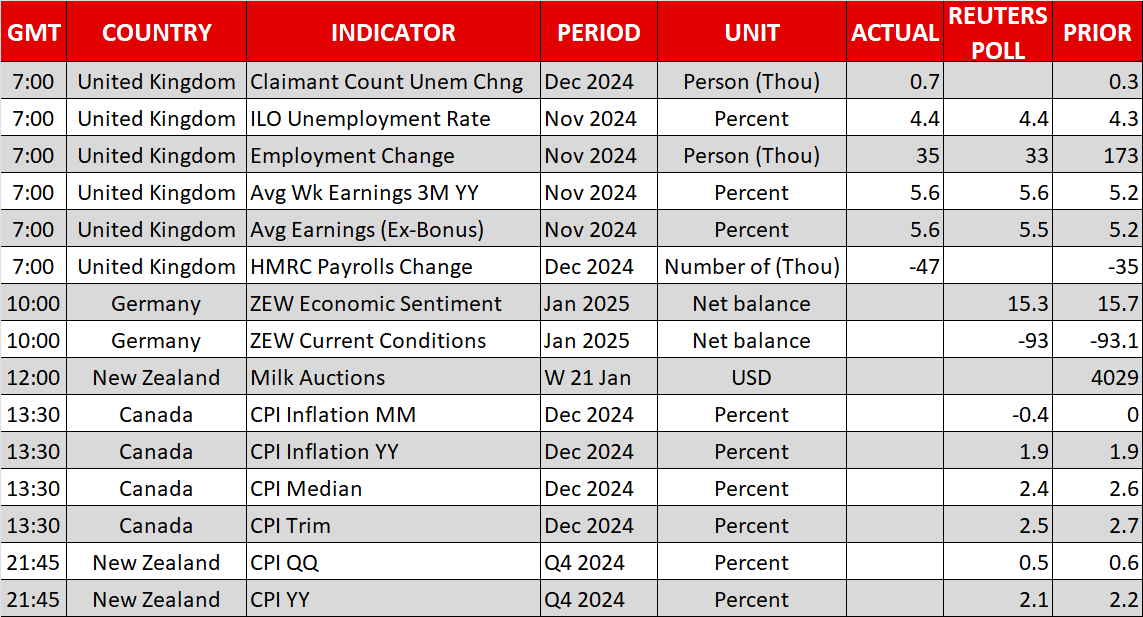

Canada CPI and Davos on today’s agenda

As for today’s agenda, loonie traders will lock their gaze on the Canadian CPI numbers, as weaker-than-expected prints may seal the deal for a rate cut at next week’s decision. The World Economic Forum in Davos may also attract special attention today, as the Ukrainian President Volodymyr Zelenskiy and Israeli President Isaac Herzog step onto the rostrum.

.jpg)