Upbeat PMIs push GBPUSD back to the upper end of the range

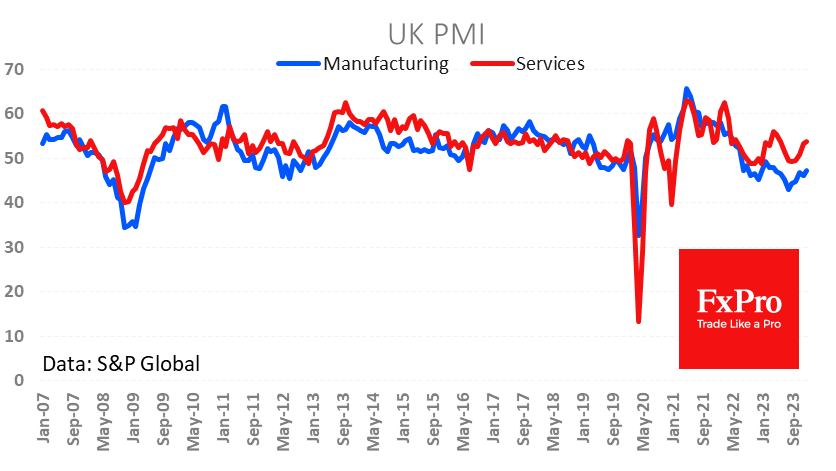

In contrast to mainland Europe, UK PMIs markedly exceeded expectations, noting an overall increase in business activity.

The manufacturing PMI rose to 47.3 in January from 46.2, noticeably above the expected 46.7. This is the highest reading of the index since April last year, although it has remained in contraction territory (below 50) for the past 18 months.

The services sector, which nosedived in August-October, is gaining momentum once again, with the corresponding index rising to 53.8, the highest since May 2023. Economists, on average, had forecast a rise to only 53.1.

The above-expected reading caused the pound to surge, taking GBPUSD to 1.2770, near the upper end of its trading range since mid-December.

The pound received support on touching the 50-day moving average a week earlier and new buying support on Tuesday on a fresh approach to that line. Bulls in the pound are showing strength, buoyed by rising risk appetite, with which the former has a strong positive correlation.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)