Will Japan’s fiscal restraint stand out as U.S. Credit weakens?

For years, the U.S. wore the crown of fiscal responsibility-or at least pretended to. Treasuries were the go-to move when markets got jittery, and “risk-free” meant red, white, and blue. But lately, that shine’s been fading.

Enter Japan. Yes, Japan - the same economy often labelled sluggish and over-leveraged. While Washington racks up debt and shrugs at downgrades, Tokyo’s doing something radical: keeping calm and showing restraint.

It’s not flashy, and it won’t make headlines like trillion-dollar tax cuts, but investors are noticing. With America’s credit rating slipping and bond yields popping, Japan’s quiet discipline might just become its loudest message yet.

U.S. credit: From Gold standard to warning sign

Moody’s dropped the hammer on 16 May - cutting the U.S. sovereign credit rating from the once-untouchable Aaa to Aa1. It is not exactly a market earthquake, but it is definitely a signal that the “world’s safest asset” is no longer immune to scrutiny.

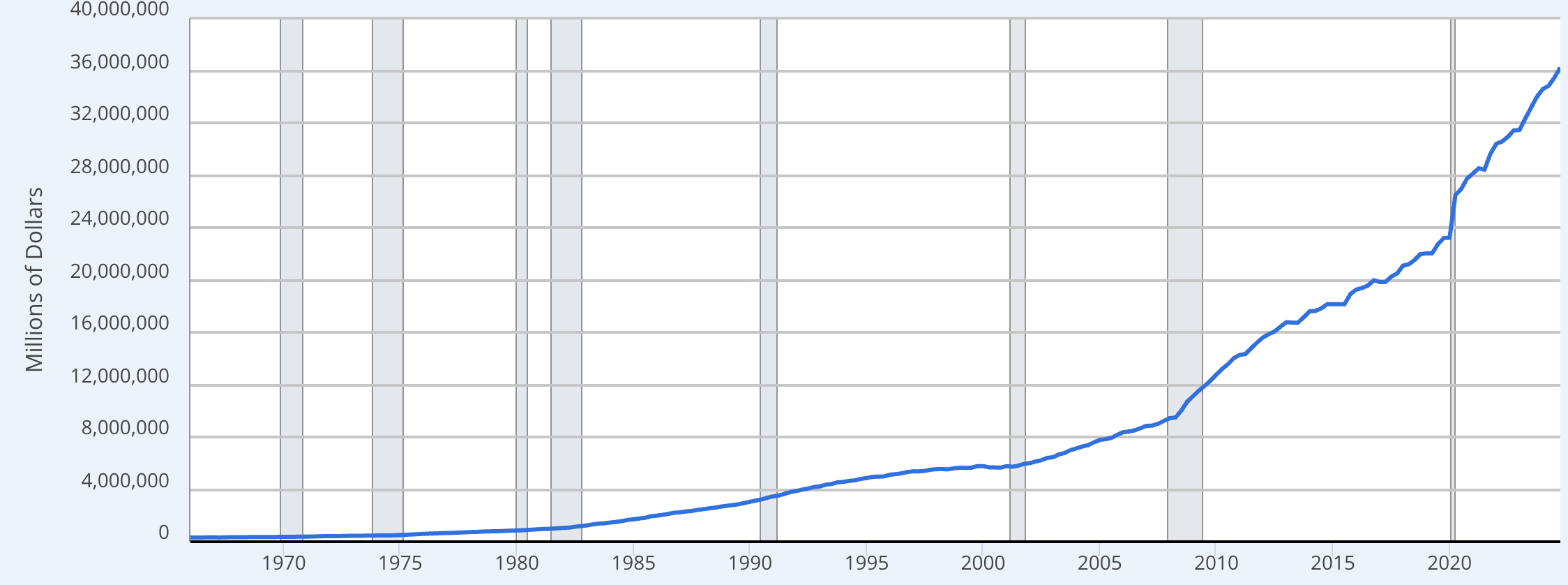

And the reasons? Classic Washington: ballooning deficits, political gridlock, and a total lack of urgency to fix any of it. The national debt has sprinted past $36 trillion, with more on the way. Trump’s latest tax proposals - still in play - could add another $5.2 trillion to that mountain by 2034.

