US inflation accelerates but lags income growth

US inflation accelerates but lags income growth

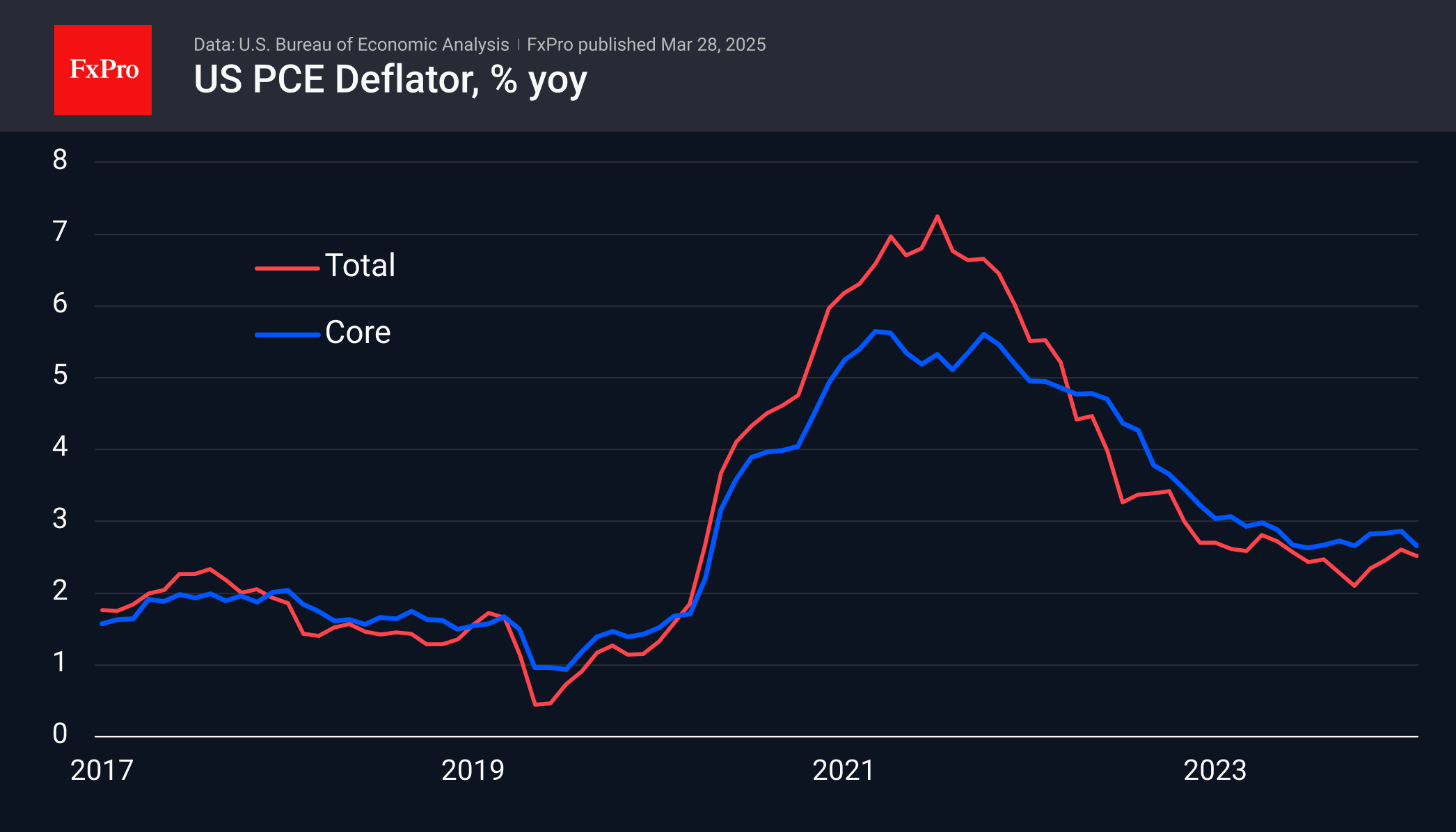

The Fed's preferred indicator of US inflation, the core index of personal consumption expenditure, accelerated from 2.6% to 2.8% in February. This is above the expected 2.7%, confirming that it is too early to see a sustained downward trend in prices.

