Yen sinks to intervention ‘danger zone’

Yen hits the danger zone

Currency traders are dusting off their FX intervention playbooks after the Japanese yen briefly fell to its lowest levels since 1990 against the dollar, drawing fierce warnings from officials in Tokyo that they could step in to defend the currency.

Dollar/yen is currently flirting with the 152 region, which is where Japanese authorities intervened back in 2022. In response, Finance Minister Suzuki escalated his threats, pledging to take “decisive steps” against disorderly moves in the FX space.

This is a phrase that Suzuki also used in October 2022 before he ordered intervention, but it's crucial to note that the yen fell another 5% after those comments before Tokyo actually pulled the trigger. Therefore, the language used so far falls short of signaling imminent intervention, something corroborated by the calm in the options market.

Of course, there’s always a risk that Tokyo does not follow the same sequence as its previous interventions and decides to act immediately. Still, this seems like a low-probability scenario for now. If dollar/yen manages to slice above the 152 threshold and Japan does not step in, there isn’t much to stop a rally towards the 155 area according to the charts.

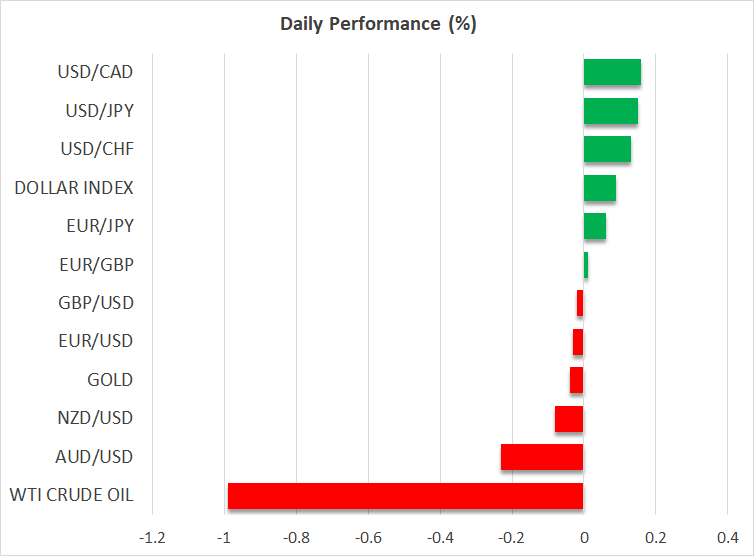

Swiss franc gets hit, dollar recovers

Another underperformer in the FX arena has been the Swiss franc. The currency has already fallen 7% against the US dollar this year, with the losses accelerating last week after the Swiss National Bank surprised investors with a rate cut.

Beyond the rate cut, another problem for the franc is the SNB’s strategy on FX interventions. Last year the SNB was buying francs on the open market, to boost the currency and dampen imported inflation. But with inflation now running low, there’s no incentive to do that anymore. In fact, the SNB could go back to selling francs soon, keeping the currency on the ropes.

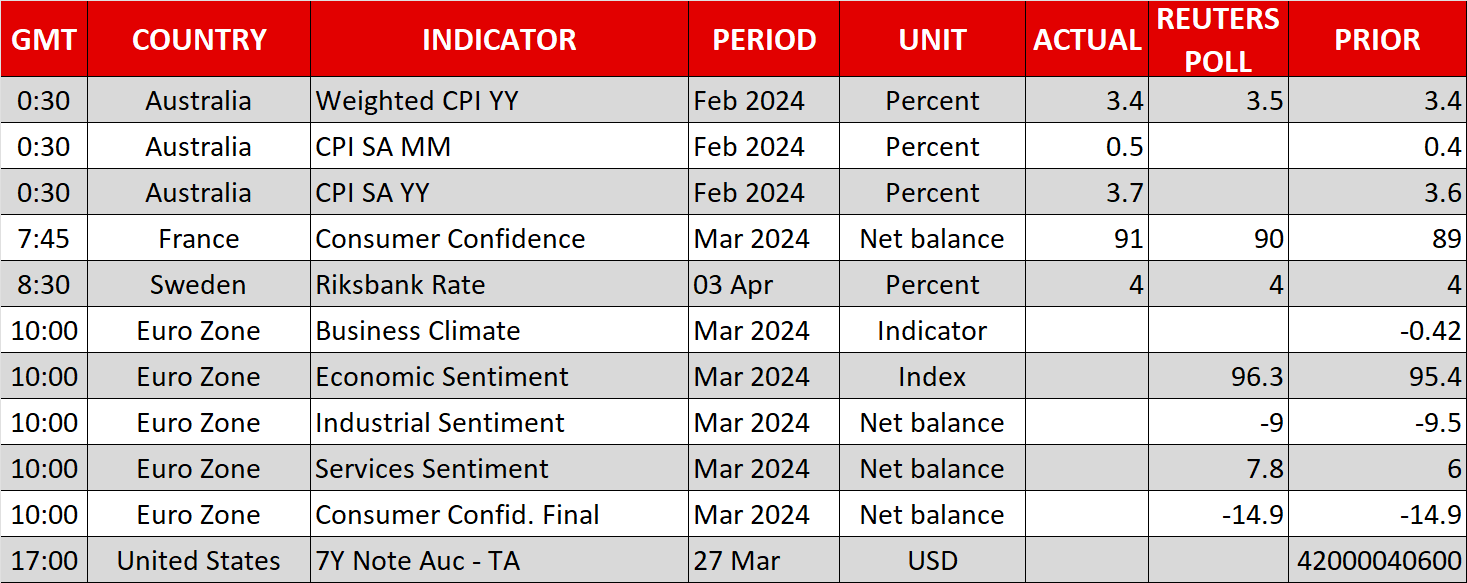

Meanwhile, the US dollar mounted a comeback yesterday, erasing some early losses to close the session nearly unchanged with some help from decent economic data and a strong Treasury auction. Overall, trading has been choppy this week with most major FX pairs moving without a clear direction, which might also reflect quarter-end flows.

Gold steadies, stocks tick lower

In precious metals, gold prices continue to trade sideways near their all-time peaks. Bullion seems to have established a temporary trading range between $2,145 and $2,200 in recent weeks, with the only violation being last week’s short-lived rally to a new record high.

The impressive part is that gold has gone on a tear this year even with Treasury yields and the dollar moving higher, which are usually negative developments for the zero-yielding metal that is priced in dollars. Gold is essentially flying against the wind, with sovereign purchases from central banks probably doing the heavy lifting.

Finally, US stock markets encountered some late selling yesterday, closing with minor losses. The main underperformer was Nvidia, although its retreat likely reflected some profit-taking, instead of any fundamental change in the landscape.

As for today, the spotlight will fall on Fed Board Governor Waller, who will deliver a speech on the economic outlook at 22:00 GMT befor e the Economic Club of New York.

e the Economic Club of New York.