Yen in the crossfire: Could trade policies unleash forex volatility?

The Japanese yen is central to a high-stakes currency battle, and global markets are paying close attention. Why? Because shifting trade policies, particularly tariff adjustments, inject uncertainty into the forex market.

With major economies recalibrating their approaches, the implications could be massive-sending shockwaves through financial markets, triggering heightened volatility and setting up some of the most lucrative trading opportunities in recent memory.

Let’s dive into what’s at play.

The Yen’s dilemma: Stuck in a holding pattern

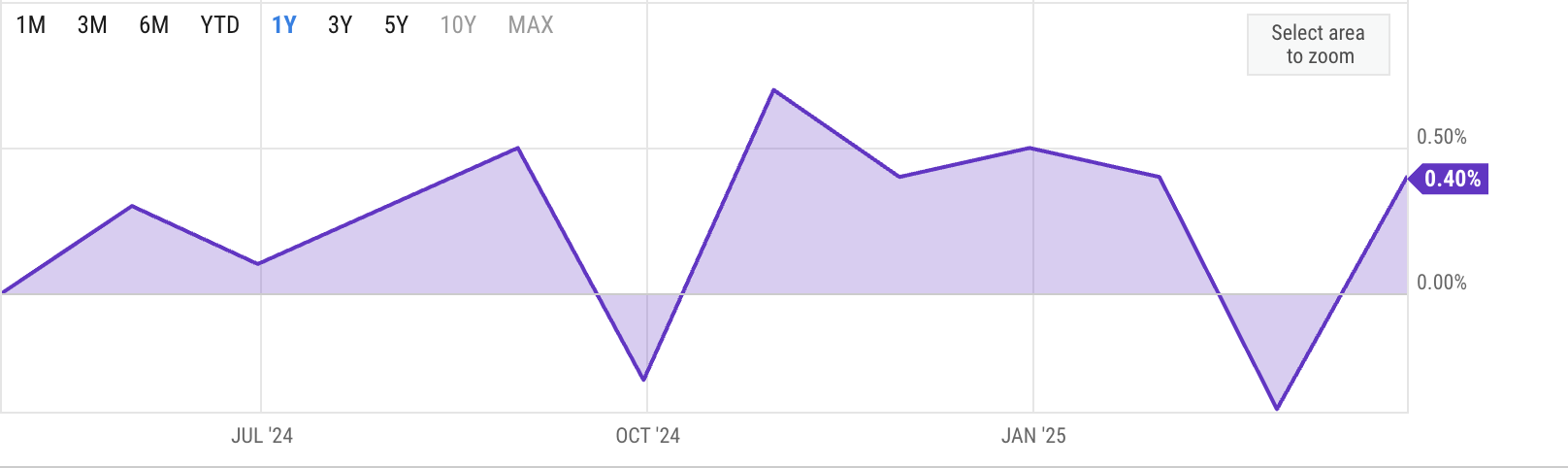

Despite periodic gains against the USD, the yen struggles to maintain upward momentum. Market uncertainty keeps traders waiting and anticipating policy shifts that could drive major moves. This kind of hesitation often sets the stage for significant breakouts-when markets waver; sharp price swings tend to follow.

Japan finds itself in a tough predicament. If new tariffs or trade restrictions weigh heavily on Japanese exports, the Bank of Japan (BoJ) might be forced to reconsider its monetary policy to cushion the economy. Yet, inflation data suggests the BoJ should continue its tightening path. It’s a classic scenario of being caught between a rock and a hard place.

Source: YCharts

Meanwhile, policymakers are signaling that trade restrictions could widen, impacting multiple economies rather than a select few with notable trade imbalances. That’s particularly concerning for Japan, given its export-heavy economy, which remains highly vulnerable to global trade disruptions.

EUR/USD in a holding pattern ahead of key policy news

As traders brace for long-awaited tariff announcements, EUR/USD remains pinned near the 1.0800 level. Market participants are on edge, with U.S. officials repeatedly postponing decisions on new trade measures. The prolonged uncertainty has left investors guessing about what’s next.

