US personal savings rate nears the historical bottom

US personal savings rate nears the historical bottom

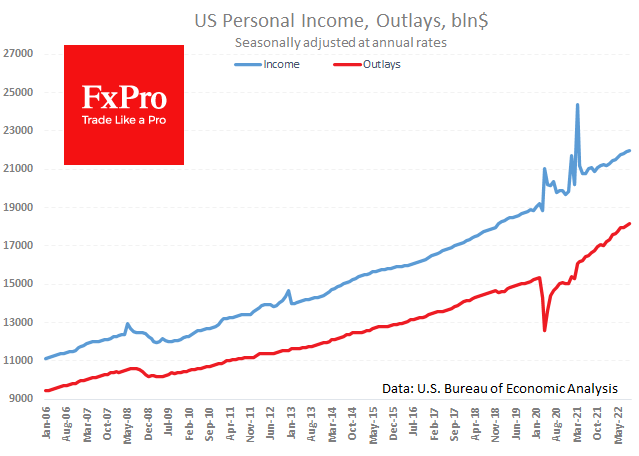

Americans' Personal spending rose 0.6% in September, the same as a month earlier, while income growth was up 0.4% in each of the two months.

Total earnings grew 5.2% YoY, as did earnings, whereas due to a cutback in tax credits, disposable income rose only 3.1% YoY. Spending, meanwhile, closely mirrors inflation, adding 8.2% in September compared to the same month a year earlier.

Spending growth is usually a positive signal for the markets because it pulls the entire economy along.

However, this growth driver is near exhaustion as savings have fallen to 3.1% of income and are near the lows since 2007. Historically, the lowest Americans saved was in 2005, when the rate fell to 2.1%, and the yearly average was 2.9%. Approaching the savings rate to the 3% threshold has cooled the housing market, as we see in our case.

The low savings rate can be explained by maintaining the same living standard (spending). However, the steepest rise in credit interest rates in 40 years and a falling stock market have prompted Americans to save a historically low proportion of their income. In this environment, there is likely to be a further drop in interest in long-term purchases such as homes and cars.

However, before you shout ‘’crisis!’’, you should remember that enormous sums have gone into savings during the pandemic. In the two years since March 2020, almost twice as much has been saved as in the two years before (61.4 trillion vs 32.4 trillion). In other words, Americans still have something to spend, and their debt burden is not as high as it was in 2005-2008.

The fall in the savings rate close to historic lows is a red flag, and it is now worth paying increased attention to the consumption behaviour of Americans. Given the savings accumulated during the pandemic, economic growth (excluding the suffering housing sector) has a high chance of further development for the foreseeable future. If we are right, there is no reason for the Fed to change its intentions to aggressively raise rates and keep them high for an extended period.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)