Will GBPUSD make a comeback after post-Fed tumble?

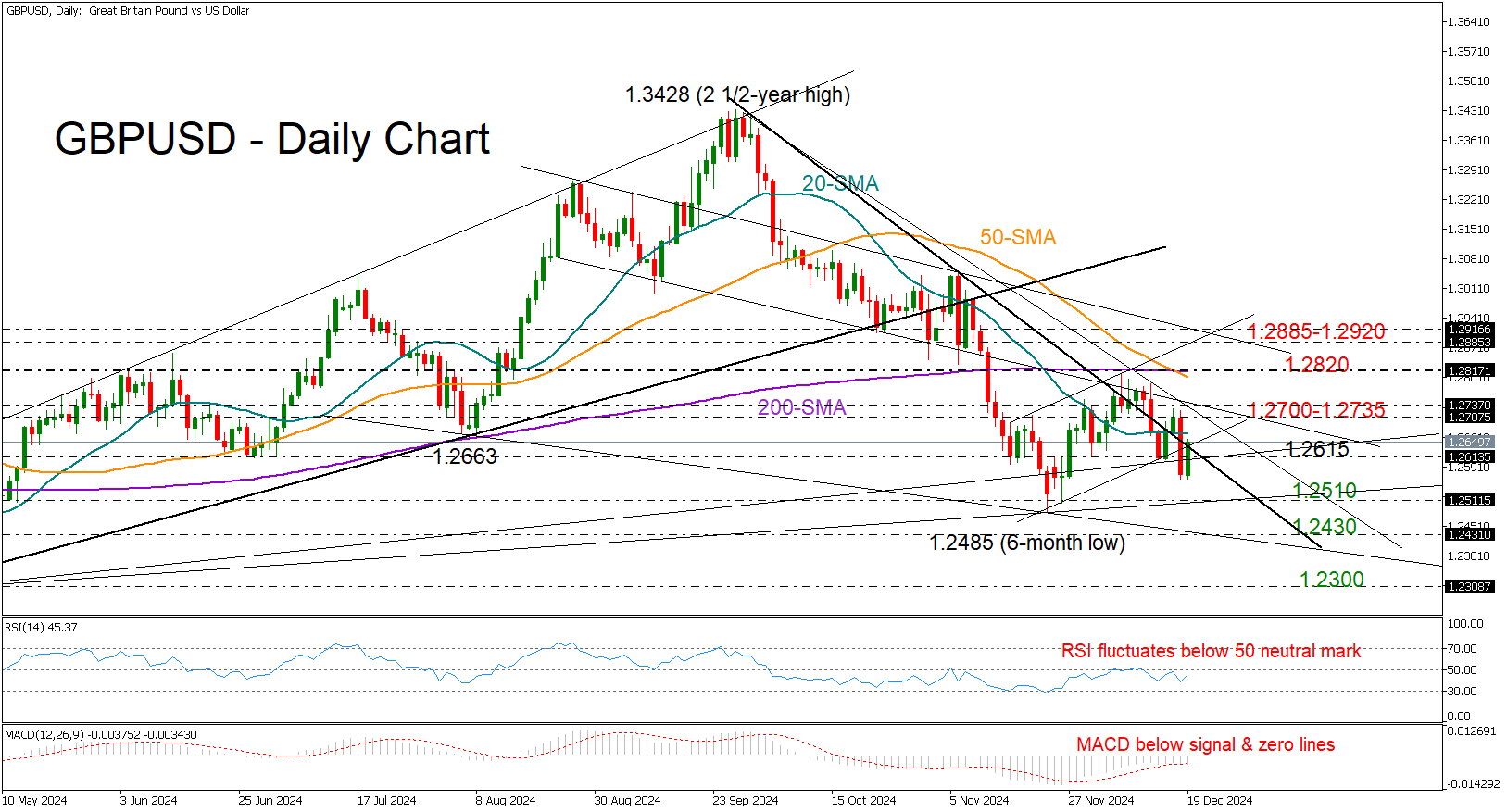

GBPUSD is trying to heal its wounds after taking a hit from the Fed’s hawkish rate cut, which squeezed the price to a three-week low of 1.2560 and back below the 20-day simple moving average (SMA) late on Wednesday.

Unlike its major peers, the British pound avoided new lower lows in the short-term picture and managed to hold its ground above the 1.2510 support zone as traders maintained some patience ahead of the Bank of England’s rate decision. However, despite this resilience, the technical indicators remain bearish and the completed death cross between the 50- and 200-day SMAs may keep traders on edge, unless something changes soon.

A continuation below 1.2500 could allow the pair to take a breather near the 1.2430 constraining zone. Otherwise, GBPUSD could suffer a freefall toward April’s low near 1.2300, a break of which could take it into the 1.2170-1.2200 region.

On the flip slide, should the price maintain its positive momentum above 1.2615, it may next head for the 1.2700-1.2735 region. A successful penetration higher could then shift the spotlight to the flattening 200-day SMA at 1.2820, which is where the price peaked at the start of the month. Hence, a close above it could prompt an extension toward the 1.2885-1.2900 area.

Overall, GBPUSD’s short-term outlook is still a bit shaky. The pair could stay under pressure in the coming sessions, and a real test will come if it can run above 1.2820 for a sustained recovery. A drop below 1.2500 would put it back on a bearish path.

.jpg)