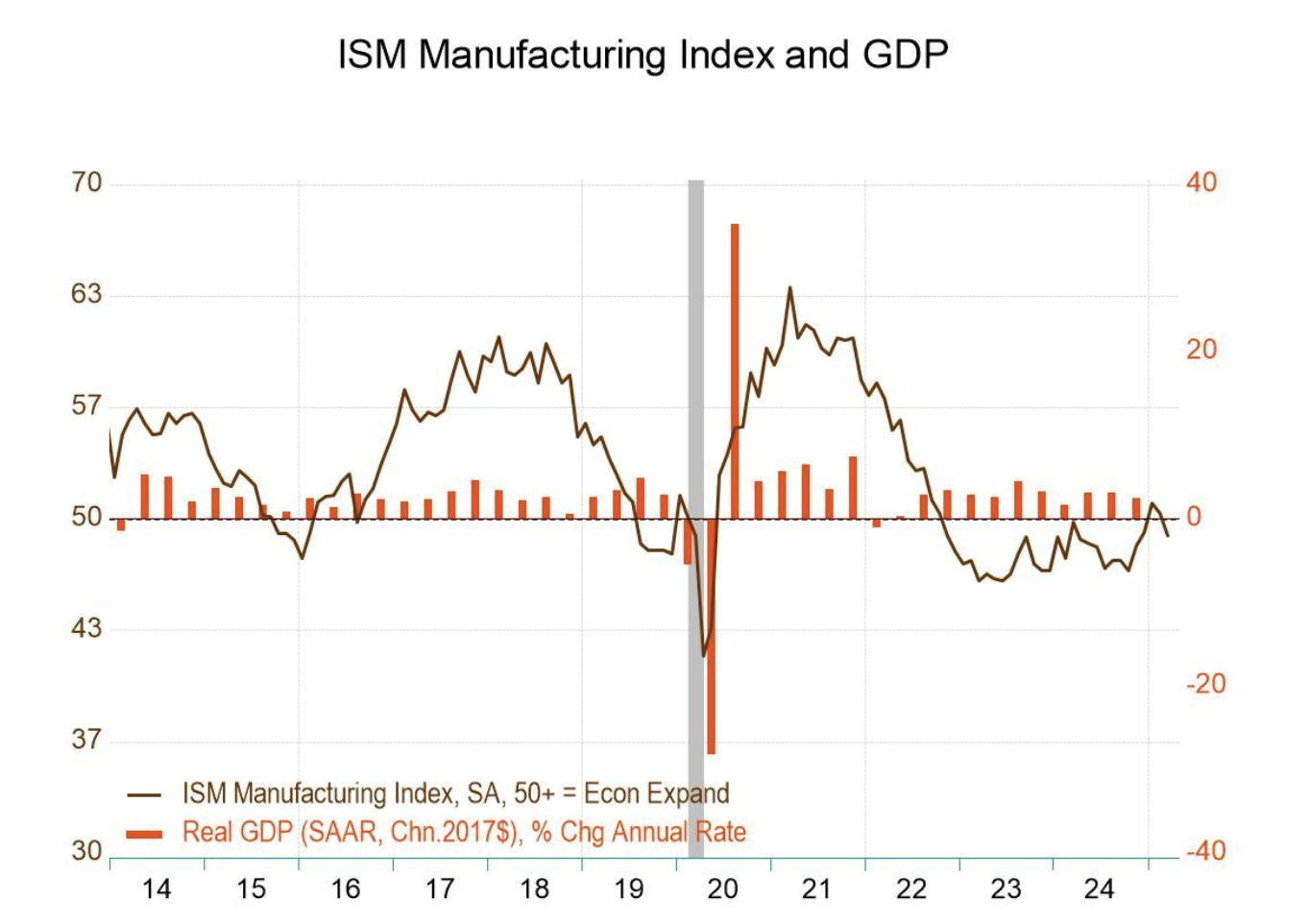

Adding to the unease, the latest U.S. ISM Manufacturing PMI for March declined to 49.0 from 50.3, reflecting economic contraction as businesses prepare for potential trade turbulence.