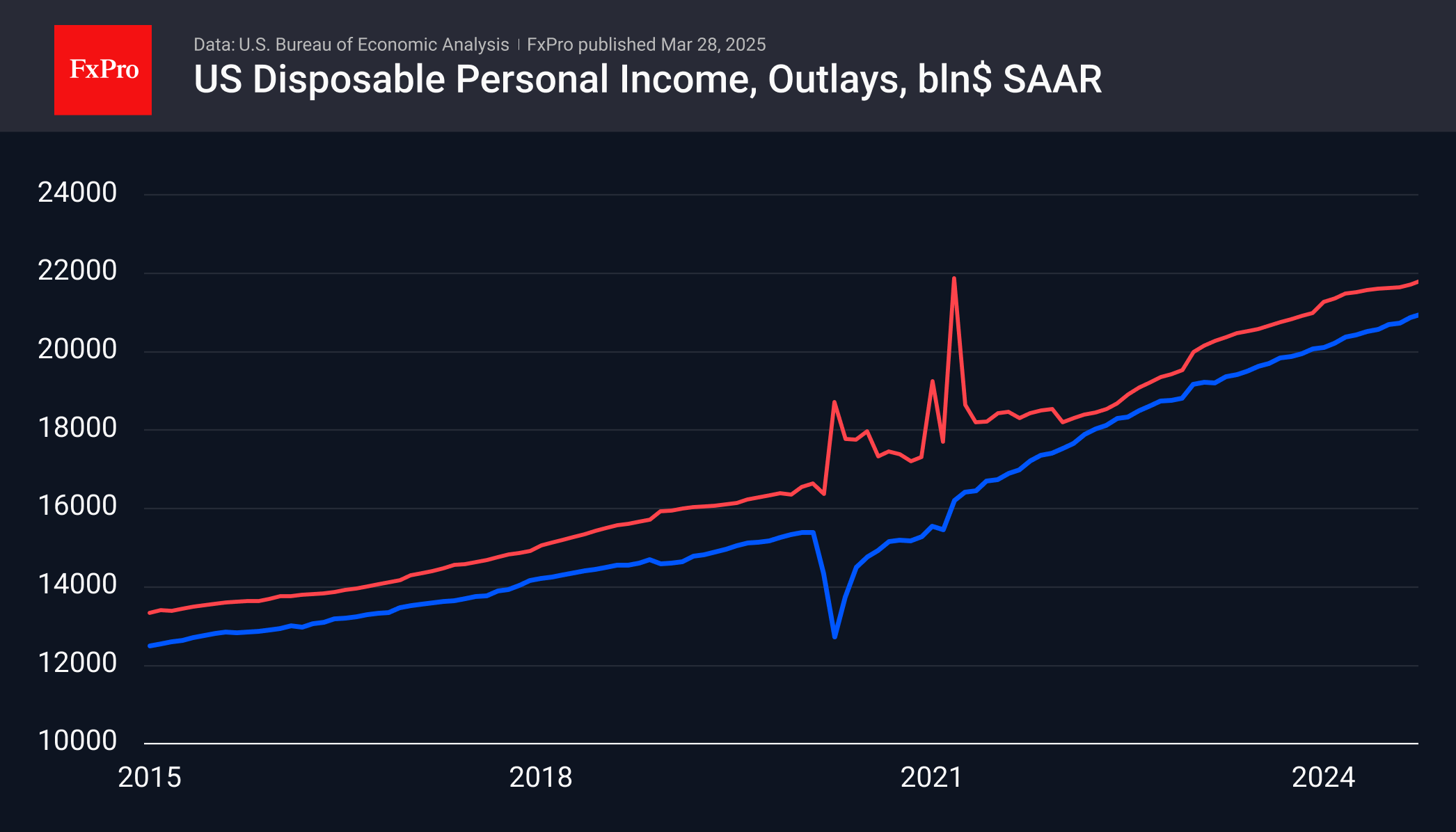

At the same time, we note the second month of acceleration in income growth, which added 0.8% in February after a 0.7% increase in January. Total spending rose by 0.6% after a contraction of 0.4% earlier. As a result, Americans' personal savings exceeded 4.6%, approaching the norm. The savings rate was mostly above 5% from 2013 to 2022. The rate only went below it during the inflationary surge of 2022 and between 2004 and 2008.

This is negative news for the US stock market, where worries around tariffs are crushing recovery attempts. These bearish sentiments are reinforced by the technical picture, which has seen sellers retake the lead as the major US equity indices have attempted to move back into territory above their 200-day moving averages. Temporarily, there is a positive correlation between the dollar and US equity indices due to speculation that a weak economy will intensify Fed rate cuts, regardless of inflation.

However, robust income growth and normalisation of the savings rate so far make it possible to dismiss the idea of a serious recession in the US soon.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)