Source: U.S. Department of the Treasury. Fiscal Service via FRED

Moody’s said it plainly: no one seems serious about solving this. The U.S. isn’t just in debt - it’s pretending it doesn’t matter.

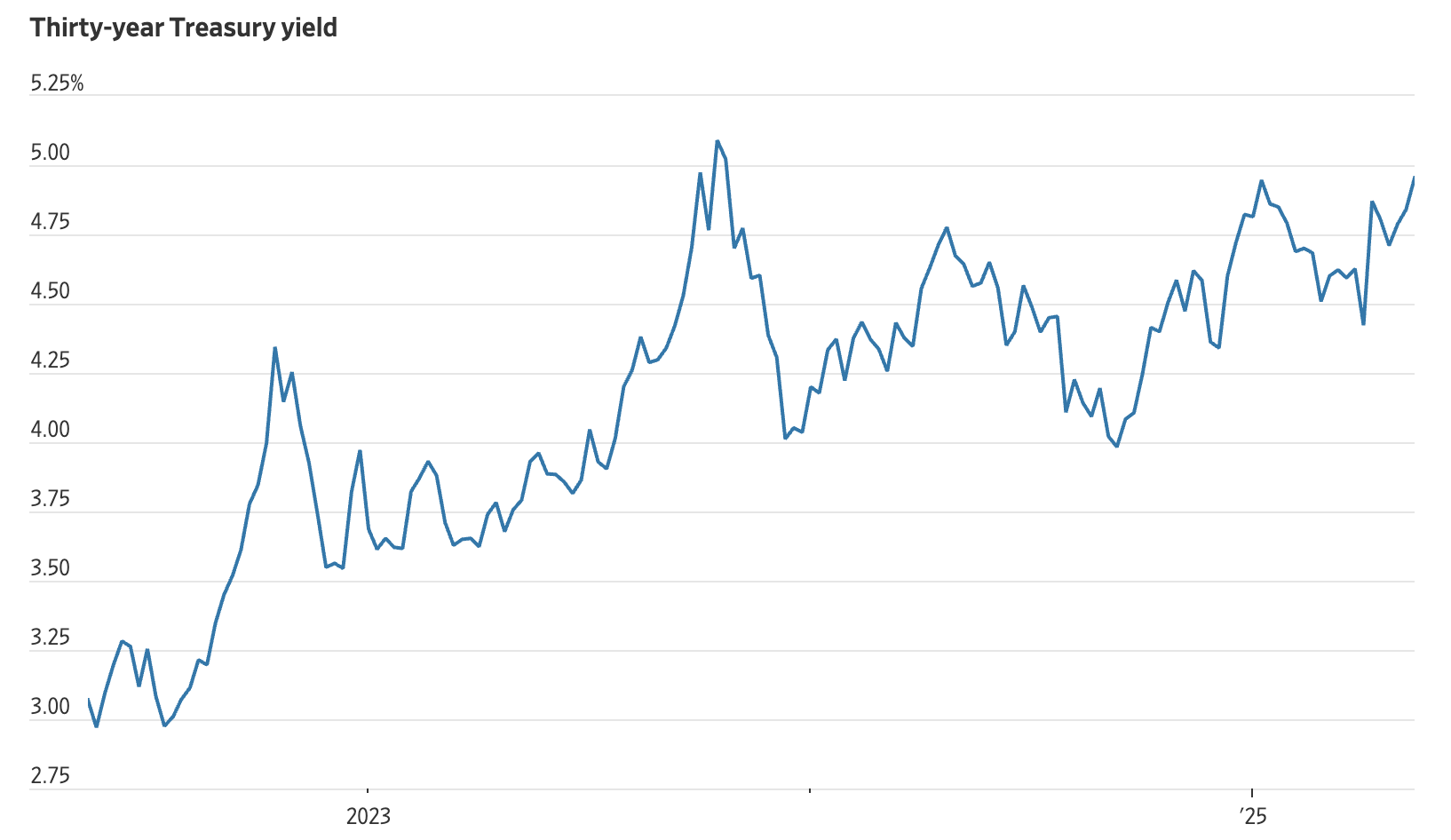

The bond market reacted accordingly. Yields on the 10-year and 30-year Treasuries jumped. The dollar softened. And investors are wondering if this is still the safe haven they think it is.

Source: Tullet Prebon, WSJ

Meanwhile in Tokyo: Quiet, careful, intentional

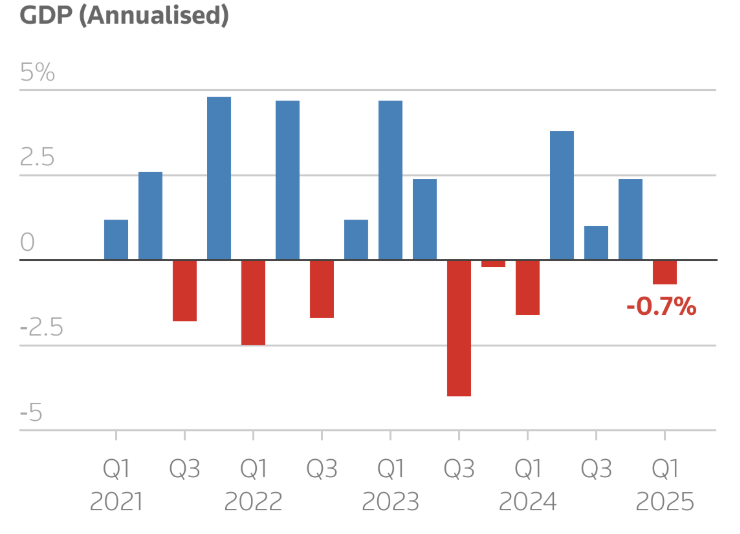

Across the Pacific in Japan - a country dealing with its own economic slowdown. The economy contracted 0.7% in Q1, growth is patchy, and yes, Japan still holds one of the highest debt-to-GDP ratios in the developed world.

Source: LSEG

But here’s what’s different: Tokyo isn’t making things worse.

The Bank of Japan is finally shifting gears after years of ultra-loose monetary policy. Inflation’s creeping up again, and central bank officials are hinting they’re not afraid to tighten further if needed. For a country that kept rates at near-zero for decades, that’s a meaningful pivot.

On the fiscal side, Prime Minister Shigeru Ishiba isn’t reaching for the usual political playbook. Instead of cutting taxes ahead of a key election - as many expected- he said no. His reasoning? Japan’s finances are too fragile to risk a sugar rush. That kind of discipline might be boring - but boring looks pretty good when everyone else is sprinting toward a cliff.

Investors are paying attention (Even if quietly)

Japan isn’t about to dethrone the U.S. in terms of global financial clout - but its quiet consistency is gaining traction. In fact, it might start to show up where it counts: in capital flows.

Japan remains the second-largest foreign holder of U.S. Treasuries. But if its own tightening cycle picks up speed, Tokyo may start unwinding some of those holdings. That would push U.S. yields even higher, right when Washington needs cheap borrowing the most.

And there’s a broader trend here. Investors are no longer blindly rewarding big spending and loose policy. The global appetite for “responsibility” seems to be returning. Japan’s blend of caution and credibility could stand out - not because it’s exciting, but because it’s rare.

Technical outlook: USD/JPY forecast

To be clear, no one’s saying the dollar will be dethroned overnight, or that Japan is poised to take over as the financial capital of the world. But perception matters. And right now, the perception that America always does the right thing in the end is starting to erode.

The irony is thick: Japan, long mocked for its stagnation, is becoming a symbol of discipline. America, once the poster child for fiscal strength, is now flirting with unsustainable debt, partisan paralysis, and credit downgrades.

The world is watching - and, increasingly, it’s hedging.

At the time of writing, the USD/JPY pair is slumping towards the $144.00 mark. Sell-side bias is evident on the daily chart. However, the volume bars paint a picture of waning sell pressure, which could mean an uptick in prices. Should the pair continue to slump, prices could find a support floor at the $142.10 price level. If we see an uptick, prices could encounter resistance walls at the $145.51 and $148.29 price levels.

Source: Deriv MT5