Source: ISM, BEA/Haver analytics

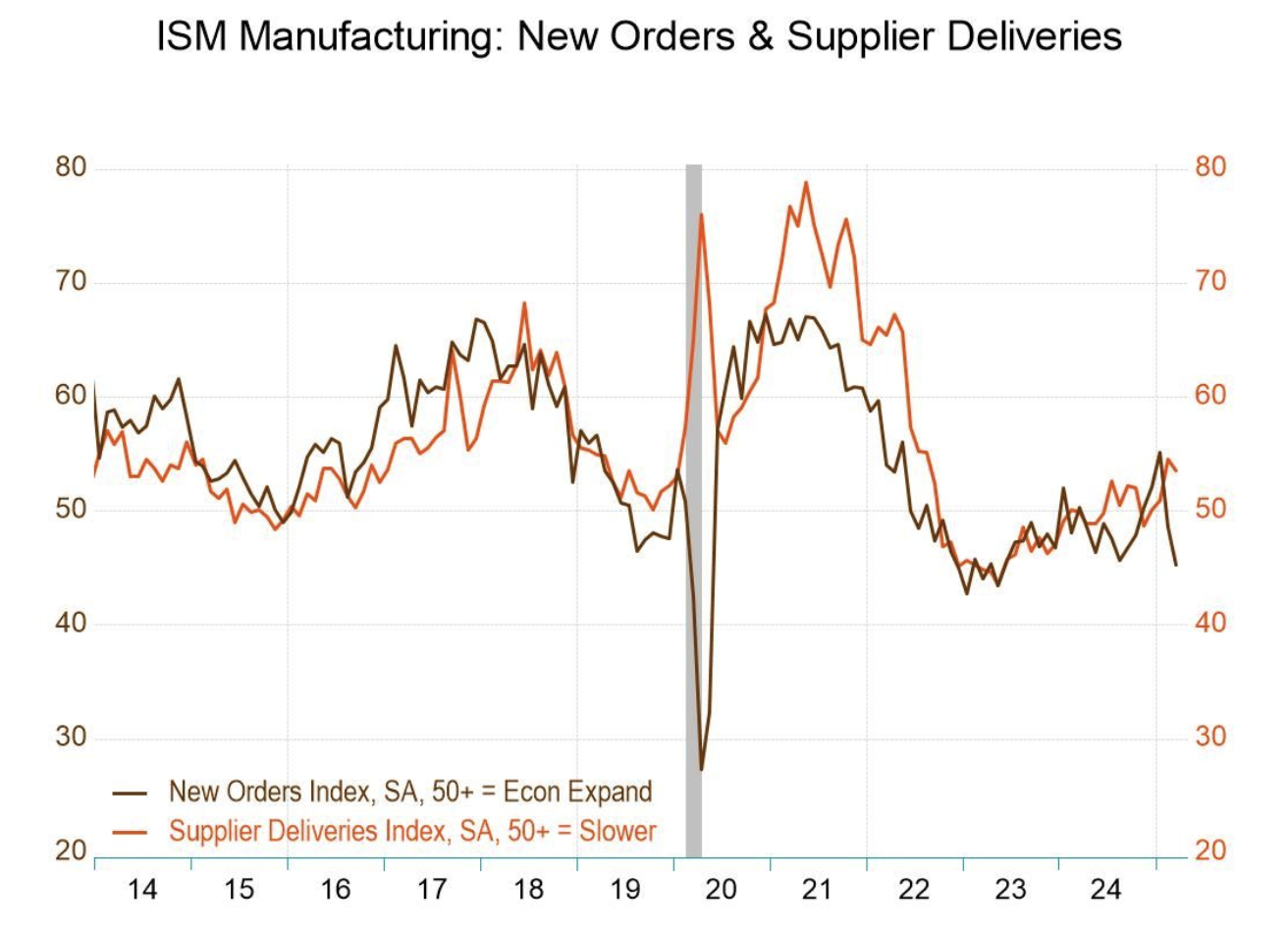

The Manufacturing New Orders Index plunged to a two-year low of 45.2, signaling further economic distress.

Source: ISM, BEA/Haver analytics

Diverging Central Bank strategies: The big picture

Global central banks are moving in opposite directions. The BoJ is expected to maintain its tightening stance, while the Federal Reserve and other major central banks increasingly signal potential rate cuts. Typically, such a divergence would favor JPY's strength against the USD. However, trade uncertainty has overshadowed these expectations, leaving traders cautious.

Economic indicators worldwide are flashing warning signs. Manufacturing slowdowns, persistent inflation, and evolving labor market conditions all point to potential trouble. Stagflation-the toxic combination of sluggish growth and stubborn inflation- remains a looming risk. If trade policies tighten further, volatility could escalate rapidly.

The upcoming U.S. Nonfarm Payrolls (NFP) report, set for release this Friday, could critically gauge how new trade policies are impacting the broader economy. A disappointing jobs report could amplify market reactions in the coming days.

Tariff turmoil: The fallout from "Liberation Day"

Former President Trump has dubbed April 2 "Liberation Day," with reports suggesting a sweeping 20% tariff on nearly all imports is under consideration. While such a move could theoretically strengthen the U.S. dollar in the short term, analysts warn that the real concern is whether aggressive tariffs exacerbate stagflation risks.

"Markets will be on edge ahead of the announcement," says Carol Kong, a currency strategist at Commonwealth Bank of Australia. And the uncertainty isn’t going away anytime soon-traders will likely be adjusting to the fallout of new trade measures for weeks to come.

What does this mean for the JPY trade? It’s all about timing. For those closely watching policy shifts, this period of uncertainty could present exceptional trading opportunities.

Technical analysis: Outlook as tariff wars rage on

At the time of writing, the USDJPY pair is in consolidation mode. Upward pressure is limited as downward pressure also finds support. Prices remaining below the moving average suggest that the primary trend is still bearish for the pair, however, RSI rising steadily just above the midline suggests that some upward pressure could be building.

The key upside levels to watch are $150.33 and $150.85. On the downside, the key support levels to watch are $149.32 and $148.70.

Source: Deriv MT5

Disclaimer

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance.