USDJPY buyers appear strong in 2024

· USDJPY shows some progress

· MACD and RSI turn up

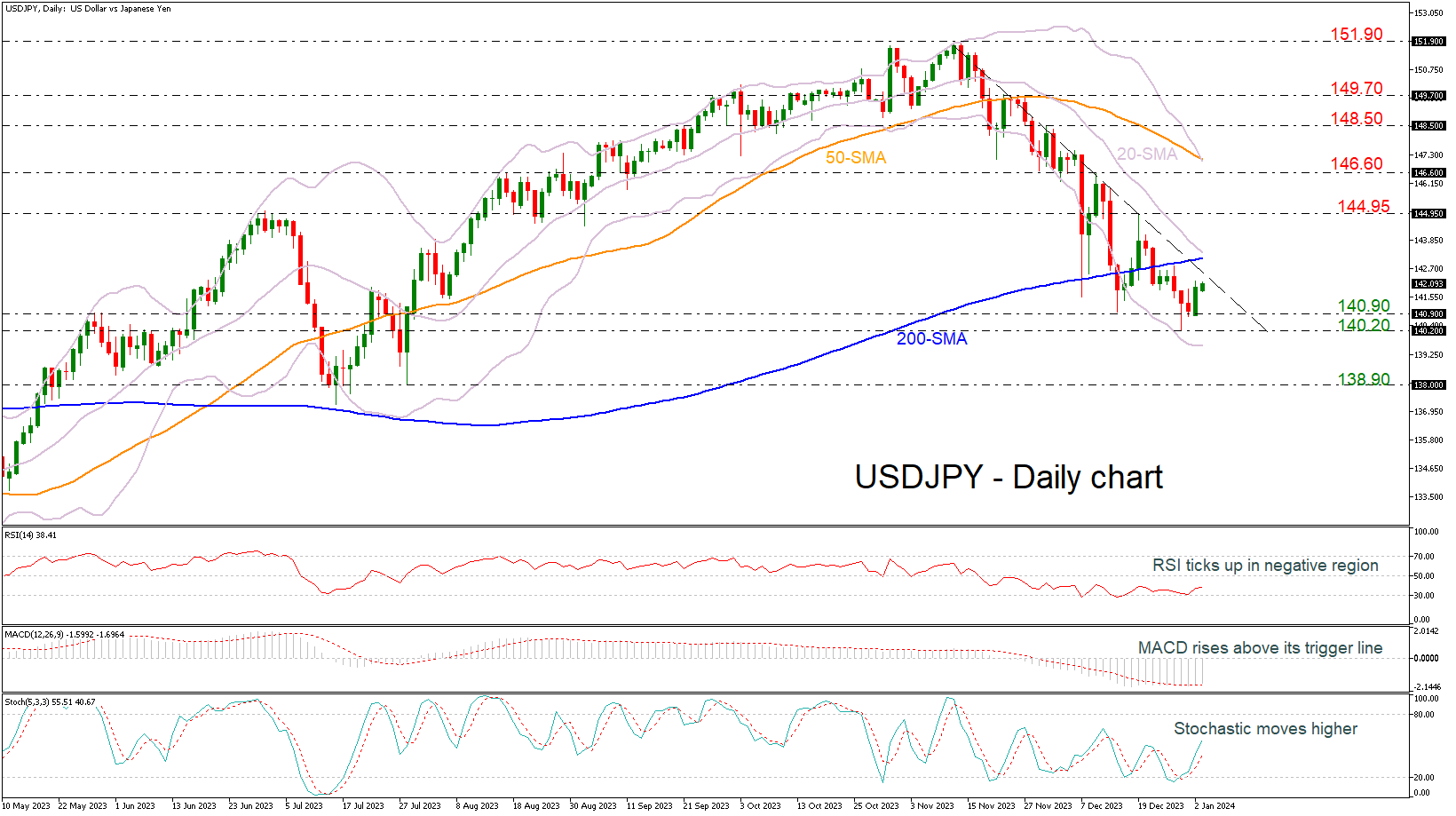

USDJPY started 2024 in a positive mode as it rebounded off the 140.90 support level with strong resistance coming from the steep descending trend line.

The RSI is below its 50 neutral mark, although it has strengthening, and the MACD is keeping its footing above its red signal line and within the negative area. Yet, the stochastic oscillator is looking for an upside reversal, but it’s uncertain if there is enough bullish power to boost the price towards the November top of 151.90.

In the event of an uptrend resumption above the immediate resistance lines of the downtrend line at 142.60, the 200-day simple moving average (SMA) at 143.15 and the mid-level of the Bollinger band at 143.40, the bulls might take a breather near the 144.95 barricade before stretching towards the 146.60 level. Should it give way, the door would open for the 50-day SMA, which overlaps with the upper Bollinger band at 147.00.

Nevertheless, the pair has key levels underneath for protection against selling forces. The 140.90 and the 140.20 support levels have been limiting downside movements over the past three weeks. If the bears take the lead again, the pair could plummet towards the 138.90 support, registered on July 28.

In brief, USDJPY buyers are trying to take control; however, it needs significant boost to change the current bearish outlook to bullish in the short-term timeframe.

.jpg)